By Pam Martens: November 17, 2014

It’s called the Dracula fraud case against JPMorgan because no matter how many times JPMorgan’s lawyers try to kill it, the case rises up from the dead to find new life. Now, with former JPMorgan insider Alayne Fleischmann revealed by Matt Taibbi in Rolling Stone as someone who has critical firsthand evidence that a jury needs to hear in this case, a potential $1.6 billion jury award against JPMorgan is looking winnable – if the case can ever get in front of a jury.

The lawsuit was filed by affiliates of the Belgian-French bank Dexia, which received multiple bailouts by the two governments during the financial crisis. Dexia’s original complaint that was filed on January 19, 2012 in New York State Supreme Court, alleged widespread fraud in the sale of Residential Mortgage Backed Securities (RMBS) by JPMorgan, its direct affiliates and two firms it purchased during the financial crisis in 2008 – Bear Stearns and Washington Mutual.

Dexia had purchased $1.6 billion of the securities, which were assigned AAA ratings by Moody’s and Standard and Poor’s. Almost all of the securities, according to the lawsuit, are now rated junk and have suffered significant losses. Notably, 13 of the RMBS alleged to be fraudulently sold to Dexia affiliates were sponsored by JPMorgan, not Bear Stearns or Washington Mutual. JPMorgan has launched a major public relations offensive to try to shift the blame to the firms it acquired while portraying itself as the conservative mortgage underwriter.

After extensive discovery and depositions, two sealed documents have been filed in the case along with 242 exhibits from plaintiffs that are not under seal. That raises the question as to whether one of the sealed documents is Alayne Fleischmann’s potentially jury-shocking internal letter that was revealed in Taibbi’s article. Fleischmann, an attorney who worked as a Transaction Manager at JPMorgan, has alleged “massive criminal securities fraud” in her department at JPMorgan, which was assigned with assuring that only good mortgage loans were securitized but, instead, under pressure from bosses, waived in the drek that was likely to default during the same time period that the Dexia plaintiffs’ lawsuit covers. After failing to stop the fraudulent process with verbal warnings, Fleishmann memorialized the details in a long letter to a superior.

The U.S. financial system, the economy, and the nation’s housing market suffered the greatest collapse since the Great Depression in 2008 to 2010 – in no small part because of “massive criminal securities fraud” in the underwriting of toxic mortgage pools sold off as AAA-rated credits. Millions of Americans are still underwater on their mortgages because of fraudulent appraisals that were part of that securitization machinery. Economic growth and job creation are still subpar and the nation’s debt has mushroomed as a result of fiscal stimulus attempts to resuscitate the economy. Given that backdrop, one has to ask why Americans should tolerate any documents being filed under seal in lawsuits that go to the heart of this matter.

Also at stake is the reputation of the United States as a credible financial center supported by a credible justice system to right wrongs.

The Dexia case was filed almost three years ago, on January 19, 2012 in New York State Supreme Court. The powerhouse Wall Street law firm representing JPMorgan, Cravath, Swaine & Moore LLP, didn’t like the venue and succeeded in having the case remanded to Federal Court where it was assigned to Judge Jed Rakoff, the man who has positioned himself as the upholder of all that is pure and noble when it comes to Wall Street.

Rakoff reduced Dexia’s claims from $1.6 billion to about $5.7 million with a two-page order that said virtually nothing on April 3, 2013, promising a reasoned opinion would follow. Instead of a reasoned opinion, a month and half later Rakoff bounced the case from his Federal courtroom back to New York State Supreme Court where it had originally started, on the premise that he never had jurisdiction to hear the case in the first place based on a recent Appellate court ruling.

Rakoff also ruled that since he never had jurisdiction, his ruling to reduce the claims was null and void, meaning that Dexia’s lawyers would have to refile all of their opposition papers again in New York State Supreme Court and engage in oral arguments all over again on the Summary Judgment motion, a complete duplication of what had happened over many months in Federal court.

The insult to Dexia’s law firm, Bernstein Litowitz Berger & Grossmann LLP (BLB&G) is equally matched by the insult to the public interest. Few private actions have come as close as this one to building a documented case that fraud occurred in almost every aspect of the securitization pipeline at JPMorgan Chase – not just at the firms it purchased in the crisis, Bear Stearns and Washington Mutual.

Dexia’s exhibits include emails and internal documents, which suggest a practice and pattern of fraud on the part of JPMorgan. While the case is a civil action, Dexia has effectively built a ready-made criminal case for the Justice Department to bring against the individuals implicated in the exhibits.

Back in February 2013, when news of Dexia’s filing of the damning documents appeared in press reports, former Senator Ted Kaufman said: “It is just hard to believe that if the Department of Justice had made Wall Street fraud a major priority, with the resources they have, they could not have found these same emails and brought these cases.”

Dexia’s 145-page amended complaint (see Dexia v Bear Stearns, et al Amended Complaint) indicated that “JPMorgan’s 2006 Annual Report had reassured investors that JPMorgan had ‘materially tightened’ its underwriting standards and would be ‘even more conservative’ in originating mortgages.” Instead, according to the complaint, “by October 2006, JPMorgan had itself become alarmed by the increasing number of late payments in its own subprime portfolio, causing JPMorgan to sell its own investments in subprime mortgages” while dramatically ramping up the toxic brew it was securitizing and selling to the public. The complaint reads:

“From 2006 to 2007, JPMorgan nearly doubled its securitizations of residential mortgages — from $16.8 billion in 2006 to $28.9 billion in 2007. To generate these enormous amounts of securities, JPMorgan incentivized its Chase Home Finance employees to originate high-risk mortgages, loosened underwriting standards, pressured appraisers, and included the resulting poor-quality mortgages into JPMorgan securitizations, including those in the RMBS at issue here.”

The lawyers also indicated they have numerous confidential witnesses (CWs) available to testify, such as CW 19, a senior mortgage underwriter at Chase Home Finance from 2002 through 2008. CW 19 stated that “for subprime mortgages, underwriters were compensated based on the number of mortgages that they approved, whereas prime mortgages underwriters were compensated based on the number of loans reviewed, regardless of whether the loan was approved — thus skewing the system in favor of approving subprime loans, regardless of quality.”

Another confidential witness, CW 21, a senior mortgage processor and junior underwriter at Chase Home Finance said that underwriters were “ ‘discouraged [from] checking out [the borrower’s] place of employment’ and other critical information reflecting mortgage quality. As an example, CW 21 recalled one instance where an underwriter wanted to confirm a borrower’s employment and based on the result, denied the loan. CW 21 stated that the loan officer and branch manager came to the underwriter and said, ‘Can’t you just pretend like you didn’t check the job?’ ”

The lawsuit also references an internal memo at JPMorgan, titled “Zippy Cheats & Tricks,” calling it was a primer on how to get risky mortgage loans approved by Zippy, Chase’s in-house automated loan underwriting system by inflating borrowers’ income or otherwise falsifying their loan application.

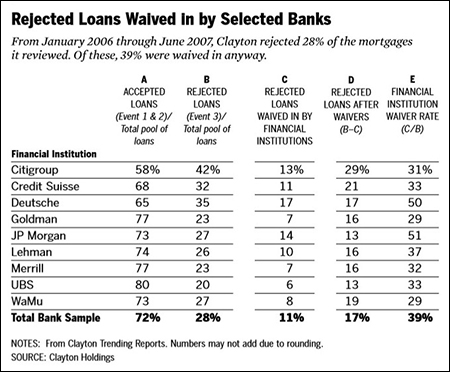

The amended complaint references evidence provided to the Financial Crisis Inquiry Commission by Clayton Holdings, the outside vendor used by JPMorgan to check the quality of mortgage loans it was considering for securitization. Dexia’s complaint notes: “Clayton stated that JPMorgan had waived in 51% of the loans that Clayton had marked as fatally defective into mortgage pools that JPMorgan securitized between January 2006 and June 2007 — higher than any other financial institution during the same period.”

Dexia makes even more powerful arguments in its Memorandum of Law in opposition to the Cravath Motion for Summary Judgment. Lawyers for Dexia write:

“Here, Defendants intentionally designed and implemented policies aimed at maximizing deal volume while concealing the critical defects in the mortgages they securitized. Independent, experienced loan underwriters re-underwrote a 10-30% sample of loans to verify they were underwritten in accordance with the loan sellers’ guidelines. The underwriters sent Defendants [JPMorgan, et al] reports scoring each loan in the sample on the following scale: EV1 (meets guidelines), EV2 (does not meet guidelines but compensating factors justify an exception), or EV3 (does not meet guidelines, materially defective).

“These independent assessments of the sample of loans backing the Certificates were devastating. The results revealed to Defendants that large portions of the sampled loans (20% to 80%) had ‘material’ defects, including fraudulent incomes, inflated property appraisals, or missing material documents required by the guidelines to ensure credit quality and compliance. Having been informed that the sample showed so many defective loans that the term sheets and data files providing investors with aggregate pool data could not be accurate, Defendants deliberately concealed the poor quality of the overall loan pools.

“First, Defendants’ personnel (often with little to no underwriting experience) overrode the independent underwriters’ determinations and reduced the number of EV3s in the sample. For example, in connection with its securitization of a pool of loans, JPM’s third party diligence provider determined that 54% was a materially defective EV3. JPMorgan did not expand its sample set and override the EV3 determinations so that the final due diligence report reflected that only 5.8% of the sample pool were EV3s. Defendants overrode diligence samples with 54% EV3s to create final reports reflecting 5.8% EV3s.

“Second, Defendants ignored the fact the remaining loan pool contained similar material defects, acquiring the entire pool and selling it to investors like FSAM [a Dexia affiliate] without disclosure of the true quality of the loans. Third, when the rating agencies asked for diligence results to calibrate their ratings models, Defendants provided only the final sanitized reports, without disclosing the massive critical deficiencies in the sample and the remaining non-sampled loans.”

Instead of a strong fraud case like this moving quickly in front of a jury while witnesses’ memories are still fresh, the case has been tied up for almost two years in a Motion for Summary Judgment asking to find in favor of the defendants filed by Cravath, first in Federal Court before Judge Rakoff and now in New York State Supreme Court before Judge Marcy Friedman. To give you an idea of the tenuous thread on which this two-year stall rests, this is an excerpt from the transcript of oral arguments where Cravath lawyer, Daniel Slifkin, explains one prong of his position:

“And so we are clear, we submit there is absolutely no evidence of falsity. And aside from reliance on specific pieces of information, there is no evidence of falsity with respect to the data. We might have a debate as to some of the evidence about due diligence and I know your Honor is familiar with the EV1, EV2, EV3. We can debate that back and forth, and we are expressly not doing that on summary judgment. But when it comes to the data, the numbers, the metrics and so forth, about the loan pools underlying the certificates, the mortgages themselves, there is no allegation of falsity. There isn’t a single mortgage that’s identified or single number where they say that number is wrong, let alone, and you knew it and we relied upon it and it caused our harm.”

Oral arguments on the Summary Judgment motion occurred before New York State Supreme Court Judge Marcy Friedman on September 9, 2014. Her decision is expected at any time.