By Pam Martens: June 21, 2013

In the past two trading sessions, Wednesday and Thursday of this week, the Dow Jones Industrial Average has shaved 550 points out of investors’ pockets. Mainstream media is in lock-step agreement that the decline is owing to fears of slowing growth in China and the potential for the Federal Reserve to “taper,” or retrench from buying $85 billion a month in mortgage-backed securities and U.S. Treasuries.

To borrow a phrase from H.L. Mencken, “When you hear somebody say ‘this is not about money,’ it’s about money.”

There’s an old expression on Wall Street: bull markets eventually crumble under their own weight. That’s because, at some point, the value of the market is too big to drive higher. It has only one direction in which it can move and that’s down. It’s about money.

According to the World Bank, the total value (or market capitalization) of all domestically listed stocks in the U.S. has moved from $11.7 trillion at the end of 2008 to $18.6 trillion at the end of 2012. That means it takes roughly $1.8 trillion to move the market 10 percent higher. That’s a lot of money, even when leveraged with enormous amounts of margin debt.

As the U.S. stock market has moved higher, it did so on the back of rising margin debt. According to the Federal Reserve, margin debt on the books of broker dealers has increased from $276.5 billion at the end of 2010 to $379.5 billion at the end of March 2013. (The New York Stock Exchange released a report early this month showing that margin debt had reached an all-time record as of April 30, 2013, to a whopping $384 billion.)

Morgan Stanley released a study this past January, showing that hedge funds’ portfolio holdings stood at 153 percent of the cash provided to them by investors.

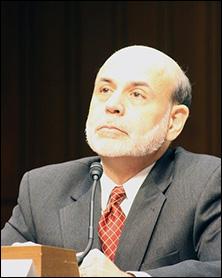

That data had to give Fed Chairman Ben Bernanke pause, as likely has the stock market setting new highs in the face of extremely tepid economic growth.

An instant means of dampening stock market speculation and forcing a market correction is for the Fed to hint at a pull back in its bond buying program, known as Quantitative Easing 3 (QE-3). The market’s comfort level that this program is now baked into the system has engineered the term QE-Infinity. Any pull back by the Fed in bond buying would force all interest rates higher – including the interest rate that hedge funds and other investors pay on their margin debt. It’s the potential for margin buying to become too expensive to be economically attractive and the fear that one’s hedge fund competitors will get through the exit door faster that set off the panic selling on Wednesday and Thursday.

China and QE-Infinity were the sparks – margin debt was the giant tank of gasoline.

Typically, in the midst of panic selling, there will be a flight to quality into U.S. Treasuries as the money has to go somewhere. When every investment is simultaneously selling off, that’s a clear cut case for the wholesale dumping of margined securities by hedge funds. The money didn’t find its way into Treasuries because it wasn’t real money to begin with – it was margin debt.

Would Fed Chairman Ben Bernanke actually create a stampede out of the stock market and induce a severe economic contraction by sharply curtailing the Fed’s bond buying program? Right now, the Fed is in a quandary. Does it risk a sharp economic downturn by letting rates rise, or does it continue easing and risk another giant speculative bubble in stocks and junk bonds that could cause even bigger economic damage when the bubble bursts from a higher plateau in the future.

One thing is clear, the Fed would not be trash talking QE-Infinity unless it was worried about bubbles — not in the face of the manufacturing report that came out early this month and the dismal job market.

According to the Institute for Supply Management (ISM), its manufacturing index contracted in May to a reading of 49, the lowest level since it registered a reading of 45.8 percent in June 2009. The weakness was broadly based with the new order index registering 48.8 percent and the Backlog of Orders Index registering 48 percent. A reading below 50 is a sign of contraction.

On May 22, 2013 Bernanke testified as follows to the Joint Economic Committee of Congress:

“Recognizing the drawbacks of persistently low rates, the FOMC actively seeks economic conditions consistent with sustainably higher interest rates. Unfortunately, withdrawing policy accommodation at this juncture would be highly unlikely to produce such conditions. A premature tightening of monetary policy could lead interest rates to rise temporarily but would also carry a substantial risk of slowing or ending the economic recovery and causing inflation to fall further. Such outcomes tend to be associated with extended periods of lower, not higher, interest rates, as well as poor returns on other assets. Moreover, renewed economic weakness would pose its own risks to financial stability.”

Hedge funds don’t actually fear the end of QE-Infinity. They fear that the Fed has decided it’s going to talk down bubbles.