By Pam Martens and Russ Martens: August 3, 2017

The Federal Reserve Board of Governors is supposed to have a roster of seven Governors. It currently has four. Equally alarming, it lists just two members serving on each of its eight committees. One Fed Board Governor, Lael Brainard, is listed as one of the two members on six of the eight committees, or 75 percent of all committees. Governor Jerome Powell sits on five of the eight committees, or 63 percent of all committees.

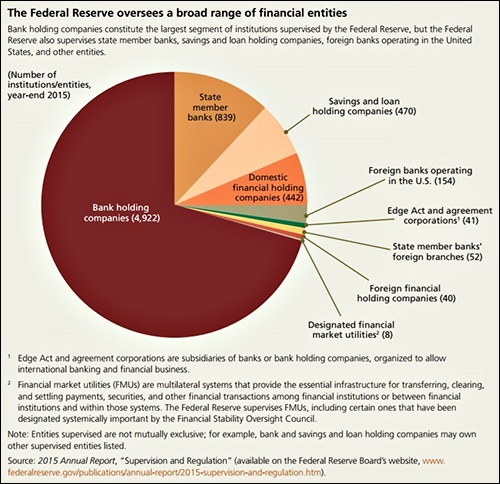

The Fed’s Committee on Supervision and Regulation consists of just Powell and Brainard. And yet, this is what the Fed’s 2015 Annual Report describes as the institutions the Fed supervises:

4,922 Bank Holding Companies

442 Domestic Financial Holding Companies

470 Savings and Loan Holding Companies

839 State Member Banks

154 Foreign Banks Operating in the U.S.

Along with other entities per the graph above.

There has long been the suspicion that the Fed has farmed out much of its work of supervising the largest and serially malfeasant Wall Street banks to the Federal Reserve Bank of New York. There has also long been the suspicion that the New York Fed has grown too cozy with the banks it oversees to do the job properly. (See related articles below.)

The Trump administration appears intent on levitating the stock market by promising Wall Street more deregulation. The public must never forget that the Federal Reserve wore blinders and Congress sat on its hands as Wall Street spun out of control in a frenzy of speculative excess and corruption, leading to the greatest financial collapse from 2008 to 2010 since the Great Depression. Two-member committees at the Fed are a brazen affront to what this nation has been put through at the hands of Wall Street and its misguided regulators.

Related Articles:

U.S. Senate Tries Public Shaming of New York Fed President Dudley

Forex Guilty Pleas and the New York Fed’s Blinders

Fed Chair Bernanke Held 84 Secret Meetings in the Lead Up to the Wall Street Collapse

Carmen Segarra: Secretly Tape Recorded Goldman and New York Fed

New York Fed’s Answer to Cartels Rigging Markets – Form Another Cartel

Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?

Relationship Managers at the New York Fed and Citibank: The Job Function Ripe for Corruption

New Documents Show How Power Moved to Wall Street, Via the New York Fed

Intelligence Gathering Plays Key Role at New York Fed’s Trading Desk

Libor Scandal Grows: Barclays Banged On the Door of the New York Fed 12 Times

Trading Floor of the Federal Reserve Bank of New York; In Photos, Over the Years