By Pam Martens and Russ Martens: January 29, 2024 ~

On July 27 of last year, the Vice Chair for Supervision at the Federal Reserve Board of Governors, Michael Barr, made the following statement as part of the proposed new capital requirements for mega banks in the U.S. – revealing the stunning news that the serially-charged mega banks on Wall Street have been allowed to use their own internal risk models to tell the Fed how much risk-weighted assets they have and, thus, how much capital they need to hold. Barr stated:

“For a firm’s lending activities, the proposed rules would end the practice of relying on a bank’s own individual estimates of their own risk and instead use a standardized, but risk-based measure of credit risk. Standardized credit risk approaches do a reasonably good job of approximating risks, while internal models are prone to underestimate such risks.

“Second, for a firm’s trading activities, the proposed rules would adjust the way that the firm is required to measure market risk, which is the risk of loss from movements in market prices. These changes are intended to correct for gaps in the current rules.”

Relying on the mega banks that have been regularly charged with criminal acts and manipulating markets and who brought the U.S. economy to its knees with their financial crash of 2008, because their risk models were as helpful as a row boat in a tsunami, is yet one more clear indication that federal banking regulators have been completely captured by the Wall Street mega banks.

According to the Fed, the newly proposed capital rules will not stop federal regulators from relying on the mega banks to provide the information that sets their capital requirements, it will just change the models. The Fed and its fellow bank regulators wrote as follows about their so-called Basel III reforms:

“Under the proposed expanded risk-based approach, banking organizations would calculate total risk-weighted assets using (1) a new standardized approach for credit risk; (2) the revised approach for credit valuation adjustment (CVA) risk; (3) a new standardized approach for operational risk; and (4) the revised approach to market risk.”

Two economists are now calling out this insanity in a new academic paper. Anat Admati is the Professor of Finance and Economics at Stanford Graduate School of Business. Martin Hellwig is a German economist. The two are co-authors of the newly released and expanded book The Bankers’ New Clothes: What’s Wrong with Banking and What to Do about It. To call attention to the lies that bankers and their lobbyists perpetuate to get watered-down or gutted rules from their regulators, Admati and Hellwig have released a paper debunking the 44 flawed claims that bankers have been getting away with. One of those flawed claims goes to the heart of this debate on required capital. The pair write:

“Flawed Claim 29: Assigning risk weights to assets when determining required equity [equity capital] is a way of bringing serious quantitative analysis to bear on bank regulation…

“Proper measurement of the risks to which a bank is exposed would have to consider the counterparty credit risks and their correlations with the underlying risks of the banks. The scope for doing so is limited by a lack of data and by the never-ending changes in risks and correlations that occur when counterparties change their own positions. In practice, the use of risk weights in bank regulation allows banks to be extremely highly indebted, masks important risks, and adds to the interconnectedness of the system. Whereas proponents of the system argue that it is important to require banks to have more equity funding when their assets are riskier, in fact the system allows banks to get away with much less equity funding when they say that their assets are less risky. A uniform ratio of required equity [equity capital] to total assets would provide a lower bound on the banks’ leverage and would enable supervisors to intervene when the ratio is breached before it may be too late. By contrast, because some risk weights are (near) zero, the risk-weighting system allows very high leverage.

“The ability of banks to ‘economize on equity’ is enhanced by their ability to use their own models to assess risks. The scope for manipulation they have is largest for assets in the trading book, which is why they were keen to put mortgage-backed securities and the like into the trading book, subject to mark-to-market accounting rules. Most of the losses in 2007-2009 were incurred on assets in the trading book, where equity often was as low as 1 percent of investments…”

What the Fed and its fellow federal regulators have been effectively doing is turning capital requirements over to the casino. Consider what happened when the 158-year old Lehman Brothers failed in 2008 and filed for bankruptcy. Just five days before Lehman failed, it was sporting a capital ratio of 11 percent, suggesting that it was adequately capitalized. But four weeks after its bankruptcy on September 15, 2008, its debt was valued at only 9 cents on the dollar, suggesting its unsecured creditors were going to lose 91 percent of their money. While the recovery rate improved over time as market values stabilized, there is no question that Lehman’s regulators were in the dark – or chose to be in the dark – about just how highly leveraged this financial institution was in 2008.

Unknown to most Americans, the reckless Lehman Brothers was allowed by its regulators to own two federally-insured banks: Lehman Brothers Bank, FSB and Lehman Brothers Commercial Bank. Together, they held $17.2 billion in assets as of June 30, 2008, 75 days before Lehman went belly up.

Today, four of the largest trading houses on Wall Street own federally-insured banks that rank among the largest seven federally-insured banks in the U.S.: JPMorgan Chase, Bank of America, Citigroup, and Goldman Sachs.

Another key problem with allowing the criminally-inclined mega banks to calculate their own risk-weighted capital needs is that only a handful of people inside the bank understand the risks that are hiding in the shadows in the bank’s off-balance-sheet exposures.

On its way to becoming a 99-cent stock in March of 2009 and needing a secret $2.5 trillion bailout in cumulative loans from the Fed between December 2007 and June 2010, Citigroup was using off-balance-sheet SIVs (Structured Investment Vehicles) to boost its profits and hide its risks. When the bank was forced to move these vehicles back onto its balance sheet, its debt was downgraded and its stock tanked further.

Any suggestion that the mega banks on Wall Street have cleaned up their reckless risk-taking is undermined by the number of times they have needed to be bailed out since the crash of 2008 – the worst economic crisis since the Great Depression. (The New York Fed has become the official money funnel for Wall Street bailouts while being, literally, owned by some of the biggest banks on Wall Street.)

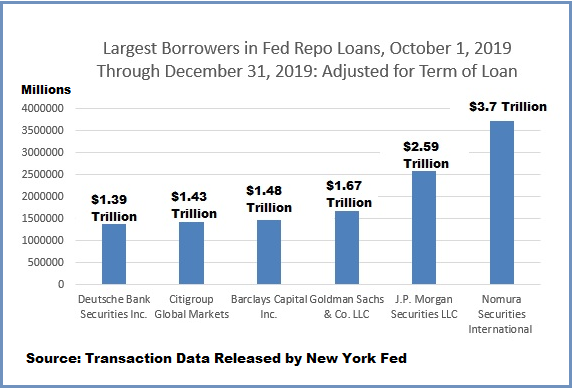

The first banking crisis since that of 2008 began on September 17, 2019 – for reasons the Fed has yet to explain with any credibility. In the last quarter of 2019, the New York Fed had to shovel emergency repo loans cumulatively totaling (on a term-adjusted basis) $19.87 trillion into Wall Street banks. As the chart below indicates, just six trading units of the mega banks on Wall Street received 62 percent of that amount. (Unadjusted for the term of the loan, the cumulative total was $4.5 trillion.)

Under the Dodd-Frank financial reform legislation of 2010, the Fed had to release the names of the banks that received these bailouts, and the dollar amounts of each loan, two years after the program began. While mainstream media went to court to get this information in 2008, there was a total mainstream media blackout when the Fed released the data for the 2019 bailouts. (See There’s a News Blackout on the Fed’s Naming of the Banks that Got Its Emergency Repo Loans; Some Journalists Appear to Be Under Gag Orders.)

The next banking crisis occurred in March 2020 and was blamed on the pandemic. The share prices of the four largest banks (by deposits) collapsed by as much as 40 to 60 percent between January 2, 2020 and March 18, 2020. The Fed rolled out the same alphabet soup of emergency lending programs that it had rolled out in 2008 – with the New York Fed once again in charge of the bulk of those programs.

Three years later, in the spring of 2023, the second, third and fourth largest bank failures in U.S. history occurred: Silicon Valley Bank and Signature Bank in March and First Republic Bank on May 1.

To deal with last year’s failures, the Fed did something that it has never done before in its 110-year history. It began accepting underwater bonds as collateral for emergency loans to teetering banks while paying 100-cents on the dollar on that collateral for loans of up to one year in duration. (Historically, the Fed has imposed a haircut on collateral and made overnight loans through its Discount Window.) The Fed called this bailout program the Bank Term Funding Program (BTFP).

In recent weeks, the amounts being borrowed under the Bank Term Funding Program have spiked. The bailout facility had a balance of $121.7 billion as of December 7, 2023. As of its last report date on January 24, 2024, it had soared to $167.8 billion.

Last Wednesday, after weeks of watching banks increasingly tap the Bank Term Funding Program almost a year after the banking crisis was supposed to have subsided, the Fed announced it would cut off any more loans from the BTFP on March 11.

As we have repeatedly stated, and the brilliant Law Professor Art Wilmarth has documented, the only meaningful way to genuinely reform the mega banks is to restore the Glass-Steagall Act, which will separate casino banking from the federally-insured deposits of U.S. commercial banks.

As we have repeatedly stated, and the brilliant Law Professor Art Wilmarth has documented, the only meaningful way to genuinely reform the mega banks is to restore the Glass-Steagall Act, which will separate casino banking from the federally-insured deposits of U.S. commercial banks.