By Pam Martens and Russ Martens: June 3, 2015

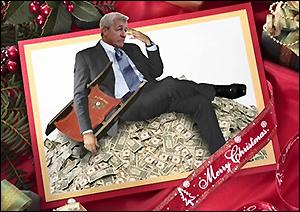

The General Accountability Office (GAO) released a sobering study yesterday that looks at how much 55-64 year olds have been able to set aside for retirement. The short answer is: excruciatingly too little. Why that is happening can best be summed up by a headline out this morning at Bloomberg News: Jamie Dimon Becomes Billionaire Ushering in Era of the Megabank.

The GAO study found the following: Approximately 55 percent of households age 55-64 in America have less than $25,000 in retirement savings, including 41 percent who have zero. Most of the households in this age group have some other resources or benefits from a Defined Benefit plan, but 27 percent of this age group have neither retirement savings nor a Defined Benefit plan. For the 59 percent of households age 55-64 with some retirement savings, the GAO study estimates that the median amount saved is about $104,000. While about 15 percent of these households have retirement savings amounts over $500,000, 11 percent have retirement savings below $10,000 and 24 percent have savings of less than $25,000.

The conclusion to draw from this study is that millions of Americans will never be able to stop working, to enjoy a financially-worry free retirement, to have a nest-egg into their 80s, or even to eat nutritionally balanced meals in retirement because Wall Street’s megabanks that Jamie Dimon concocted with Sandy Weill have eaten America’s lunch – and its future. Occupy Wall Street was right: the megabanks got bailed out; Americans got sold out – and are still being sold out by the self-declared felonious megabanks who have found ever creative ways of siphoning off trillions from the pockets of the working class while paying back pennies on the dollar, courtesy of the revolving-door regulators and sycophants in Congress.

On June 18 of last year, the Senate held a hearing on one of the myriad of Wall Street’s wealth transfer schemes: high frequency trading. Senator Elizabeth Warren aptly described the scheme:

“High frequency trading reminds me a little of the scam in Office Space. You know, you take just a little bit of money from every trade in the hope that no one will complain. But taking a little bit of money from zillions of trades adds up to billions of dollars in profits for these high frequency traders and billions of dollars in losses for our retirement funds and our mutual funds and everybody else in the market place. It also means a tilt in the playing field for those who don’t have the information or have the access to the speed or big enough to play in this game.”

Another core component of Wall Street’s asset-stripping devices is the 401(k) plan which has replaced most of the Defined Benefits plans that previously provided a fixed income in retirement which, together with Social Security, allowed Americans to live in dignity during retirement.

As Frontline’s Martin Smith exposed in The Retirement Gamble on PBS in April 2013, under a 2 percent 401(k) fee structure, almost two-thirds of your working life will go toward paying obscene compensation to Wall Street; a little over one-third will benefit your family – and that’s before paying taxes on withdrawals to Uncle Sam.

This is the relevant portion of the transcript from the program:

John Bogle [Founder of the low-cost Vanguard Funds]: Costs are a crucial part of the equation. It doesn’t take a genius to know that the bigger the profit of the management company, the smaller the profit that investors get. The money managers always want more, and that’s natural enough in most businesses, but it’s not right for this business.

Smith: Bogle gave me an example. Assume you’re invested in a fund that is earning a gross annual return of 7 percent. They charge you a 2 percent annual fee. Over 50 years, the difference between your net of 5 percent — the red line — and what you would have made without fees — the green line — is staggering. Bogle says you’ve lost almost two thirds of what you would have had.

Bogle: What happens in the fund business is the magic of compound returns is overwhelmed by the tyranny of compounding costs. It’s a mathematical fact. There’s no getting around it. The fact that we don’t look at it— too bad for us.

Smith: What I have a hard time understanding is that 2 percent fee that I might pay to an actively managed mutual fund is going to really have a great impact on my future retirement savings.

Bogle: Well, you have to rely on somebody to get out a compound interest table and look at the impact over an investment lifetime. Do you really want to invest in a system where you put up 100 percent of the capital, you the mutual fund shareholder, you take 100 percent of the risk and you get 30 percent of the return?

We confirmed the above math in detail in a related article.

To summarize all of the above – your lifetime of work and saving for retirement have been about making the Jamie Dimons of Wall Street billionaires. Wall Street mega banks seized millions of homes through illegal foreclosures in the lead up to the 2008 collapse. They got away with it. The banks themselves, not regulators, then got to determine the number of people they had victimized. The megabanks further enriched themselves making bets that the housing market would collapse, using their inside knowledge of the bogus loans they had made. None of the banking titans went to jail for that either. They simply paid back pennies on the dollar. One of the hedge funds titans involved in that scam didn’t pay back a dime of the $1 billion he made, didn’t get prosecuted, but, instead, got an auditorium named after him at NYU and an award during this year’s NYU commencement.

Americans can sit back and accept their fate of poverty in retirement or they can engage with fellow citizens to take back their country by restoring the Glass-Steagall Act to strip the megabanks of the ability to gamble for the house with trillions of dollars of the little guys’ insured deposits and demand campaign finance reform to strip the megabanks of the ability to perpetually place their toadies in Congress.