-

Recent Posts

- Jamie Dimon’s Washington Post OpEd Gets Pummeled at Yahoo Finance

- In the Span of 72 Hours, Four People Tied to a Hewlett-Packard Criminal Case Died in Two Separate Events

- Crypto Took Down Another Federally-Insured Bank and Just Handed Its CEO a 24-Year Prison Sentence

- All the Devils from 2008 Are Back at the Megabanks: Leverage, Off-Balance-Sheet Debt, Over $192 Trillion in Derivatives, Shaky Capital Levels

- New Study Says the Fed Is Captured by Congress and White House — Not the Megabanks that Own the Fed Banks and Get Trillions in Bailouts

- Data from the Fed’s Emergency Funding Program Shows Spring 2023 Banking Crisis Was Far Deeper than Americans Were Told

- These FDIC-Insured Banks Have Lost 69 to 40 Percent of their Market Value Year-to-Date

- Exposure at Hedge Funds Has Skyrocketed to Over $28 Trillion; Goldman Sachs, Morgan Stanley and JPMorgan Are at Risk

- We Charted the Plunge and Rebound in the Nikkei Versus Nomura and Citigroup; the Correlation Is Frightening

- Former U.S. Labor Secretary Says Billionaires Have No Right to Exist Because their Wealth Comes from Five Illegal or Bad Practices

- Citigroup Is Having a Helluva Summer: A Protest on Thursday Will Turn Up the Heat

- Nikkei Has Biggest Drop in History: Here’s What’s Causing the Global Market Selloff

- JPMorgan Is Tapping Illiquid Assets in its Global Collateral Program; the New York Fed Is Paying for Its Services

- Bank Regulators Issue Warnings on Fintech and Banking as Disasters Pile Up

- Donald Trump Gives a Speech on Not Letting China Win the Crypto Race – Not Realizing China Banned Crypto Mining and Transactions Four Years Ago

- The New York Fed Has Contracted Out Key Functions to JPMorgan Chase; We Filed a FOIA and Got These Strange Invoices

- On the Eve of Netanyahu’s Address to Congress, Senator Bernie Sanders Delivers a Breathtaking Assessment of His War Crimes

- Trump’s Sit-Down with Netanyahu at Mar-a-Lago Will Cost U.S. Taxpayers Millions While Profiting Trump’s Business

- Protecting Trump and His Jet-Setting Adult Children During His Presidency Cost Taxpayers Over $1 Billion

- A Congressman and a Doctor Reported a Woman Being Shot at Trump Rally: She’s Vanished from Official Reports

- Jamie Dimon Goes Missing from Earnings Call, After Dumping $183 Million of His JPMorgan Chase Stock Earlier this Year

- U.S. Senate Candidate Backed by Hedge Fund Billionaires Was Sitting in Front Row at Trump Rally as the Sniper Fired into the Bleachers

- Project 2025: The Fossil Fuel and Banking Money Behind the Madness

- The Fund Created to Unwind a Failing Megabank Has a Problem: There’s No Money in It

- Joe Biden Versus the New York Times

- Grand Jury Transcript in Jeffrey Epstein Case Is Released, Raising Questions about Epstein’s Darkest Secrets Being Protected in JPMorgan Cases

- The Supreme Court Crowns a King, Immunizing Future Criminal Acts Under Project 2025 – a Right Wing Manifesto

- The Debate Disaster and the Supreme Court’s “Chevron” Repeal Have a Money Trail Leading to Charles Koch

- Congressman Andy Barr Stacks a Hearing on the Fed’s Stress Tests with Lobbyists for Megabanks

- The Fed Posts Historic Operating Losses As It Pays Out 5.40 Percent Interest to Banks

- Goldman Sachs’ Bank Derivatives Have Grown from $40 Trillion to $54 Trillion in Five Years; So How Did Its Credit Exposure Improve by 200 Percent?

- The Fed and FDIC Wake Up Suddenly to the Threat of Derivatives, Flunking the Four Largest Derivative Banks on their Wind-Down Plans

- Is the Stock Market Setting Investors Up for a Tech Bust Similar to the Dot.com Bust?

- Chase Bank Customers Are Reporting a Wave of Wire Fraud in their Accounts; the Bank Won’t Make Good on the Looted Funds

- The Senate Race in Ohio Is the Sickest in U.S. History in Terms of Billionaire Money from Outside the State

- Sullivan & Cromwell’s Legal Work for Sam Bankman-Fried’s Crypto House of Fraud Is Getting a Closer Look in Two Federal Court Cases

- Crypto Tries to Recreate the Koch Money Machine to Pack Congress with Shills

- French Fears Ignite Selloff in U.S. Megabanks and Foreign Peers

- Crypto Just Got Exponentially More Dangerous: Meet Fairshake

- Nvidia Hit a $3 Trillion Market Cap Last Week; Dark Pools Are Making Over 300,000 Trades in the Stock Weekly

- The Consumer Financial Protection Bureau Is Making Enemies in All the Right Places

- A Former Exec at Citibank Raises Alarm Bells in Federal Court Over Failed Risk Controls Inside the Bank

- Charles Koch’s Money Is Being Used in Elections in Ways Only Orwell Could Have Imagined

- Freakonomics and Frankenbanks: JPMorgan Chase Sucked Up 18 Percent of All Profits of 4,568 FDIC-Insured Banks in the First Quarter

- Academic Study Provides Hard Numbers to the Sick, Revolving Door Culture at Goldman Sachs, JPMorgan and Citigroup

- $244 Billion of Treasury Debt to Hit the Market Today and Tomorrow as Interest Rates Spike on Ballooning Supply

- CFTC Fines J.P. Morgan Securities — a Fed Primary Dealer — $100 Million for Failing to Surveil Potential Spoofing and High Frequency Trading for Eight Years

- Another FDIC-Insured Bank Got in Bed with Fintech; It’s Now Got a Dumpster Fire and Desperate Pleas from Customers for their Money

- Citigroup Gets Fined $79 Million Two Years After It Caused a $300 Billion Flash Crash in European Stock Markets

- After Weeks of Howling by MAGA Republicans for the Chair of the FDIC “to Resign,” a Democrat Delivers the Decisive Stab in the Back

Search Results for: epstein

Janet Yellen’s Treasury Department Hires 5-Count Felon JPMorgan Chase to Look for Fraud

By Pam Martens and Russ Martens: October 11, 2023 ~ Immediately upon departing her post as Chair of the Federal Reserve, but prior to getting the nod from the Biden administration to become U.S. Treasury Secretary, Janet Yellen engaged in what the courageous reporter at ProPublica, Jesse Eisinger, called a “two-fisted money grab from banks.” Yellen raked in more than $7 million in speaking fees with the bulk of that coming from Wall Street banks and trading houses, including JPMorgan Chase. In a Tweet, Eisinger said: “This is corruption, but isn’t called that because it’s so quotidian.” Now there is the appearance that a quid pro quo is coming full circle. According to a press release posted on JPMorgan Chase’s website, “it has been designated by the United States Treasury Department under a financial agency agreement to provide account validation services for federal government agencies” in order to ensure “Treasury’s commitment to … Continue reading

A Public Policy Professor Who Served Under Three U.S. Presidents, Says Jamie Dimon Is an Oligarch and Has “Hijacked the System”

By Pam Martens and Russ Martens: October 4, 2023 ~ Jamie Dimon is the Chairman and CEO of the serially-charged criminal trading operations of JPMorgan Chase, which thanks to the repeal of the Glass-Steagall Act in 1999, is also allowed to own the largest federally-insured bank in the United States and use its trillions of dollars in mom and pop deposits to gamble in derivatives. Robert Reich is Professor of Public Policy at the University of California, Berkeley; served in the administrations of Presidents Ford and Carter and as Labor Secretary under Clinton; is the author of 18 books, including bestsellers The Work of Nations, Saving Capitalism, and Aftershock: The Next Economy and America’s Future. Reich received his B.A. from Dartmouth College, his M.A. from Oxford University where he was a Rhodes Scholar, and his J.D. from Yale Law School. Jamie Dimon made the mistake of coming into the radar of … Continue reading

Five-Count Felon JPMorgan Chase Gets Hit with Another Federal Fine for 40 Million Derivative Violations; Pays 37 1/2 Cents Per Violation

By Pam Martens and Russ Martens: October 2, 2023 ~ In the eyes of Wall Street veterans who are paying close attention to what’s going down at the mega banks on Wall Street, federal regulators are making the crime wave at these banks worse, not better. The federal fines for egregious behavior at these banks are getting smaller and more meaningless by the day. Take, for example, what happened on Friday. The Commodity Futures Trading Commission (CFTC) fined three of the largest trading houses on Wall Street a combined $53 million for derivative reporting violations. Those trading houses were units of Goldman Sachs, Bank of America, and JPMorgan Chase. But what was particularly tone deaf about the CFTC’s settlement with JPMorgan Chase was the tiny amount of the monetary fine and the praise heaped on the five-count felon bank for its “cooperation” with the federal regulator. According to the CFTC, over … Continue reading

Professors Point to JPMorgan Chase as Poster Boy of a Financial System Dependent on Corruption to Sustain Itself

By Pam Martens and Russ Martens: September 18, 2023 ~ The full day conference sponsored by nonprofit watchdog Better Markets last Wednesday was a unique opportunity to gain brilliant insights from academic experts who have battled on the frontlines of the most unprecedented and ongoing era of corruption in U.S. financial history. (You can watch it on YouTube at this link.) In fact, at the close of the conference, Anat Admati, Professor of Finance and Economics at Stanford Graduate School of Business, summed up the U.S. financial system in five words: “Corruption has become the system.” Admati’s celebrated 2013 book, The Bankers’ New Clothes: What’s Wrong with Banking and What to Do about It, co-authored with German economist Martin Hellwig, will have an expanded new edition coming out in early January. The new edition includes coverage of the banking failures this spring and four new chapters: “Too Fragile Still,” “Bailouts and Central … Continue reading

Another FDIC-Insured Bank Is Teetering, Closing at 27-1/2 Cents Yesterday, Down 96 Percent in a Year

By Pam Martens and Russ Martens: September 14, 2023 ~ There may be a lesson here: don’t put the word “Republic” in the name of your bank; don’t hold a lot of uninsured deposits; and don’t have wads of unrealized losses on your investment securities. If those lessons sound familiar, it’s because they played out in stunning fashion earlier this year when the second, third and fourth largest bank failures in U.S. history occurred. One of those banks that blew up was First Republic Bank, which was put into FDIC receivership on May 1 and later sold, under much controversy, to the already behemoth JPMorgan Chase, the largest bank in the U.S. (JPMorgan Chase can’t seem to stay away from criminal charges. It thus far has notched five felony counts in its belt and is currently being sued by the U.S. Virgin Islands for “actively participating” in Jeffrey Epstein’s sex-trafficking of minors … Continue reading

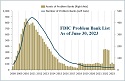

FDIC Releases a New Problem Bank List: It’s an Exercise in Fantasy

By Pam Martens and Russ Martens: September 11, 2023 ~ Last Thursday, the Federal Deposit Insurance Corporation (FDIC) released its Quarterly Banking Profile for the quarter ending June 30, 2023. The report includes the FDIC’s Problem Bank List. While the actual names of the problem banks aren’t provided, the total assets listed provide an indication of whether any large banks are on the list. The FDIC’s first quarter banking profile had published a “Problem Bank List” showing just 43 banks with total assets of $58 billion as of March 31, 2023. Unfortunately, on March 10 Silicon Valley Bank blew up with assets at year-end 2022 of $209 billion. Two days later, on March 12, Signature Bank blew up with assets of $110 billion as of year-end. Clearly, the FDIC did not see these as problem banks in advance of their blowing up in a matter of days. What the FDIC did know … Continue reading

The SEC and DOJ Are Doing Damage Control for 5-Count Felon JPMorgan Chase

By Pam Martens and Russ Martens: August 31, 2023 ~ In much of the United States, if a person is convicted of a felony after conviction on two prior felonies, they receive a severe prison sentence. It’s known as the Three Strikes Law. But if you are the largest bank in the United States, charged by the U.S. Department of Justice with five felony counts since 2014, along with other major crimes for which you are given a non-prosecution agreement, not only do you not get harsher treatment for each new criminal act, but you actually get two federal law enforcement agencies doing damage control for you. We’re talking about JPMorgan Chase and its cozy relationship with the Securities and Exchange Commission (SEC) and certain officials within the U.S. Department of Justice (DOJ). Take, for example, what happened on June 22 of this year. The SEC issued a Cease-and-Desist order against the … Continue reading

Mega Banks Take Down Stock Prices after a Fitch Warning About a Possible Downgrade to JPMorgan Chase and Its Peers

By Pam Martens and Russ Martens: August 16, 2023 ~ Yesterday, the Dow Jones Industrial Average took a tumble of 361 points by the closing bell. Numerous headlines attributed the big decline to a weakening economy in China. But the actual trigger for angst among traders was a headline at 5:30 a.m. EDT yesterday at CNBC. The headline read: “Fitch warns it may be forced to downgrade dozens of banks, including JPMorgan Chase.” JPMorgan Chase is not just the biggest bank in the United States in terms of assets and deposits. It is the biggest bank in terms of its derivative exposure. According to the federal regulator of national banks (those operating across state lines), the Office of the Comptroller of the Currency (OCC), as of March 31, 2023, JPMorgan Chase Bank had assets of $3.2 trillion and derivative exposure of more than $59 trillion notional (face amount). The OCC report also … Continue reading

Judge Jed Rakoff Has Regularly Dined in the Past with the Chairman of the Law Firm that Just Got a Big Win in His Court in the JPMorgan Sex Trafficking Case

By Pam Martens and Russ Martens: August 14, 2023 ~ In 2017, Simon & Schuster released the book, The Chickenshit Club, by the Pulitzer-prize winning public interest writer, Jesse Eisinger. The title derives from the premise that the prosecutors at the U.S. Department of Justice are too worried about losing a case or harming their ability to get those seven-figure pay packages at the big Wall Street law firms to do their jobs properly as prosecutors. Aside from that narrative, which is brilliantly analyzed by Eisinger, the book reveals a stunning fact about Manhattan federal district court Judge Jed Rakoff – a man who has gone out of his way to portray himself with the media as the protector of the public interest. Eisinger writes this: “Karp, sixteen years younger, and Rakoff began having dinner every several months, often with their wives and other lawyers, at restaurants around Manhattan: Il Gattopardo, … Continue reading

WeWork’s Stock Imploded to 13 Cents Yesterday; Its Cult-Master, Adam Neumann, Cashed Out Years Ago and Is a Billionaire

By Pam Martens and Russ Martens: August 10, 2023 ~ That office space company we warned our readers about so extensively in 2019, WeWork, collapsed to 13 cents a share yesterday. Its bonds were trading at about 13 cents on the dollar. WeWork’s stock has been on a steady decline since the company began to trade publicly on October 21, 2021. The chart above shows how investors would have fared in WeWork stock versus a 10-year U.S. Treasury note since WeWork started trading in 2021. The collapse in the share price this week came as a result of an 8-K filing with the Securities and Exchange Commission on Tuesday in which the company uttered these discomforting words: “…as a result of the Company’s losses and projected cash needs, combined with increased member churn and current liquidity levels, substantial doubt exists about the Company’s ability to continue as a going concern.” The … Continue reading