By Pam Martens and Russ Martens: October 20, 2016

CNBC’s David Faber Asks Goldman Sachs CEO Lloyd Blankfein If There’s a Secret Banking Cabal, October 19, 2016

There’s a new mantra making the rounds of Washington and Wall Street. No matter how big the lie you’re caught in, no matter how much documented evidence exists against you, just deny, deny, deny. That’s how Democratic National Committee Interim Chair Donna Brazile handled the email released by WikiLeaks showing that she leaked a debate question to Hillary Clinton; that’s how Hillary Clinton handled revelations about sending classified government material over an unclassified server in the basement of her home; and that’s how Goldman Sachs CEO Lloyd Blankfein is handling the widespread public perception that there’s a banking cabal meeting in secret to plot its continued dominance over the interests of the average U.S. citizen.

Yesterday, CNBC’s David Faber interviewed Blankfein and asked about the suggestion that Donald Trump had made on October 13 in a speech in West Palm Beach, Florida that there is an international banking conspiracy undermining the sovereignty of the United States. Faber asked Blankfein: “So am I to take it that you weren’t meeting in secret with international banks and Hillary Clinton to plot the destruction of U.S. sovereignty?” Blankfein responded: “We could parse that clause by clause, but to every clause, the answer is no, we weren’t doing it. We weren’t meeting in secret and we certainly weren’t plotting destruction.”

The first half of Blankfein’s answer is flatly false and he knows it. The big Wall Street banks do meet in secret and have been doing it for decades. His own General Counsel, Gregory Palm, part of the Management Committee at Goldman Sachs, is part of the secret cabal.

Just five days before Blankfein made his false denial, Bloomberg News’ reporters Greg Farrell and Keri Geiger had landed the bombshell report that the top lawyers of the biggest Wall Street banks had been meeting secretly for two decades with their counterparts at international banks. At this year’s secret May meeting at a posh hotel in Versailles, the following were among the big bank lawyers in addition to Palm according to the Bloomberg report: Stephen Cutler of JPMorgan (a former Director of Enforcement at the SEC); Gary Lynch of Bank of America (also a former Director of Enforcement at the SEC); Morgan Stanley’s Eric Grossman; Citigroup’s Rohan Weerasinghe; Markus Diethelm of UBS Group AG; Richard Walker of Deutsche Bank (again, a former Director of Enforcement at the SEC); Robert Hoyt of Barclays; Romeo Cerutti of Credit Suisse Group AG; David Fein of Standard Chartered; Stuart Levey of HSBC Holdings; and Georges Dirani of BNP Paribas SA.

The Bloomberg report indicates that the meetings are secret and that this is the first time their existence has been reported to the public. But this is hardly the first time there have been reports of Wall Street banks huddling in secret.

Just this past July we raised the question as to whether the CEO of JPMorgan Chase, Jamie Dimon, was violating anti trust law by meeting secretly with competitors following a February 1 report in the Financial Times of “secret summits.” As we reported at the time:

According to guidelines published by various trade associations and law firms, the following rules must be followed when conducting meetings between competitors to avoid the perception, or actual charges, of antitrust violations:

– Meetings must be regularly scheduled and should never be secret.

– A properly designated Chairman shall prepare and follow a formal agenda which should be reviewed in advance by legal counsel.

– Legal counsel should be present at all meetings.

– Formal written minutes of meetings should be taken and archived.

– Properly instituted bylaws should be followed.

– A Board of Directors should be properly instituted.

– Any company meeting the requirements of the bylaws should be allowed membership in the group.

Secret summits that are by invitation-only, have no boards or bylaws, no public minutes would certainly appear to be both violations of anti trust law as well as fueling the public perception of conspiratorial meetings.

The top Federal regulator of the Wall Street bank holding companies, the Federal Reserve, has also fueled the perception of banking cartels by allowing the New York Fed to sponsor its own bank groups like the Foreign Exchange Committee, which has been operating for the past 38 years and whose members, JPMorgan Chase and Citigroup, each pleaded guilty on May 20, 2015 to a felony count brought by the U.S. Justice Department for – wait for it – engaging in rigging foreign exchange markets. The New York Fed-sponsored group, among other things, writes best practices rules for Wall Street.

The New York Fed also bizarrely sponsors the Financial Markets Lawyers Group. Its web site is an extension of the New York Fed’s web site. Members of the group are from the same Wall Street banks whose General Counsels are meeting secretly in posh hotels once a year.

While the New York Fed sponsored groups (see its latest one here) have regularly scheduled meetings, bylaws and minutes, it’s an affront to common sense to suggest that Wall Street banks serially charged with crimes against the public should be writing their own best practices rules. This Ayn Randian concept that businessmen will do what’s best for the public interest without any interference from government has twice in the past century nearly bankrupted the United States – in the Great Depression when Wall Street banks were allowed to hold savings deposits and again in 2008 when the Wall Street banks crashed with the taxpayer on the hook for the trillions of insured savings deposits they held, thanks to the mass de-regulation of Wall Street in 1999 under the Bill Clinton administration.

We don’t believe that Wall Street banking executives have ever plotted the destruction of the United States. We believe the majority want their children and grandchildren to grow up in a socially stable America. But we also believe they have been blinded by their greed, their multi-million dollar bonuses, their mansions in Greenwich, their yachts and penthouses, from consciously acknowledging that their actions brought us to the brink and continue to endanger America’s economy and future.

Congress has known for some time that the structure of Wall Street and its Federal regulators is contributing to egregiously harmful cartel activity. In August 1976, the House of Representatives Committee on Banking, Currency and Housing released a report titled: Federal Reserve Directors: A Study of Corporate and Banking Influence. The report drills down to one of the ongoing problems today:

“The big business and banking dominance of the Federal Reserve System cited in this report can be traced, in part, to the original Federal Reserve Act, which gave member commercial banks the right to select two-thirds of the directors of each district bank. But the Board of Governors in Washington must share the responsibility for this imbalance. They appoint the so-called ‘public’ members of the boards of each district bank, appointments which have largely reflected the same narrow interests of the bank-elected members. The parochial nature of the boards affects the public interest across a wide area, ranging from monetary policy to bank regulation. These are the directors, for example, who initially select the presidents of the 12 district banks—officials who serve on the Federal Open Market Committee, determining the nation’s money supply and the level of economic activity. The selection of these public officials, with such broad and essential policymaking powers, should not be in the hands of boards of directors selected and dominated by private banking and corporate interests.”

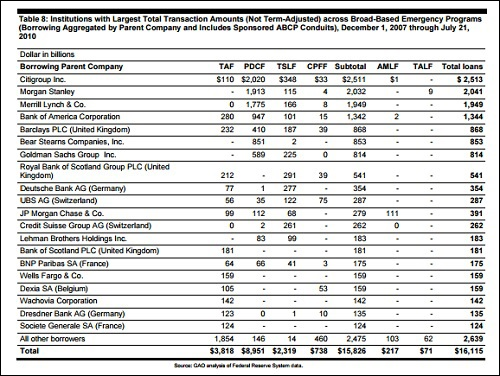

Following the financial crash in 2008, the Federal Reserve battled in court for years to avoid providing details of the money it funneled to the Wall Street banks and their global brethren during the years of the crisis. When the Federal Reserve lost that court battle, the Government Accountability Office (GAO) eventually issued a detailed report in 2011 that chronicled the mind-boggling secret Fed loans, all of which had been made at super low interest rates, many below 1 percent, without any public disclosure or authorization from Congress. The final tally came to $16.1 trillion in cumulative loans. (See Table 8 below from the GAO report.) It was not just Wall Street banks that got the bailout but their foreign competitors as well, as millions of families in the U.S. were foreclosed on by the same banks.

Since the crisis, the U.S. national debt has skyrocketed from $9 trillion to $19.5 trillion, more than doubling in just eight years while the $9 trillion took 232 years to accumulate while financing major wars and the Great Depression. In no small part, that debt growth came from the fiscal stimulus needed to shore up the economy as a result of the Wall Street-fueled financial collapse.

America needs to get its house in order before it loses its credit rating and its international reputation as a sane, well-managed country. Denying that we have a serious banking cartel problem is not going to get the job done.

Update: This article has been updated to reflect that Richard Walker of Deutsche Bank was also a former Director of Enforcement at the SEC. Are you noticing a pattern here?