By Pam Martens and Russ Martens: March 7, 2016

It was considered big news last week that House members Maxine Waters of the Financial Services Committee and Al Green of the Subcommittee on Oversight and Investigations have requested that the Government Accountability Office (GAO) launch an investigation of “regulatory capture” on Wall Street.

That news broke on Friday, one day after Senator Elizabeth Warren grilled the head of a Wall Street self-regulatory agency in a Senate hearing on a new study showing that stockbrokers with serial records of misconduct are allowed to remain in the industry. Warren also cited another recent study showing that even when investors prevail in arbitrations against bad brokers, they may never get paid. According to the study, over $60 million in fines owed to investors have not been paid since 2013.

The individual that Senator Warren was grilling is Richard Ketchum, head of the Financial Industry Regulatory Authority (FINRA), a self-regulatory body financed by Wall Street that oversees brokerage firms and has a division that runs a private justice system known as mandatory arbitration that hears all claims against bad brokers. FINRA was previously known as the National Association of Securities Dealers (NASD) but its reputation became so damaged as a self-regulator that it changed its name to FINRA. (Like that was really going to help.)

What the public doesn’t know is that for over 30 years, the GAO has been investigating these identical problems on Wall Street and making recommendations for cleaning up the mess. After 30 years, it should be abundantly clear that reading GAO reports and shaking one’s head isn’t getting the job done. Serious, radical reform of Wall Street is necessary and that means eliminating crony regulators and the entire self-regulatory system.

As far back as 1978, the GAO published the results of an investigation into the Securities and Exchange Commission’s oversight of the self-regulatory actions of the NASD. The report found flaws in the NASD’s examinations of brokerage firms and that the SEC had “not dealt aggressively enough with inspection oversight problems.”

Again in 1994, the GAO looked into unscrupulous broker activity on Wall Street. The study found that there was the perception that the SEC and NASD were “lenient” in disciplinary actions and that some brokers that had been barred from keeping a license to make securities transactions were entering other sectors of the financial services industry.

By July 17, 1996, this egregiously flawed system of oversight led to the U.S. Justice Department charging the largest firms on Wall Street with price fixing on the electronic stock market known as Nasdaq, while the self-regulator, the NASD, was aware of the problems but simply ignored them. The Justice Department findings made it clear that the price fixing had been taking place for more than a decade. (The more recent cartel activity of rigging Libor and rigging foreign currency markets by Wall Street banks is simply an extension of what was transpiring in 1996.)

The outrage was so widespread in 1996 that the trade magazine, Registered Representative, ran a cover story titled “How the NASD Was Corrupted.” The magazine cover included this assessment:

“The SEC’s investigation of the NASD uncovered a self-regulatory system corrupted by the influence of powerful market making firms. Top NASD officials knew about problems and chose to look the other way. NASD staff went along. Even the SEC had plenty of clues that something was amiss.”

By 2003, Wall Street was reeling from news coverage of how regulators had allowed Wall Street stock research to become corrupted in order for the banks to get investment banking deals. The PBS program, Frontline, aired a program on May 8, 2003 titled “The Wall Street Fix.” Correspondent Hedrick Smith tells viewers: “It’s a story of pervasive corruption here on Wall Street, how brokers and analysts shaped and hyped the telecom boom, pocketed enormous profits and then took millions of ordinary investors on a catastrophic ride, $2 trillion in losses on WorldCom and other telecom stocks.”

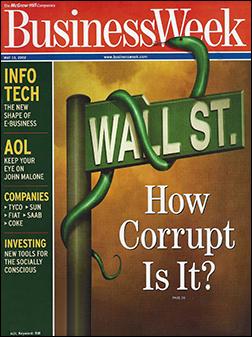

A year earlier, BusinessWeek had asked this simple question on its cover: “Wall Street: How Corrupt Is It?” with a snake curled around the street sign suggesting the answer.

As for the regulators and Congress tolerating investors being victimized twice – first by the unscrupulous broker and then when their arbitration award is not paid – (should the investor be so lucky to have his or her case heard before non conflicted arbitrators), the GAO has been investigating unpaid awards for almost two decades with nothing to show for it.

In a report titled “Securities Arbitration: Actions Needed to Address Problem of Unpaid Awards,” the GAO found that 49 percent of the arbitration awards to investors were not paid at all in 1998 and 12 percent were only partially paid. GAO said it “estimated that the amount of unpaid awards was about $129 million, or 80 percent of the $161 million awarded to investors during 1998.”

And here we are, 18 years later, with Senator Warren asking the head of NASD’s successor, FINRA, what he plans to do about $60 million in unpaid awards to investors dating back to 2013.

FINRA also likes to brag about how much it has done to help investors by setting up BrokerCheck, where investors can check to see if their stockbroker has a disciplinary history. But the problems here are myriad. We put in a broker’s name whom we know was licensed and employed at Smith Barney as a retail broker over a long period. The broker doesn’t even exist in the database. Nor does he exist in the Investment Advisor lookup. He just doesn’t exist. Brokers with five, six and even seven arbitration claims against them are still employed at the same firm. But you wouldn’t know that from the BrokerCheck system which shows serial employer name changes when it is actually the same firm. So the uninitiated at the GAO or SEC might assume that the broker is being fired for misconduct and moving to a new firm when he is actually sitting in the same seat for three decades without any serious disciplinary measures being taken because he is producing large commissions for his firm.

Another problem is that FINRA’s arbitrators allow Wall Street firms to agree to settle arbitrations and have the matter expunged from the broker’s record. Reuters reported in 2013 that “Brokers succeeded 96.9 percent of the time between mid-2009 and the end of 2011 in expunging details about cases brought by investors against their firms that were later settled, according to the Public Investors Arbitration Bar Association, a trade group for lawyers representing investors.”

In one instance, according to the Reuters article, one broker “requested expungement 40 times – and was granted relief by arbitration panels for 35 of the requests.”

Congress has known for decades that self-regulation doesn’t work. And installing Wall Street’s former lawyers or Wall Street executives at the SEC doesn’t work either. Tolerating the systemic conflicts of interest at the New York Fed, the sole regulator of Wall Street bank holding companies, has been catastrophic to the U.S. economy. Congress fully understands what’s causing regulatory capture; it just doesn’t have the guts to do anything about it but kick the can down the road to the GAO.

As far as electing another U.S. President whose campaign has been financed by Wall Street and expecting a different outcome, let’s hope and pray most Americans are smarter than that.