By Pam Martens: June 19, 2013

In years past, a prominent mutual fund company published an annual chart showing how each of the components of the Dow Jones Industrial Average had performed over the past 70 years versus the performance of its star fund. The chart was buried inside a flashy brochure.

Over many years, I studied this chart, double checked it, marveled at it and theorized why there were these fascinating anomalies. I wasn’t curious about the mutual fund, mind you. I was astonished by the vast incongruities in the performance of those 30 stocks.

One stock that was always among the top performers was Procter and Gamble. One stock that was always among the bottom performers was IBM. And yet, IBM was the legendary Big Blue; it was revered by millions as the quintessential blue chip stock.

Each year I put the new chart in a plastic sleeve and when clients came into my office for a portfolio review, I would carefully point out the dramatic differences in performance between this consumer staples stock versus many of the cyclicals on the list, particularly Big Blue. My clients would gasp and realize that everything they thought they knew about efficient markets was dead wrong — the news about this gap in performance had yet to reach the masses.

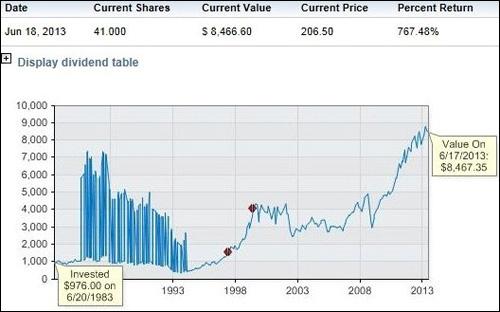

Fortunately, Procter and Gamble and IBM have provided investors with a stock performance calculator on their own web sites. You can do the math yourself and be just as astonished each year. Procter and Gamble does not include its cash dividend as being reinvested when showing its performance. IBM gives you the option of showing performance with cash dividends reinvested or not.

I did the calculation after the market closed yesterday. After 30 years, $1000 invested in Procter and Gamble grew by 2,168 percent to $22,684 – not including the cash it was paying you in dividends for 30 years. The same $1000 (actually $976) invested on the same date 30 years ago in IBM, grew to a measly $8,467 or 767 percent – and that’s with the dividend reinvested, giving you no cash flow for three decades.

As always, be aware that past performance is no guarantee of future results.

Full disclosure: Myself and my family do own Procter and Gamble (and that old chart in a plastic sleeve). We do not own IBM. Neither we nor Wall Street On Parade receive funding or advertising of any kind from Procter and Gamble.

————-

Pam Martens, the Editor of Wall Street On Parade, managed the life savings of average Americans for 21 years on Wall Street. Her personal finance columns seek to help the public better understand the jargon, complexities, and conflicts of Wall Street. The information that appears on this site cannot, and does not, take into account your particular investment goals, your unique financial situation or income needs and is not intended to be recommendations appropriate for you. When it comes to making your own investment decisions, you should always consult in advance with your financial advisor and accountant.

At times, Wall Street On Parade links to news or opinion on other sites which we believe to be in the public interest. These web sites may also contain investment advice or investment advertising. We receive no remuneration for these links, provide them purely in the public interest, and are not endorsing or recommending any investment information that may appear on the site.