By Pam Martens and Russ Martens: October 7, 2024 ~

Jamie Dimon Sits in Front of Trading Monitor in his Office (Source: 60 Minutes Interview, November 10, 2019)

On September 24, the Office of the Comptroller of the Currency (OCC) released its Quarterly Report on Bank Trading and Derivatives Activities for the second quarter of this year. The OCC is the federal regulator of banks that operate across state lines, which are known as “national banks.”

The shorthand for this report should be the “Casino Report.” Increasingly, the report showcases how much dangerous trading activity the brokerage firms on Wall Street have been able to muscle into their federally-insured banking units where the deposits of millions of average Americans reside. Since the repeal of the Glass-Steagall Act in 1999 under the Bill Clinton administration, Wall Street trading firms have been allowed to combine with federally-insured banks – creating an endless series of crises and bailouts.

No bank has been able to blur the lines between a trading casino and a federally-insured bank more aggressively than JPMorgan Chase – and get away with it under the nose of its federal bank regulators. (See Related Articles below.) Almost all of this transformation has occurred with Jamie Dimon sitting at the helm of the bank as Chairman and CEO.

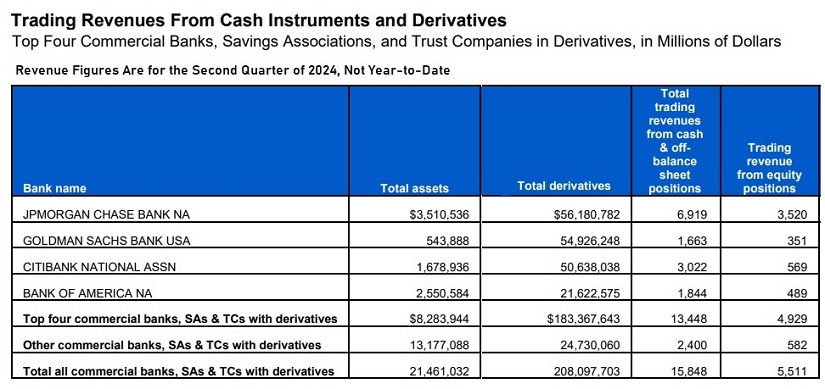

According to the FDIC, as of June 30 there were a total of 4,539 federally-insured commercial banks and savings associations in the U.S. According to Table 19 located in the Appendix of the current OCC report (see partial section below), all commercial banks and savings associations in the U.S. which held derivatives as of June 30, 2024 had trading revenues totaling $15.848 billion. Of that sum, JPMorgan Chase Bank NA represented $6.9 billion or 44 percent.

Even more striking, JPMorgan Chase Bank’s equity trading revenues (stock trading) inside its federally-insured bank came in at $3.5 billion of the total $5.5 billion in stock trading at all banks and savings associations, or a whopping 64 percent of the total.

The Securities and Exchange Commission (SEC), whose job it is to provide regulatory oversight of stock trading in the U.S., is not allowed to peek inside federally-insured banks to see what is going on with stock trading. This appears to be a feature, not a bug, of the megabanks’ refashioning of the landscape of Wall Street.

Of equal concern, as we reported recently, federally-insured banks are not allowed to employ licensed traders. According to the Wall Street self-regulator, FINRA, only broker-dealers are allowed to employ licensed traders and only licensed supervisors are allowed to oversee this trading. (For what happens when trader licensing rules are subverted, see our report: Jamie Dimon’s Top Women and Their Missing Licenses.)

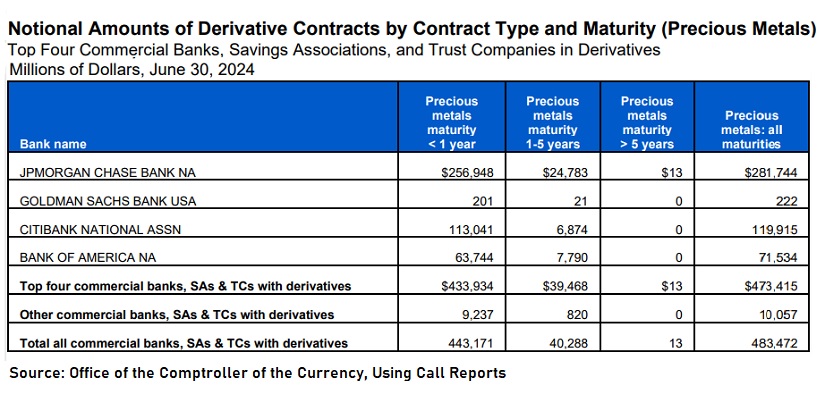

JPMorgan Chase Bank NA also appears to have a stranglehold on trading gold and silver contracts inside its bank. Table 21 in the latest OCC report shows that all commercial banks, savings associations and trust companies with derivatives account for $483 billion in precious metals contracts. Of that sum, JPMorgan Chase Bank NA holds $281.7 billion, or 58 percent.

That concentration of activity by one bank in precious metals is being tolerated by federal regulators despite the fact that the U.S. Justice Department criminally charged JPMorgan Chase just four years ago with engaging in “tens of thousands of episodes of unlawful trading in the markets for precious metals futures contracts….” The bank admitted to the charges.

According to the Justice Department, the rigging occurred for more than eight years, from March of 2008 to August of 2016. The Justice Department wrote that traders at JPMorgan Chase:

“…knowingly and intentionally placed orders to buy and sell precious metals futures contracts with the intent to cancel those orders before execution (‘Deceptive PM [Precious Metals] Orders’), including in an attempt to profit by deceiving other market participants through false and fraudulent pretenses and representations concerning the existence of genuine supply and demand for precious metals futures contracts. By placing Deceptive PM Orders, the Subject PM Traders intended to inject false and misleading information about the genuine supply and demand for precious metals futures contracts into the markets, and to deceive other participants in those markets into believing something untrue, namely that the visible order book accurately reflected market-based forces of supply and demand. This false and misleading information was intended to, and at times did, trick other market participants, including competitor financial institutions and proprietary traders, into reacting to the apparent change and imbalance in supply and demand by buying and selling precious metals futures contracts at quantities, prices, and times that they otherwise likely would not have traded.”

Related Articles:

JPMorgan’s Federally-Insured Bank Is Fined $348 Million for Losing Track of “Billions” of Trades