(Left to right, top) Fed Chairman Jerome Powell; Randal Quarles, Vice Chair for Supervision; Richard Clarida, Vice Chair; (left to right, bottom) Lael Brainard, Michelle Bowman.

By Pam Martens and Russ Martens: August 3, 2020 ~

Federal Reserve Chairman Jerome Powell and Randal Quarles, the Vice Chairman for Supervision at the Fed, have stated in testimony before Congress that they would be providing transaction level details of their Section 13(3) Emergency Lending Facilities on a regular, ongoing basis. But the three oldest of those facilities, the Primary Dealer Credit Facility (PDCF), the Commercial Paper Funding Facility (CPFF), and the Money Market Mutual Fund Liquidity Facility (MMLF), which were all created more than four months ago in mid-March, have yet to release any transaction level details to the public.

The Fed is required to provide reports every 30 days on its emergency lending facilities. Those reports are located at this Fed website. If you scroll down, you will find that transaction level reports have been provided for four of the Fed’s emergency lending programs. But the three programs listed above, which are the oldest of the programs, have no transaction level details.

Without the transaction level details, the public has no idea which Wall Street banks or trading firms are borrowing from the Fed. Without this transaction level detail, the public has no way of discerning if one or more particular banks are facing a liquidity squeeze, as happened in September 2008.

What is the Fed attempting to hide from the American people and why is Congress letting it get away with it?

Our best analysis suggests that the silence from both the Democrats and the Republicans in Congress results from the following: Just months before a critical presidential election, the Democrats would have to admit that the Dodd-Frank legislation of 2010 that was signed into law by President Obama when Democrats controlled both houses of Congress, did not get the job done in making the U.S. financial system safer after the worst financial collapse in 2008 since the Great Depression. That might provide a nasty reminder that it was another Wall Street Democrat in the White House, Bill Clinton, that set that train wreck in motion nine years earlier by repealing the Glass-Steagall Act in 1999 in order to please Sandy Weill at Citigroup and the New York Times editorial board.

Republicans in Congress don’t want to broach the subject either because they have spent the last four years rolling back even the weak protections that existed in the Dodd-Frank legislation.

We know from the Fed’s weekly release of the line items on its balance sheet that as of April 8, just a few weeks after these three programs started, the Primary Dealer Credit Facility had ballooned to Fed loans of $33 billion while the Money Market Mutual Fund Liquidity Facility had soared to $53 billion in loans.

The Commercial Paper Funding Facility (CPFF) grew far more slowly but has made some wild moves that should be raising concerns in Congress, since this is the same kind of market stress that occurred during the last financial crisis. According to the Fed’s balance sheet, as of May 20, the CPFF stood at $4.3 billion, but one week later, on May 27, it had almost tripled to $12.8 billion, strongly suggesting that a large financial institution could not roll over its commercial paper, had nowhere else to turn, and had to come to the Fed as lender of last resort.

The Primary Dealer Credit Facility (PDCF) is the most notorious of these Fed programs, having secretly funneled $8.95 trillion cumulatively in below-market rate loans to Wall Street’s mega banks and their global bank derivative counterparties during the financial crisis of 2007 to 2010, according to a government audit.

The Fed battled in court for years to keep the details of the PDCF and its sibling Wall Street bailout programs behind a dark curtain. Thanks to an amendment attached to the Dodd-Frank financial reform legislation of 2010 by Senator Bernie Sanders, the Government Accountability Office (GAO) was instructed to conduct an audit of the PDCF and the rest of the alphabet soup of programs created by the Fed. When the audit was released in July 2011, Sanders said this:

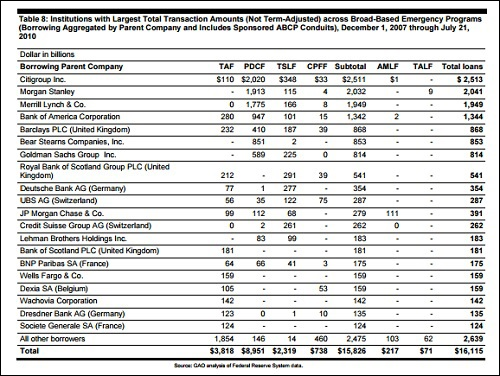

“As a result of this audit, we now know that the Federal Reserve provided more than $16 trillion in total financial assistance to some of the largest financial institutions and corporations in the United States and throughout the world…No agency of the United States government should be allowed to bailout a foreign bank or corporation without the direct approval of Congress and the president.” (See chart below.)

But the GAO audit did not include all of the Fed’s emergency programs. When the Levy Economics Institute did its own tally, using the Fed’s own transaction data, the total assistance came to $29 trillion.

We learned from the GAO audit that the Primary Dealer Credit Facility was the largest Wall Street bailout program during the financial crisis. It issued 1,376 loans that cumulatively totaled $8.95 trillion. Then, as now, the Fed attempted to sell the program as helping American workers and businesses. It did no such thing. It went to bail out the bad bets made by the trading and derivative desks at the mega Wall Street banks. Of the $8.95 trillion in loans issued by the PDCF, $5.7 trillion, or 64 percent, went to Citigroup, Morgan Stanley and Merrill Lynch according to the GAO audit.

It’s time for Congress to step up to the plate and demand a full accounting from the Fed on behalf of the American people.