By Pam Martens and Russ Martens: July 29, 2024 ~

The New York Fed, which has bank examiners engaged in supervising JPMorgan Chase, has also repeatedly provided bailout funds to JPMorgan Chase; was supervising JPMorgan Chase when it lost $6.2 billion of deposits from its federally-insured bank by gambling in derivatives on its London trading desk; allowed JPMorgan Chase’s Chairman and CEO, Jamie Dimon, to previously sit on the New York Fed’s Board of Directors, even as he faced the $6.2 billion derivatives trading scandal; and the New York Fed has exclusively used JPMorgan Chase to hold, as custodian, more than $2.3 trillion of the Federal Reserve’s Mortgage-Backed Securities (MBS) for the past 15-1/2 years – despite JPMorgan Chase admitting to five felony counts brought by the criminal division of the U.S. Department of Justice during that time.

If there was an admitted felon in your neighborhood, would that be your first choice for a house sitter?

During the financial crisis of 2008, in an effort to restore liquidity to seized up markets, the Fed announced it planned to buy $500 billion of MBS that was backed by government-sponsored enterprises (GSEs) Fannie Mae, Freddie Mac, and Ginnie Mae. That was the first of what would become Quantitative Easing (QE) to infinity at the Fed. The Fed’s MBS holdings have grown from the planned $500 billion to $2.3 trillion as of last Wednesday.

In a typical move, the Federal Reserve outsourced its MBS buying program to the New York Fed, which, in turn, farmed out one critical leg of the program (custodianship of the MBS) to the very Wall Street megabank that had corrupted a significant part of the MBS market: JPMorgan Chase.

A little more than a month after the Fed’s 2008 MBS announcement, on December 31, 2008, the New York Fed signed a contract with JPMorgan Chase to be the sole custodian of the securities it bought under the MBS program. That contract with JPMorgan Chase was amended on April 1, 2010; April 26, 2011; April 17, 2014 and again on January 30, 2017. (As of today, the original contract and its amendments are available at the New York Fed’s website. Should those documents vanish, we have archived the same documents on our website here.)

This spring, Wall Street On Parade became curious as to just how much JPMorgan Chase was reaping in revenues from serving as a vendor to the New York Fed. On April 18, via email, we filed a Freedom of Information Act request with the New York Fed, asking for the following:

“Please provide copies of invoices that the New York Fed received from JPMorgan Chase (or any of its subsidiaries such as Chase Bank or JPMorgan Securities) during the 2023 calendar year.

“We are particularly interested in invoices for custodial and cash management services related to MBS securities held in custody by JPMorgan Chase for the Federal Reserve Bank of New York.”

While the Federal Reserve Board of Governors is a federal agency and subject to FOIA, the 12 regional Fed banks are considered private corporations, not legally subject to FOIA. The New York Fed, however, regularly states that it “complies with the spirit of the Freedom of Information Act” in providing documents to the public.

Under FOIA, Wall Street On Parade was entitled to a response in 20 business days. Since these invoices should have been easily obtainable in the Accounts Payable department of the New York Fed, and we were asking only for those from last year, 20 business days seemed to us like an adequate response time.

Instead, on May 16 we received an email from the New York Fed telling us they needed more time and were planning to provide us the documents on July 1. When July 1 came around, the New York Fed told us the new projected date was July 12. When July 12 arrived, we were told to expect the invoices on or before July 26. On that date, we received a cover letter and 158 documents – with the amounts that JPMorgan Chase had billed to the New York Fed redacted behind blocks of black ink.

Stalling on FOIA requests and providing journalists with useless information has become a favorite sport at both the Federal Reserve and the New York Fed. (See also: Reporters Who Ask Tough Questions at Fed Press Conferences Have a Habit of Being Disappeared from the Room.)

Despite blacking out the very information we had requested – how much JPMorgan Chase had billed to the New York Fed in one year – after making us wait almost three months, we were able, nonetheless, to make some interesting findings from the sanitized documents.

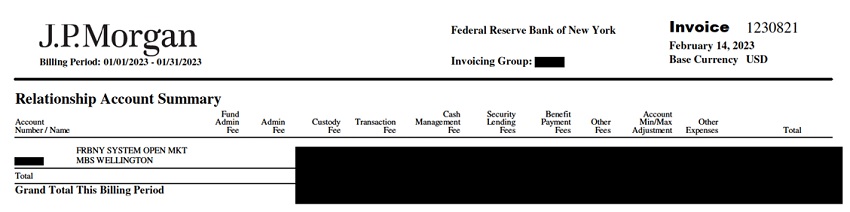

Per the invoice graphic above from the documents, covering the billing period of January 1, 2023 through January 31, 2023, JPMorgan Chase appears to be billing for a lot more than just providing custodianship of the MBS assets. There are menu tabs for the following services billed: “Custody Fee,” “Transaction Fee,” “Cash Management Fee,” “Security Lending Fees,” “Benefit Payment Fees,” “Other Fees,” and “Other Expenses.”

Equally of note, there does not appear to be any significant documentation provided to the New York Fed to support how these fees were calculated.

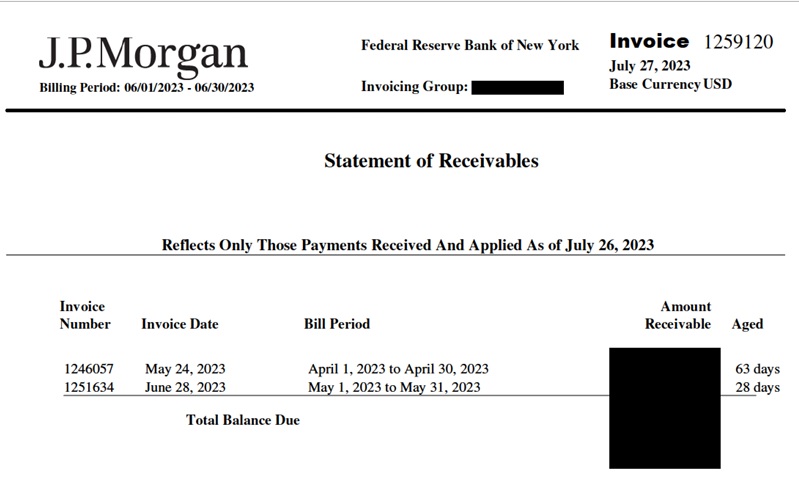

Another curiosity is that the New York Fed allows invoices from JPMorgan Chase to go unpaid for more than two months in multiple cases. (See the invoice below as one sample.)

And raising our eyebrows were invoices that we did not know existed. These are the invoices toward the end of the document that are marked as “Tri-Party Collateral Management Fees.” We’ll be reporting on that aspect of these invoices later this week.

We will also be filing a formal complaint with the Federal Reserve Inspector General over how this FOIA request was handled, involving the largest federally-insured bank in the United States and its perpetually blind-folded supervisor, the New York Fed.

Related Articles:

These Are the Banks that Own the New York Fed and Its Money Button

Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?