By Pam Martens and Russ Martens: May 30, 2024 ~

On January 18, 2019 the Cambridge University Press published a stunning research paper from the Journal of Institutional Economics. The paper provides the hard numbers to support the thesis that federal banking and securities regulators have arrived at a deep understanding and acceptance that the more connections they acquire while working in government and the more prominent their position becomes – the fatter their future paycheck will be once they make the leap to a megabank on Wall Street.

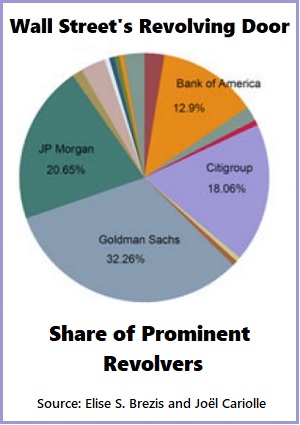

The authors call what the “public servants” are selling to their prospective Wall Street employers “bureaucratic capital.” The authors then provide the hard data in the chart below, showing that Goldman Sachs, JPMorgan, and Citigroup are light years ahead of their peers in monetizing public service to fatten their own bottom lines and create an influence network. (The structure of that influence network, minus the child sex trafficking, is not all that dissimilar to what Jeffrey Epstein was operating with the assistance of the largest U.S. bank, JPMorgan Chase.)

The brilliant study is by Dr. Elise S. Brezis, Professor of Economics at Bar-Ilan University in Israel, who received her PhD in Economics from MIT; and Dr. Joël Cariolle, Research Officer at the Foundation for Studies and Research on International Development (FERDI) in France. Dr. Cariolle received his PhD from the University of Clermont Auvergne in France.

The authors write:

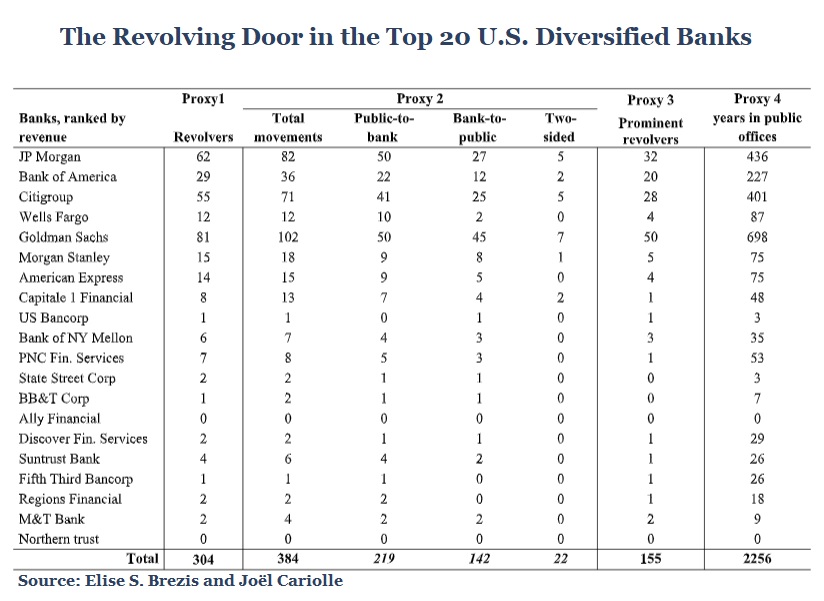

“Looking at the revolving door in the 20 biggest US diversified banks, we identified 304 revolvers, among which 155 are considered as prominent. These revolvers have undertaken 384 revolving door movements between public and private positions and vice versa, mostly undertaken between 1960 and 2015, corresponding to a total of 2,256 years of experience in public office.”

The chart above from the study shows that of the 155 public servants who had risen to “prominent” positions, Goldman Sachs captured 50 of those or 32 percent; JPMorgan had captured 20.65 percent; while Citigroup had captured 18 percent.

To understand how the revolving doors at the Wall Street megabanks swing in both directions, we recommend our January 2020 article: Goldman Sachs: The Vampire Squid’s Alum Control Two Fed Banks, the U.S. Treasury, the European Central Bank and the Bank of England.

To further understand how no amount of public outrage can stop the swinging of Wall Street’s revolving door, consider that the Cleveland Fed has just named a female exec, Beth Hammack, who spent the last three decades at Goldman Sachs, to be its new president, notwithstanding the fact that a former Vice Chairman of Goldman Sachs created the worst trading scandal in the Fed’s 111-year history just three years ago and has been in the headlines ever since. (See our report earlier this month: Goldman Sachs Shines Up Its Swamp Creature Reputation by Rehiring Robert Kaplan as Vice Chairman – the Guy Who Traded Like a Hedge Fund Kingpin While President of the Dallas Fed.)

And to appreciate just how enormously lucrative rising to a prominent position in government can turn out to be, consider how Robert Rubin went from Co-Chairman of Goldman Sachs to join President Bill Clinton’s administration in 1993, rising to the position of U.S. Treasury Secretary in January 1995. Four years later, after Rubin helped in repealing one of the most important pieces of banking legislation in history – the Glass Steagall Act of 1933 – Rubin went straight to join the primary beneficiary of that repeal, Citigroup. Over the next decade of sitting on Citigroup’s Board, Rubin amassed $120 million in compensation.

When Rubin exited Citigroup in 2009, it was in the midst of receiving the largest bailout in U.S. banking history; its stock price had collapsed, eventually trading at 99 cents in March of 2009.

There are numerous eyewitness accounts to support the thesis of the Brezis and Cariolle research paper. When James Kidney, a 25-year veteran trial attorney at the Securities and Exchange Commission retired in 2014, he set off pandemonium inside the SEC when the speech he delivered at his retirement party went viral. Kidney blamed the demoralization at the agency on its revolving door to Wall Street. The best SEC lawyers, according to Kidney, “see no place to go in the agency and eventually decide they are just going to get their own ticket to a law firm or corporate job punched.”

What every engaged American should read after digesting the Brezis and Cariolle research paper, is the seminal book on the history of the making of these megabanks on Wall Street. That book is Law Professor Arthur Wilmarth Jr.’s Taming the Megabanks: Why We Need a New Glass-Steagall Act. Wilmarth offers the following (and much more) on the revolving door and its attendant evils at the megabanks:

What every engaged American should read after digesting the Brezis and Cariolle research paper, is the seminal book on the history of the making of these megabanks on Wall Street. That book is Law Professor Arthur Wilmarth Jr.’s Taming the Megabanks: Why We Need a New Glass-Steagall Act. Wilmarth offers the following (and much more) on the revolving door and its attendant evils at the megabanks:

“The revolving door between Washington and Wall Street, in combination with extensive social connections between regulators and industry leaders, promoted a form of ‘cultural’ or ‘cognitive’ capture, in which regulators deferred to the views of industry leaders regarding the best ways to draft, interpret, and implement financial regulations.”

That’s been very good for minting billionaires like Sandy Weill at Citigroup and Jamie Dimon at JPMorgan Chase. For the American people – not so much.