By Pam Martens and Russ Martens: February 7, 2024 ~

New York Community Bancorp (NYCB) closed out 2023 with a share price of $10.23. At the closing bell yesterday, its share price was $4.20 – a year-to-date decline of 59 percent. More pain is expected today as the credit rating agency, Moody’s, cut the regional bank’s credit rating two notches to junk after the market closed yesterday.

Moody’s noted in its downgrade that a third of the bank’s deposits lack FDIC insurance. Uninsured deposits were a key factor in the rapid meltdown of Silicon Valley Bank in March of last year as $146 billion in deposits attempted to exit the bank in the span of 48 hours, leading to the FDIC being forced to take the bank into receivership.

NYCB’s rapid share price descent began on January 31 when the bank filed an 8K form with the SEC indicating a $260 million net income loss in the fourth quarter; a dividend cut from 17 cents to 5 cents; and a $552 million provision for credit losses on commercial real estate – an area of growing concern by the credit rating agencies.

As of September 30 of last year, the Federal Reserve ranked NYCB the 28th largest banking institution in the U.S. At that time, it was reporting $111 billion in assets. As of December 31, 2023, it reported assets of $116 billion.

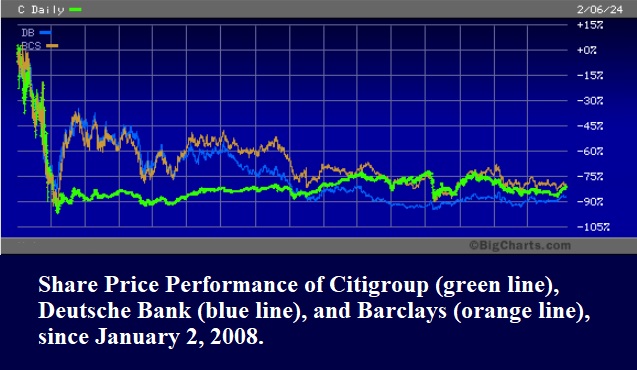

NYCB’s share price is now 76 percent below its level of January 2, 2008, the year of the worst Wall Street financial crisis since the Great Depression. But far more troubling is the fact that the share prices of three global mega banks, Citigroup, Barclays and Deutsche Bank, have lost even more in market value in the same span of time. (See chart above.)

As of September 30, 2023, Citigroup had assets of $2.4 trillion; Barclays had assets of $2.01 trillion; and Deutsche Bank had assets of $1.49 trillion. While Barclays is a U.K. bank and Deutsche Bank is a German bank, both banks are heavily interconnected to U.S. global banks via derivatives and trading.

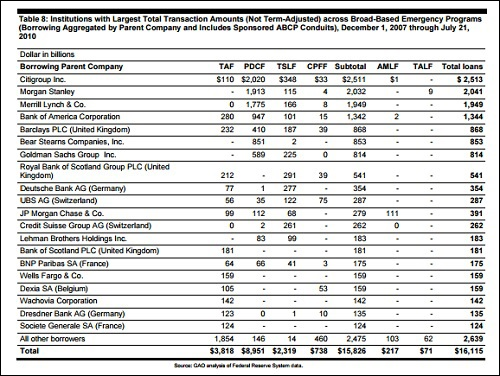

According to the audit performed by the Government Accountability Office (GAO) following the 2008 financial crash, Citigroup received secret cumulative loans from the Fed totaling $2.5 trillion from December 2007 through July of 2010; Barclays received $868 billion; and Deutsche Bank received $354 billion. At the time, the American people had no idea that Citigroup was insolvent and being propped up by the Fed or that foreign banks were getting hundreds of billions of dollars in handouts from the U.S. central bank. (See chart below from the GAO audit.)

And if bank regulators want to worry about uninsured deposits today, perhaps New York Community Bancorp’s total deposits of $81.4 billion should not be at the top of their deposit worries.

According to the FDIC, as of June 30, 2023 there were 4,645 federally-insured commercial banks and savings associations in the United States. Uninsured deposits at all 4,645 institutions totaled $7.134 trillion at the end of the second quarter. But according to call reports filed by JPMorgan Chase Bank, Bank of America, Wells Fargo and Citigroup’s Citibank, as of June 30, just those four banks accounted for $4.185 trillion of uninsured deposits, or 59 percent of all uninsured deposits at all 4,645 federally-insured institutions.

That is an irresponsible concentration of risk in the U.S. banking system, tolerated by a dysfunctional regulatory system that has been captured by banks, their lobbyists and the MAGA sycophants that sit on the Senate Banking and House Financial Services Committees in Congress.

Citigroup’s Citibank, the bank that blew itself up in 2008 and received the largest taxpayer and Fed bailout in global banking history, reports in its call report for June 30, 2023 that 85.5 percent of its $1.338 trillion in total deposits are uninsured. The breakdown is as follows: It has $548.33 billion in uninsured deposits in its domestic offices plus $595.4 billion in deposits in foreign offices. (The FDIC does not insure deposits on foreign soil.) Those two figures tally up to $1.144 trillion in deposits lacking FDIC insurance out of a total deposit base of $1.338 trillion.

The breakdown for the other three mega banks are as follows: 59 percent of JPMorgan Chase’s deposits lack FDIC insurance; 51 percent at Wells Fargo; and 49 percent at Bank of America.

Until the Glass-Steagall Act is restored by the U.S. Congress, the U.S. banking system will continue to lurch from one banking crisis to the next. (See Former New York Fed Pres Bill Dudley Calls This the First Banking Crisis Since 2008; Charts Show It’s the Third.)