By Pam Martens and Russ Martens: September 11, 2023 ~

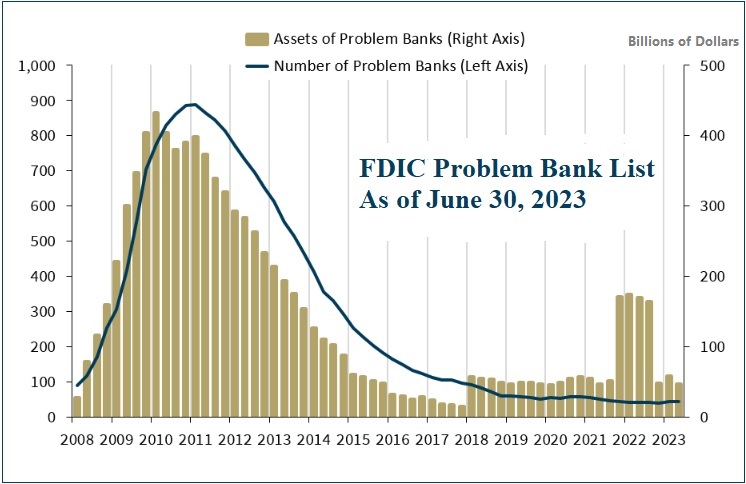

Last Thursday, the Federal Deposit Insurance Corporation (FDIC) released its Quarterly Banking Profile for the quarter ending June 30, 2023. The report includes the FDIC’s Problem Bank List. While the actual names of the problem banks aren’t provided, the total assets listed provide an indication of whether any large banks are on the list.

The FDIC’s first quarter banking profile had published a “Problem Bank List” showing just 43 banks with total assets of $58 billion as of March 31, 2023. Unfortunately, on March 10 Silicon Valley Bank blew up with assets at year-end 2022 of $209 billion. Two days later, on March 12, Signature Bank blew up with assets of $110 billion as of year-end. Clearly, the FDIC did not see these as problem banks in advance of their blowing up in a matter of days.

What the FDIC did know by last Thursday, however, was that on May 1 First Republic Bank had also blown up. As of year-end, it held assets of $213 billion. Since May 1 falls within the second quarter of the year, we would have expected to see a corresponding increase in the size of the bank assets listed on the FDIC’s Problem Bank List when it was released last Thursday.

Instead, the FDIC was still clinging to its Alice in Wonderland approach to the banking landscape in the U.S. Its Problem Bank List for the second quarter showed the number of problem banks unchanged at 43 while the assets of those banks declined from $58 billion at the end of the first quarter to $46 billion at the end of the second quarter.

First Republic Bank was the second largest banking failure in U.S. history. (The largest bank failure was Washington Mutual during the financial crisis of 2008.) Silicon Valley Bank was the third largest bank failure in U.S. history while Signature Bank ranks fourth.

On August 21, S&P Global downgraded by one notch the credit ratings on KeyCorp, Comerica, Valley National Bancorp, UMB Financial Corp and Associated Banc-Corp. The assets of those banks are as follows: KeyCorp $193 billion; Comerica $91 billion; Valley National $62 billion; UMB and Associated $41 billion each. The assets at all five banks tally up to $428 billion.

Both KeyCorp and Comerica’s publicly-traded shares have lost more than 40 percent of their value over the past 12 months.

S&P’s credit downgrades to banks on August 21 followed sweeping bank credit downgrades by Moody’s on August 7. (See our report: Moody’s Cuts Credit Ratings on 10 Banks; Places 4 of the 15 Largest Banks in U.S. on Review for Possible Downgrade.) On March 13, Moody’s had downgraded its outlook for the entire U.S. banking system.

On August 15, the Dow tumbled 361 points on news from a Fitch analyst in an interview at CNBC that even the largest banks, such as JPMorgan Chase, were at risk of a downgrade.

To put it bluntly, the FDIC’s Problem Bank List showing just $46 billion in assets in total for all problem banks in the United States is an insult to the intellect of the American people.

Another federally-insured bank that effectively failed this year but elected to voluntarily unwind itself was Silvergate Bank, which was doing business with Sam Bankman-Fried’s crypto house of frauds. On January 5 of this year, the publicly-traded parent of Silvergate Bank lost 43 percent of its market value in one trading session, bringing its stock price loss to 91 percent over the prior 12 months. By March 8 the bank had announced plans to wind down and liquidate.

Another bank failure that has received scant attention from the major business press, outside of the Financial Times, is Heartland Tri-State Bank in Kansas, which abruptly shut down on July 28. When the Financial Times called to find out what happened, they were told the following by the Kansas state bank commissioner, David Herndon:

“We declared the bank insolvent because of a scam that they fell victim to. I can’t speak to the particulars of that. Investigations are ongoing. But it had nothing to do with interest rate increases. Nothing to do with balance sheet asset quality. Nothing to do with the Fed.”

Not to put too fine a point on it, but scams that cause a bank to fail absolutely do have something to do with balance sheet asset quality.

Moreover, the idea that a state bank commissioner would brush off a reporter from an internationally-recognized financial news outlet with such opacity regarding a bank failure is simply more banking hubris in a year setting a record for banking hubris. (See related articles below.)

Heartland Tri-State Bank was a tiny institution with just $139 million in assets. But, bizarrely, according to the FDIC, it’s going to cost the FDIC’s insurance fund $54 million – or 39 percent of the bank’s total assets.

It’s now more than a month since Heartland Tri-State Bank blew up and was taken over by Dream First Bank, National Association, of Syracuse, Kansas. The public has yet to be told the details of exactly what this scam was all about and if the culprits are going to jail.

Related Articles:

An Insider Blows the Whistle on How the Fed Has Allowed Crypto to Invade Federally-Insured Banks

Four Crypto-Friendly Banks Are Being Bailed Out with Billions from a Federal Housing Program