By Pam Martens and Russ Martens: May 9, 2023 ~

The systemic threats to the U.S. financial system were not remedied when Congress passed the watered-down Dodd-Frank financial reform legislation in 2010. While that has been evident with each Federal Reserve bailout of the mega banks and their derivative counterparties, the threat has now gained increased urgency for Congress to confront as a result of a new academic study. A team of four highly-credentialed academics at four separate universities present compelling evidence that one of the four largest U.S. banks, with “assets above $1 trillion,” could be at risk of a bank run.

The study is titled: “Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?” Its authors are Erica Jiang, Assistant Professor of Finance and Business Economics at USC Marshall School of Business; Gregor Matvos, Chair in Finance at the Kellogg School of Management, Northwestern University, and Research Associate in the Corporate Finance group at the National Bureau of Economic Research (NBER); Tomasz Piskorski, Professor of Real Estate in the Finance Division at Columbia Business School and Research Associate at NBER; and Amit Seru, Professor of Finance at Stanford Graduate School of Business, a Senior Fellow at the Hoover Institution, and Research Associate at NBER.

The study focuses on unrealized losses on assets on the books of U.S. banks in a category called “held to maturity,” which under current accounting rules does not have to be marked to market, as well as unrealized losses on debt securities that also have not been marked to market, unless they are sold, for example, to raise cash to pay fleeing depositors. The professors find that “The U.S. banking system’s market value of those assets is $2.2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity.”

They then couple that finding with the threat posed to banks that hold large quantities of uninsured deposits – sums exceeding the federal deposit insurance cap of $250,000 per depositor, per bank. They then conduct various scenarios to see how different categories of banks would perform.

The most disturbing scenario is the following, which raises the issue of a bank with “assets above $1 trillion” potentially experiencing a bank run. (There are only four U.S. chartered banks that have assets above $1 trillion. According to the December 31, 2022 data from the Office of the Comptroller of the Currency, those are: JPMorgan Chase Bank N.A. with assets of $3.2 trillion; Bank of America N.A. with $2.4 trillion in assets; Citigroup’s Citibank N.A. with assets of $1.77 trillion; and Wells Fargo Bank N.A. with $1.71 trillion in assets.)

The scenario is explained as follows by the authors:

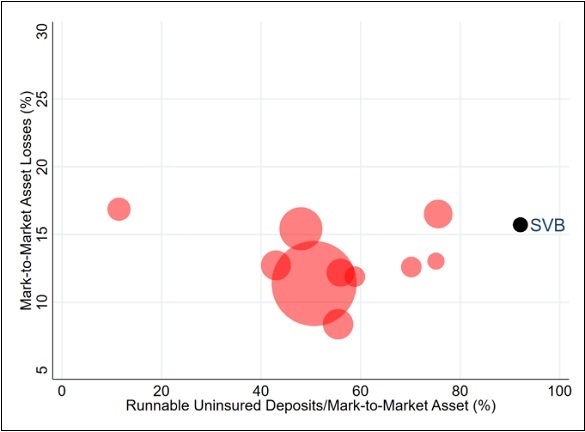

“To further assess the vulnerability of the US banking system to uninsured depositors run, we plot the 10 largest banks at the risk of a run, which we define as a negative insured deposit coverage ratio if all uninsured depositors run…Because of the caveats in our analysis as well as the potential of exacerbating their situation, we anonymize their names, but we also plot SVB [Silicon Valley Bank which failed on March 10] as comparison. We plot their mark-to-market asset losses (Y axis) against their uninsured deposits as a share of marked to market assets. Some of these banks have low uninsured deposits, but large losses, but the majority of these banks have over 50% of their assets funding with uninsured deposits. SVB stands out towards the top right corner, with both large losses, as well as large uninsured deposits funding. As Figure 5 shows [see below], the risk of run does not only apply to smaller banks. Out of the 10 largest insolvent banks, 1 has assets above $1 Trillion, 3 have assets between $200 Billion and $1 Trillion, 3 have assets between $100 Billion and $200 Billion and the remaining 3 have assets between $50 Billion and $100 Billion.”

We do not know which of the four mega banks the authors are referring to. We asked via email if they would identify the bank but they declined. Short sellers will, undoubtedly, drill down in the regulatory data filed by the four banks to determine the name of the bank in the study, so federal regulators and Congress need to move this issue immediately to the top of their banking crisis priority list.

Just 15 years ago, Citigroup/Citibank received the largest bailouts in U.S. banking history during and after the financial crisis of 2008. Its stock traded at 99 cents in early 2009. Sheila Bair, then the Chair of the Federal Deposit Insurance Corporation (FDIC), said this about Citigroup in her book, Bull by the Horns:

“By November, the supposedly solvent Citi was back on the ropes, in need of another government handout. The market didn’t buy the OCC’s and NY Fed’s strategy of making it look as though Citi was as healthy as the other commercial banks. Citi had not had a profitable quarter since the second quarter of 2007. Its losses were not attributable to uncontrollable ‘market conditions’; they were attributable to weak management, high levels of leverage, and excessive risk taking. It had major losses driven by their exposures to a virtual hit list of high-risk lending; subprime mortgages, ‘Alt-A’ mortgages, ‘designer’ credit cards, leveraged loans, and poorly underwritten commercial real estate. It had loaded up on exotic CDOs and auction-rate securities. It was taking losses on credit default swaps entered into with weak counterparties, and it had relied on unstable volatile funding – a lot of short-term loans and foreign deposits. If you wanted to make a definitive list of all the bad practices that had led to the crisis, all you had to do was look at Citi’s financial strategies…What’s more, virtually no meaningful supervisory measures had been taken against the bank by either the OCC or the NY Fed…Instead, the OCC and the NY Fed stood by as that sick bank continued to pay major dividends and pretended that it was healthy.”

Until Congress gets serious about breaking up these too-big-to-fail mega banks and restoring the banking system protections of the Glass-Steagall Act, which were repealed in 1999, every American is at risk of an unstable financial system.

Editor’s Note: The third paragraph has been updated to indicate that debt securities on the books of the banks were also included in the study.