By Pam Martens and Russ Martens: December 7, 2022 ~

If you’re the Chairman and CEO of a trucking company or air conditioner installer or a computer manufacturer (or thousands of other companies that don’t handle cash and have access to personal and financial data on millions of Americans) announcing to the world that 10 percent of your company’s new hires last year had criminal backgrounds might make you look like a social justice advocate.

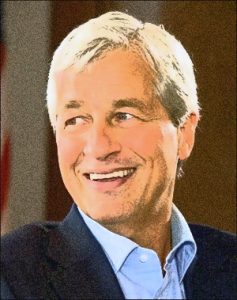

If you’re Jamie Dimon, Chairman and CEO of the largest bank in the U.S. with 5,023 bank branches across the country taking in cash each day that represents the life savings of moms and pops and pension funds, announcing that 10 percent of last year’s new hires had criminal backgrounds is not exactly a confidence builder – especially since Dimon’s bank has been charged by the U.S. Department of Justice with an unprecedented five criminal felony counts since 2014. All of the felony counts occurred during Dimon’s tenure as Chairman and CEO, and while his Board of Directors made him a billionaire with stock grants and bonuses. In addition, the bank has a broader rap sheet that likely draws the envy of the Gambino crime family.

On May 4, Dimon penned a guest opinion piece for The Columbus Dispatch. (The bank has a large operating center in Columbus.) The article includes this:

“JPMorgan Chase has a meaningful portion of colleagues who have a criminal background — in 2021, 10% of our new hires in our company had a criminal record — and retention rates for this population are very high.”

JPMorgan Chase was so proud of that article that it placed it on its corporate website.

Our skepticism about Dimon’s real agenda is fueled not just by those five felony counts and former lawyers at the bank telling regulators that fraud is condoned at the bank, but also by revelations that came out of a hearing of the U.S. Senate’s Permanent Subcommittee on Investigations on November 21, 2014. Those revelations were as follows:

On April 29, 2010 at 7:47 in the evening, Francis Dunleavy, the head of Principal Investing within the JPMorgan Commodities Group sent an email to a colleague, Rob Cauthen. The email read: “Please get him in ASAP.”

The man that Dunleavy wanted to be interviewed “ASAP” was John Howard Bartholomew, a graduate of George Washington University Law School two years earlier. But it wasn’t his law degree that Bartholomew featured at the very top of the resume he sent to JPMorgan; it was the fact that while working at Southern California Edison in Power Procurement, he had “identified a flaw in the market mechanism Bid Cost Recovery that is causing the CAISO [the California grid operator] to misallocate millions of dollars.” Bartholomew bragged in his resume that he had “showed how units in reliability areas can increase profits by 400%.”

These internal emails from JPMorgan and Bartholomew’s resume became Exhibit 76 in a two-year investigation conducted by the U.S. Senate’s Permanent Subcommittee on Investigations into Wall Street’s vast ownership of physical commodities and rigging of commodity markets. The late Senator Carl Levin, the Chair of the Subcommittee at the time, had this to say about the resume at the hearing:

“There’s two things that I find incredible about this. First, that anyone would advertise in a resume that they know about a flaw in the system — signaling that they’re ready and willing to exploit that flaw. And, second, that somebody would hire the person sending that signal.”

JPMorgan not only hired Bartholomew, according to the Senate’s findings, but within three months from the date of the email to Dunleavy, “Bartholomew began to develop manipulative bidding strategies focused on CAISO’s make-whole mechanism, called Bid Cost Recovery or BCR payments.” By early September, the strategy to game the system was put into play. By October, the JPMorgan unit was estimating that the strategy “could produce profits of between $1.5 and $2 billion through 2018.”

The strategy of gaming the Bid Cost Recovery payments, or BCR, was producing such windfall profits that another JPMorgan employee sent an email on October 22, 2010 to his colleagues, joking about the success by featuring a photograph of Oliver Twist holding out an empty bowl with the subject line: “Please sir! mor BCR!!!!”

During the Senate hearing, Senator Levin commented on the email and the reference to Oliver Twist, stating:

“Now the BCR refers to the make-whole payments that JPMorgan was using to unfairly profit from the system. And I gotta tell you it’s mighty offensive to me that JPMorgan portrays its actions as a joke, comparing itself to a poor orphan needing charity when it was ripping off consumers.”

We’re also skeptical of Dimon’s genuine commitment to workers’ welfare because of exchanges that occurred between Dimon and members of the House Financial Services Committee at a hearing on April 10, 2019.

Dimon was questioned by Congressman Al Green of Texas on whether it was true that JPMorgan Chase had released information in 2005 “indicating that it directly benefited from slavery” and had made loans using slaves as collateral. Dimon said he believed this was true. In fact, according to a 2005 report in The Guardian, it was actually worse than that – the bank’s predecessor institutions had actually owned slaves. Two banks that are now part of JPMorgan Chase made loans to plantation owners of slaves in the 1800s, accepted 13,000 slaves as collateral, and “ended up owning about 1250 slaves” when the plantation owners defaulted on the loans, according to The Guardian report.

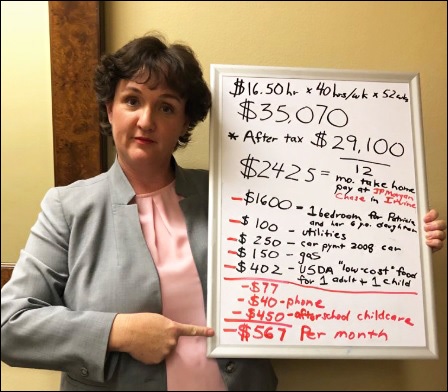

As if that disclosure wasn’t bad enough in one hearing, Congresswoman Katie Porter also revealed the paucity of wages Dimon was paying his bank tellers.

Porter asked Dimon for help with a math problem. Porter explained how Jamie Dimon’s $31 million in compensation in 2018 compared to what the bank is paying one of its bank tellers who is a single mother with a 6-year old daughter. Porter explained that she went to Monster.com and found a job in her hometown of Irvine, California for a bank teller at JPMorgan Chase. She said the job pays $16.50 per hour or $35,070 per year or an after-tax amount of $29,100 for a single mother with a six-year old child.

After deducting for rent on a 1-bedroom apartment, utilities, car payment on a 2008 car, gas, food, the cheapest cell phone, and after-school child care, the woman would be $567 in the hole each month. Porter asked Dimon how this woman should manage her budget short-fall while she’s working full time at his bank. Dimon said: “I don’t know that all of your numbers are accurate” (which prompted Porter to post the photo below on her Twitter page after the hearing).

Congresswoman Katie Porter Explains the Brutal Reality of a Single Mom Attempting to Live on What Jamie Dimon Pays His Bank Tellers

Dimon also said he doesn’t know what he would advise the woman to do but he’d like to have a conversation with the woman and try to be helpful. Porter responded: “What I’d like you to do is provide a way for families to make ends meet, so that little kids who are six years old living in a one-bedroom apartment with their mother aren’t going hungry at night because they’re $567 short…”