By Pam Martens and Russ Martens: April 28, 2022 ~

U.S. Attorney for the Southern District of New York, Damian Williams, at Press Conference on Archegos Indictments, April 27, 2022

Yesterday, the U.S. Department of Justice, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) brought charges against executives at Archegos Capital Management, the family office hedge fund that blew up in March of 2021. The Justice Department brought criminal charges while the SEC and CFTC brought civil charges.

Archegos founder and owner Sung Kook (Bill) Hwang and its former CFO, Patrick Halligan, were indicted on securities fraud and racketeering charges. William Tomita, the former Head Trader, and Scott Becker, the former Chief Risk Officer, have pleaded guilty for their roles in the fraud and are cooperating with the Justice Department.

All three federal agencies adopted the narrative that the biggest trading houses on Wall Street were the hapless victims of the Archegos’ fraud. That narrative is going to be difficult for a jury to swallow for the following reasons:

(1) the Wall Street firms invented the derivatives (total return swaps) that Archegos was using to hide its concentrated stock positions from the marketplace. The legality of those contracts has come into question. Archegos had been in operation since 2013, but had never made a 13F filing with the SEC showing its stock holdings because the Wall Street banks lumped Archegos’ stock positions into the banks’ own 13F filings, making it appear to the public as if the banks actually owned these stock positions;

(2) the same Wall Street firms provided Archegos with as much as 85 percent margin debt on the stock trades tricked up as derivative trades, despite the federal regulation requiring a maximum of 50 percent initial margin debt on stock trades. The Justice Department said that at one point Archegos had $35 billion in capital and $160 billion in market value;

(3) the same Wall Street firms were actually part of the manipulation of the stock prices in the Archegos portfolio because they were buying up the same shares to hedge their own exposure to their derivative gambles with Archegos;

(4) the same Wall Street firms were incentivized to refill the punch bowl and keep the party going at Archegos because of the fat fees they were collecting; and

(5) the Wall Street firms that the Justice Department alleges were defrauded by Archegos are some of the most sophisticated global trading firms on the planet and have been serially charged themselves with defrauding investors.

The theory of the Archegos case by the U.S. Department of Justice was so lame that U.S. Attorney Damian Williams beat it out of his press conference yesterday after taking only a handful of questions from reporters. (You can watch the video of the press conference here.)

There was a lot of backslapping at the press conference on how fast and how great the work of the federal investigators had been to bring charges in just a little over a year since Archegos collapsed, resulting in at least $10 billion in losses to its bank counterparties. But one question from a reporter at the press conference revealed just how skimpy this investigation had been. The reporter asked if there could be “10 other individuals out there that we don’t know about,” meaning 10 other Archegos-style family office hedge funds doing business with Wall Street firms in a similar fashion. U.S. Attorney Williams responded: “It’s a fair question. I can’t speculate on what else may be out there.”

If the U.S. Attorney’s office for the Southern District of New York concluded its investigation without knowing the full breadth and scope of what Wall Street is doing with these total return swaps for other family office hedge funds, can one really call this an investigation?

In April of last year, Wall Street On Parade did some digging into that matter ourselves. This is part of what we reported:

We found that billionaire Michael Bloomberg’s Willett Advisors family office hedge fund hasn’t filed a 13F since 2014 and that filing showed only $273,000 in assets. According to CaproAsia, Willet Advisors is the seventh largest family office in the world with $25 billion in assets. (Thus, when Bloomberg News’ editorial board tells you that Archegos was “No Big Deal” and that “there’s little regulators need to do,” you might want to take that with a grain of salt.)

The public has also learned recently that the SEC doles out requests to file 13F forms on a confidential basis quite frequently.

According to CaproAsia’s list of the top 10 family offices, billionaire Jeff Bezos’ Bezos Expeditions family office has $107 billion in assets. But the SEC has no 13F filing at all for the entity in its public records.

Then there is billionaire James Simon, founder of Renaissance Technologies, one of the world’s largest hedge funds. (See Did Archegos, Like Renaissance Hedge Fund, Avoid Billions in U.S. Tax Payments through a Scheme with the Banks?) Simon’s family office is called Euclidean Capital. Its 13F filing for the quarter ending December 31, 2020 shows $472 million in assets. But CaproAsia indicates that it manages $21 billion in assets. Are the rest of those assets hiding out on some bank’s balance sheet? Under the SEC’s current, billionaire-friendly, dodgy system of reporting, it’s all just one big guessing game as to whom owns what.

Another example is billionaire Bill Gates’ family office, Cascade Investment LLC. According to CaproAsia it ranks number 3 among the world’s largest family offices with $51 billion in assets. Cascade Investment LLC hasn’t filed a 13F form with the SEC since the quarter ending September 30, 2008 (coincidentally, the same quarter that Wall Street blew itself up, taking the stock market along with it). At that point in time, Cascade Investment showed $4.32 billion in stock positions. Its only filings since that time simply show what stocks it’s acquired and sold, but not the 13F which would show the full positions in its portfolio and their value.

We could go on and on, but you get the picture.

Wall Street On Parade also reported in April of last year that since the Wall Street crash of 2008, equity derivative contracts similar to those held by Archegos have exploded from $737 billion to $4.197 trillion.

A 25-year former veteran staff attorney at the SEC, James Kidney, has gone on the record as to how not prosecuting higher ups on Wall Street at the SEC provides a shot at those seven-figure jobs on Wall Street. For how the Justice Department is similarly co-opted from prosecuting the big names on Wall Street, see here and here.

Another big problem for the Justice Department’s case is the internal investigation conducted by the Big Law firm Paul, Weiss, Rifkind, Wharton & Garrison into Credit Suisse’s role in the Archegos implosion. (Last July, Credit Suisse released the 165-page report by Paul Weiss on its version of what happened.) Other Wall Street banks doing trades with Archegos included Goldman Sachs, Morgan Stanley, UBS, Nomura, Deutsche Bank and others.

This is how the Paul Weiss report portrayed the zombie risk managers at Credit Suisse:

“The Archegos-related losses sustained by CS [Credit Suisse] are the result of a fundamental failure of management and controls in CS’s Investment Bank and, specifically, in its Prime Services business. The business was focused on maximizing short-term profits and failed to rein in and, indeed, enabled Archegos’s voracious risk-taking. There were numerous warning signals—including large, persistent limit breaches — indicating that Archegos’s concentrated, volatile, and severely under-margined swap positions posed potentially catastrophic risk to CS. Yet the business, from the in-business risk managers to the Global Head of Equities, as well as the risk function, failed to heed these signs, despite evidence that some individuals did raise concerns appropriately.”

And this:

“…a Prime Services business with a lackadaisical attitude towards risk and risk discipline; a lack of accountability for risk failures; risk systems that identified acute risks, which were systematically ignored by business and risk personnel; and a cultural unwillingness to engage in challenging discussions or to escalate matters posing grave economic and reputational risk. The Archegos matter directly calls into question the competence of the business and risk personnel who had all the information necessary to appreciate the magnitude and urgency of the Archegos risks, but failed at multiple junctures to take decisive and urgent action to address them.”

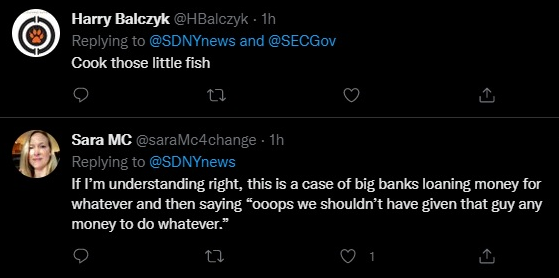

The following Tweets appeared on the Twitter page for the U.S. Attorney’s Office for the Southern District of New York shortly after it announced its findings in the Archegos matter:

Now would be a good time for the Senate’s Permanent Subcommittee on Investigations to open its own investigation and actually get to the bottom of the full scope of this fraud.