By Pam Martens: April 7, 2022 ~

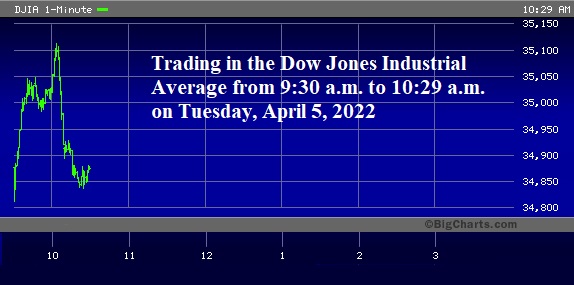

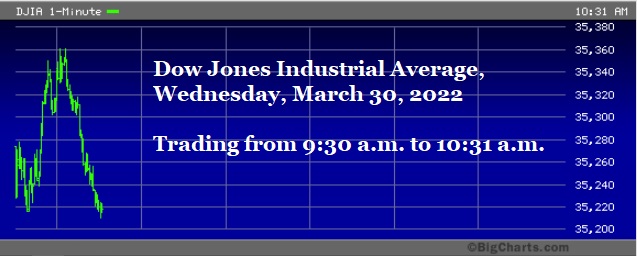

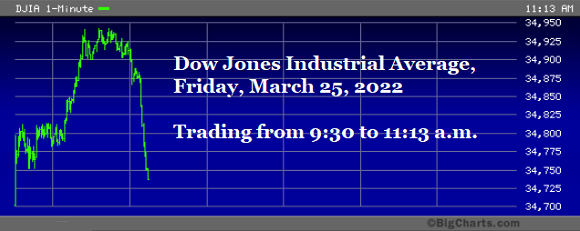

The Editor of Wall Street On Parade has been watching stock market trading patterns for more than three decades – 21 of those years at two Wall Street firms. A new pattern is emerging that strongly suggests there is an invisible hand flipping the market on a dime from a plunge in prices to a dramatic spike in prices. This could happen legitimately if sudden positive news broke, but it is happening regularly with no major news to explain the dramatic shift in sentiment. The charts below capture just four examples of what is becoming an increasingly familiar pattern in the Dow Jones Industrial Average:

On January 31 Wall Street On Parade reported that the New York Fed, which is the only one of the 12 regional Fed banks to have a trading floor – complete with those expensive Bloomberg data terminals and speed dials to Wall Street’s biggest trading houses – had decided for some reason after 100 years of operation that it needed a second trading floor in Chicago. (Read our detailed report here with photos.)

What does Chicago have that New York does not have that might come in handy to those traders at the New York Fed? The Chicago office of the New York Fed sits close to the Chicago Mercantile Exchange where S&P 500 futures are traded, as well as other futures contracts. The closer one is to the computers that process those S&P 500 trades, the bigger the trading advantage.

Let’s say, hypothetically, that there are some large hedge funds that correctly sense that the Fed has created a market bubble that is going to explode now that the Fed has allowed inflation to get out of control and the Fed has to slam on the brakes with a rapid series of interest rate hikes. Those hedge funds might be looking to pounce on the market at the open by shorting (selling) S&P 500 futures in Chicago. To prevent these hedge funds from seeing this maneuver as an easy means of reaping windfall returns while driving the market lower and lower without resistance, the New York Fed, again hypothetically, might want to launch its own counteracting purchases of the S&P 500 futures contracts. This would produce what is known as a short squeeze, where the hedge funds have to quickly buy S&P 500 futures to cover the shorts they put on, turning the market on a dime and pushing it dramatically higher.

Certainly no one wants to see the stock market crash. But is it really the job of the central bank of the United States – which is tasked with setting monetary policy – to have an ever-expanding trading floor in two major trading hubs in the U.S. and traders duking it out with hedge funds?