By Pam Martens and Russ Martens: April 4, 2022 ~

The Federal Reserve, the central bank of the United States, has a “dual mandate” to target inflation and to maintain “maximum sustainable employment.” The Fed has zero mandate to target a specified level for the Dow Jones Industrial Average or to prevent stock market crashes by printing money out of thin air and pumping it out to the trading houses on Wall Street.

But under Fed Chair Ben Bernanke during the Wall Street crisis in 2008 and Fed Chair Jerome Powell in 2019-2020, that’s exactly what the Fed decided to do.

The majority of the stock market is owned by the wealthiest 10 percent of Americans. Thus, when the stock market is bailed out by the Fed, which we can now show overtly occurred from March 9 through March 16 of 2020, the Fed is effectively bailing out the rich.

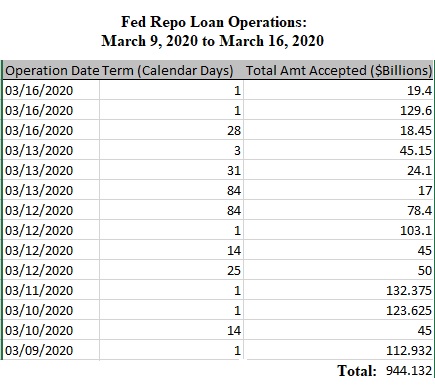

The Fed began its emergency repo loan operations on September 17, 2019 – months before there was a reported case of COVID-19 anywhere in the world. It was the first time the Fed had intervened with emergency repo loans since the financial crisis of 2008. The Fed’s repo loans continued throughout the fall of 2019 and into 2020. By Monday morning, March 9, 2020, news of the coronavirus was making headlines around the world and rattling stock markets. The Dow Jones Industrial Average (Dow) plunged 2,013.76 points that day. The Fed responded with one repo loan operation that day of $112.932 billion, which it pumped into 24 trading houses on Wall Street – its so-called “primary dealers.”

The Fed had calmed the market for the time being and on Tuesday, March 10, 2020, the Dow gained 1,167.14 points. (We can assume that the gain was aided by the fact that the Fed on March 10 had conducted two repo loan operations, pumping in a total of $168.625 billion.)

But panic set in again on Wednesday, March 11, 2020, with the Dow losing 1,464.94 points, despite the Fed conducting a one-day repo loan operation of $132.375 billion. The Fed interpreted that to mean that the Wall Street trading houses were thumbing their noses at short-term loans and wanted longer-term loans from the Fed. It would fulfill their wishes the very next day in a big way.

By early Thursday morning, March 12, a new panic had set in. Before the stock market opened at 9:30 a.m. in New York, S&P 500 futures had plunged 5 percent and were locked, limit-down. That led to a plunge of 7 percent in the S&P 500 Index shortly after the stock market opened at 9:30 a.m. in New York. That plunge triggered a circuit breaker which suspended trading for 15 minutes until 9:50 a.m. By the time the dust settled at the closing bell, the Dow had lost 2,352.60 points.

But now that we know the details of what the Fed did on March 12, it’s fair to question if the stock market could have lost 10,000 points that day but for the actions of the Fed.

Instead of one repo loan operation on March 12, the Fed conducted four separate operations. Here’s how that played out: at 8 a.m. on March 12, the Fed provided 25-day term repo loans of $50 billion; at 8:30 a.m. the Fed provided 14-day term repo loans of $45 billion; at 9:00 a.m. (one-half hour before the stock market was set to open), the Fed conducted its third repo loan operation of the day, providing $103.1 billion in one-day repo loans; and at 1:45 p.m. the Fed crafted repo loans stretching out for 84 days and totaling $78.4 billion. The Fed’s repo loan total for just that one day of March 12 was $276.5 billion.

No better evidence exists to illustrate that the Fed is targeting the level of the stock market than the actions it took on March 12. (The Fed has withheld the names of the trading houses and the amounts they received from its windfall loans for two years. It was forced to release the information last Thursday under the Dodd-Frank financial reform legislation. Since last Thursday, not one mainstream media outlet has reported the names of the trading houses that got this repo loan money from the Fed.)

The Fed’s money pot on Thursday, March 12, 2020, nicely calmed the market. On Friday, March 13, the Dow closed up 1,985 points, helped by another $86.25 billion in repo loans from the Fed in three separate operations on March 13.

Unfortunately, by Monday, March 16, the trading houses were looking for another handout from the Fed. The Dow closed down another 2,997 points that day for a Dow close of 20,188.52. From the Dow close on Friday, March 6 to the Dow close on Monday March 16, the Dow had lost a total of 5,676 points as the Fed had funneled a staggering $944.132 billion – almost a trillion dollars – to the trading houses on Wall Street.

The very next day, March 17, the Fed announced a new bailout concoction called the Primary Dealer Credit Facility. We’ll have a lot to say about that opaque Fed operation this week.

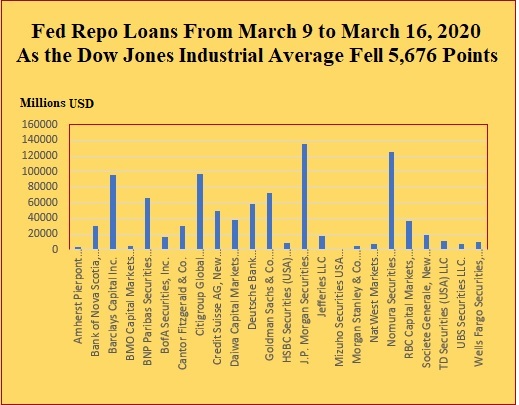

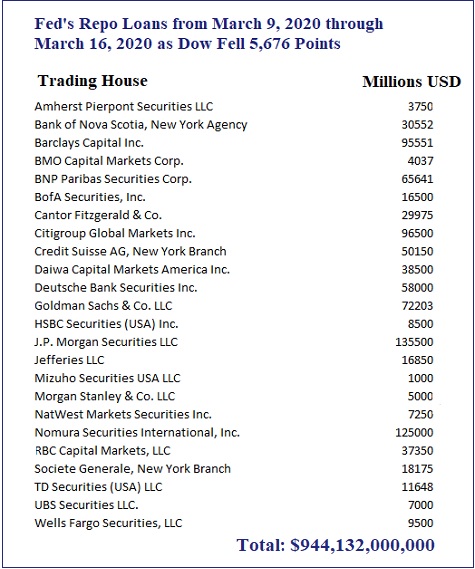

As the charts above and below indicate, in that 6-day trading span, it wasn’t depository banks that make loans to the American people that were getting these windfalls from the Fed. It was trading houses on Wall Street – many of them owned by giant foreign global banks.

The largest beneficiary was J.P. Morgan Securities, the trading unit of JPMorgan Chase, which over those six trading sessions borrowed $135.5 billion from the Fed in repo loans, much of it at 0.25 percent interest while its parent bank charged double-digit interest rates on its credit cards to consumers.

The second largest beneficiary of the Fed’s largess during those six days was the U.S. trading unit of the Japanese investment bank, Nomura, which grabbed $125 billion from the Fed.

Third in line was the perennial Wall Street bad boy, Citigroup Global Markets, which borrowed $96.5 billion during just those six trading sessions.

Fourth in line was the U.S. trading unit of the U.K. banking behemoth, Barclays, which borrowed $95.551 billion, just behind Citigroup.

Add in Goldman Sachs at $72.2 billion and the U.S. trading unit of the French global bank, BNP Paribas, at $65.6 billion and it shows that just these six banks accounted for $590 billion of the total $944 billion over those six trading sessions. To state it another way, just six trading houses out of the total of 24, grabbed 62.5 percent of the total for all trading houses participating.

This raises another big question. In terms of U.S. peer banks by assets, Bank of America (BofA) and Wells Fargo are right up there with JPMorgan Chase. But if you scrutinize the chart at the top of this article, it’s clear that Bank of America and Wells Fargo did not have the liquidity problems experienced by the top six borrowers during this panic in the stock market. Congress needs to find out why and let the American people in on the secrets.

And the final aspect of all of these opaque actions that the Fed took with its repo loans that needs to be addressed by Congressional hearings is why the public isn’t reading about any of this, or looking at the charts on this page, at any mainstream media outlet in America, which all have reporters exclusively assigned to cover every move by the Fed but have conducted a blanket news blackout on this critical subject since the Fed released the names of the borrowers last Thursday.

You can download the time and dates of the Fed’s repo loan operations at this link. Use the drop-down buttons to specify that you want just “repo” operations. The names of the trading houses and how much they borrowed are at this link. At this link you’ll need to manually delete the reverse repo operations before tabulating repo results.