By Pam Martens and Russ Martens: December 17, 2021 ~

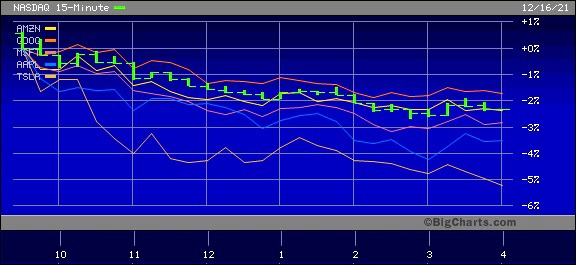

The Nasdaq Composite Index dropped 385 points yesterday for a loss of 2.47 percent. At the lows of the day, it was down 446 points at 15,119.49. That compares with a loss of just 29.79 points on the Dow Jones Industrial Average or 0.08 percent.

The Nasdaq is packed with Big Tech stocks trading at nose-bleed multiples and meager dividends, or no dividends at all. Tesla is trading at a trailing price-to-earnings ratio of 302 and pays no dividend. Amazon is trading at a trailing P/E of 67 and pays no dividends. Tesla tanked 5 percent yesterday while Amazon lost 2.56 percent. Other Big Tech losers were Apple, down 3.93 percent; Microsoft, down 2.91 percent; and a whopping smackdown of Adobe, which shed 10.19 percent. Notably, Adobe also doesn’t pay a dividend and trades at a trailing P/E of 54.

The carnage on Thursday came despite a market rally the prior day in reaction to the Fed’s announcement that it will trim back its debt purchases of Treasuries and Mortgage-Backed Securities by another $30 billion, putting it on a course to wind down the program completely by the spring of next year. The rally was in response to the Fed leaving its short-term interest rate (the Fed Funds rate) unchanged while signaling that rate increases will proceed at a slow and measured clip, despite a dramatic surge in inflation.

Yesterday’s sharp reversal in sentiment toward the tech-laden Nasdaq came on the heels of the Bank of England (BOE) raising its interest rate to 0.25 percent from 0.1 percent. The U.K. is also experiencing persistent inflation, which is expected to reach 6 percent in April, three times the BOE’s target rate of 2 percent.

The move by the BOE signaled to the market that other major central banks may not be so heavily influenced this time around (as they were following the 2008 financial crash) to let the Fed be the maestro of the interest rate orchestra. For the seminal work on how that played out, read Nomi Prins’ brilliant Collusion: How Central Bankers Rigged the World.