By Pam Martens and Russ Martens: September 9, 2021 ~

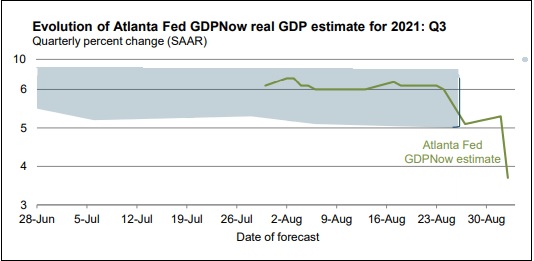

The highly respected and closely watched Atlanta Fed’s GDPNow forecast for the third quarter has been slashed by 41 percent since August 2 – from 6.3 percent GDP growth to a tepid 3.7 percent projected GDP growth on September 2. The next update to its forecast will occur tomorrow after the Producer Price Index (PPI) is released at 10 a.m. (The GDPNow update typically occurs within a few hours of a new data release.)

The Atlanta Fed’s GDPNow model is the seasonally adjusted annual rate. It comes with the following caveat:

“GDPNow is not an official forecast of the Atlanta Fed. Rather, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter. There are no subjective adjustments made to GDPNow – the estimate is based solely on the mathematical results of the model. In particular, it does not capture the impact of COVID-19 and social mobility beyond their impact on GDP source data and relevant economic reports that have already been released. It does not anticipate their impact on forthcoming economic reports beyond the standard internal dynamics of the model.”

Despite this dramatic deceleration in growth prospects for the U.S. economy in the current quarter, the following headline ran at Bloomberg News yesterday: “Fed Says Growth Downshifted Slightly July-Aug, Cites Delta.”

Downshifted slightly? Seriously? Take a close look at the above chart.

The Bloomberg News report was based on the Federal Reserve’s Beige Book – which looks at economic conditions across the 12 Federal Reserve Districts. One sentence stands out in the newly released Beige Book:

“Economic growth downshifted slightly to a moderate pace in early July through August.”

That entire sentence is problematic. The Atlanta Fed’s GDPNow forecast for the third quarter took a dramatic turn for the worse from mid-August to the end of August, dropping from 6.2 percent on August 17 to 5.1 percent on August 27. That’s a deceleration of 18 percent in 10 days.

The Federal Reserve, where Jerome Powell would like to keep his job as Chair, is now between a rock and a hard place. If it presents the hard facts on the ground it risks further dampening the mood of the consumer – who represents two-thirds of GDP growth in the U.S.

That mood is already pretty gloomy. The survey of Consumer Confidence from the Conference Board on August 31 dropped from a reading of 125.1 in July to 113.8 in August.

And the Conference Board’s report was downright cheery compared to the University of Michigan’s Consumer Sentiment Index for August. It found the following:

“There was no lessening in late August in the extent of the collapse in consumer sentiment recorded in the first half of the month. The Consumer Sentiment Index fell by 13.4% from July, recording the least favorable economic prospects in more than a decade. The Sentiment Index has only recorded larger losses in six other monthly surveys since 1978. The losses were especially large in the Expectations Index, and widespread across all demographic groups, regions, and the outlook for the economy. Personal financial prospects continued to worsen due to smaller income gains amid higher inflationary trends…Consumers’ extreme reactions were due to the surging Delta variant, higher inflation, slower wage growth, and smaller declines in unemployment. The extraordinary falloff in sentiment also reflects an emotional response, from dashed hopes that the pandemic would soon end and lives could return to normal.”