By Pam Martens and Russ Martens: August 23, 2021 ~

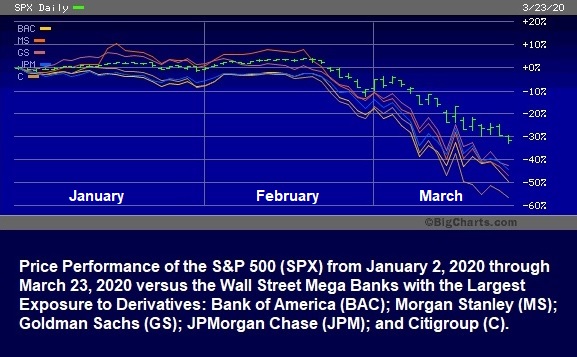

Federal Reserve Chairman Jerome Powell and Fed Vice Chairman for Supervision, Randal Quarles, would desperately like to make three of the Fed’s emergency bailout programs to Wall Street disappear from further scrutiny by Congress or the American people. That’s because the specific details of those programs do not comport with the testimony that Powell and Quarles have provided at Congressional hearings throughout the pandemic. Both Powell and Quarles have told Congress that the mega banks were a source of strength during the pandemic. (The chart above shows what was really happening.)

The three emergency lending programs that the Fed would like to make vanish are the Primary Dealer Credit Facility (PDCF); the Commercial Paper Funding Facility (CPFF); and the Money Market Mutual Fund Liquidity Facility (MMLF).

These are not only the most opaque of the Fed’s “official” bailout programs but they are also the first three emergency lending programs that the Fed stood up in 2020. The PDCF and CPFF were both announced on March 17, 2020 by the Fed. The MMLF was announced the very next day.

For each of the other Fed emergency lending programs, those created under Section 13(3) of the Federal Reserve Act, the Fed has reported the transaction details, including the names of the recipients and dollar amounts received. But the Fed has withheld that information from Congress for these three programs – despite promising complete transparency.

Now, it seems the Fed wants to make these programs disappear altogether.

In its monthly 13(3) emergency lending reports to Congress, from January through May of this year, those three programs appeared with a lump sum total for what had been loaned out but no names of recipients or transaction details. Now, even the names of those programs have completely disappeared on the most recent June, July and August reports to Congress.

Just how much money was sluiced to Wall Street under these programs? We know from the Fed’s H.4.1 weekly release of the line items on its balance sheet that as of April 8, 2020, just a few weeks after these three programs started, the Primary Dealer Credit Facility had ballooned to $33 billion in loans outstanding while the Money Market Mutual Fund Liquidity Facility had soared to $53 billion.

The Commercial Paper Funding Facility (CPFF) grew far more slowly but gyrated in disconcerting fashion in its early days. According to the Fed’s weekly H.4.1 releases, as of May 20, 2020 the CPFF stood at $4.3 billion, but one week later, on May 27, it had almost tripled to $12.8 billion, strongly suggesting that one or more large financial institutions could not roll over their commercial paper because of some kind of taint attached to it.

But the size of these three “official” emergency lending facilities pales in comparison to what the Fed had rolled out four months before COVID-19 had ever been heard of in the United States.

On June 22, 2021 the House Select Subcommittee on the Coronavirus Crisis convened a hearing to take testimony from Powell regarding the Fed’s crisis relief efforts. During Powell’s opening statement, he testified as follows:

“Our emergency lending tools require the approval of the Treasury and are available only in unusual and exigent circumstances, such as those brought on by the crisis.”

When the eyes of mainstream media are on the Fed, Powell is quick to say that the Fed can only make emergency loans with the approval of the Treasury. In fact, there was no Treasury approval, or Congressional oversight, when the Fed launched its repo loan bailouts of Wall Street beginning on September 17, 2019 – four months before the first reported case of COVID-19 in the United States. By January 27, 2020, the Fed’s ongoing repo loans to bail out Wall Street had reached a cumulative $6.6 trillion. According to the Fed’s own audited financial statements for 2020 and 2019, on its peak day in 2020 the Fed’s repo loan operation had $495.7 billion in loans outstanding to Wall Street versus $259.95 billion on its peak day in 2019. That’s a lot of Wall Street bailout money avoiding any oversight by Congress.

The American people have good reason to be skeptical of the Federal Reserve as a transparent operation as a result of how it stonewalled the public during and after its last big bailout of Wall Street from December 2007 through at least July of 2010. The Fed battled media outlets in court for years, refusing to turn over the names and dollar amounts of where the money went. When the Government Accountability Office (GAO) finally released the granular data from its audit of the Fed’s bailout programs in July of 2011, Senator Bernie Sanders’ office issued a press release stating the following:

“The first top-to-bottom audit of the Federal Reserve uncovered eye-popping new details about how the U.S. provided a whopping $16 trillion in secret loans to bail out American and foreign banks and businesses during the worst economic crisis since the Great Depression…

“The Fed outsourced virtually all of the operations of their emergency lending programs to private contractors like JP Morgan Chase, Morgan Stanley, and Wells Fargo. The same firms also received trillions of dollars in Fed loans at near-zero interest rates. Altogether some two-thirds of the contracts that the Fed awarded to manage its emergency lending programs were no-bid contracts. Morgan Stanley was given the largest no-bid contract worth $108.4 million to help manage the Fed bailout of AIG.”

But the GAO audit failed to include all of the Fed’s secret bailout programs. When the Levy Economics Institute added the additional lending facilities not included by the GAO, the total cumulative tally came to $29 trillion. The reality was that the Fed was attempting to cover up its own incompetence at supervising the mega banks on Wall Street.

In the press release, Sanders was quoted as follows:

“The Federal Reserve must be reformed to serve the needs of working families, not just CEOs on Wall Street.”

Despite two unprecedented bailouts of Wall Street in 2007-2010 and again in 2019-2021, Congress has failed to strip the Fed of its supervisory role over the mega banks on Wall Street or its ability to create electronic money out of thin air to bail out the same banks, while hiding the details from the American people.

It’s time for all Americans to demand accountability from both the Fed and Congress because it’s the American taxpayer who is on the hook for the liabilities of the Fed.