New York Stock Exchange Shutters Its Trading Floor on March 23, 2020 as Two Employees Test Positive for Coronavirus

By Pam Martens and Russ Martens: April 7, 2020 ~

It’s become your life or your trading bonus at some Wall Street firms.

On November 10 of last year, Lesley Stahl of the CBS investigative news program, 60 Minutes, interviewed Jamie Dimon, the Chairman and CEO of JPMorgan Chase. As part of the interview, Dimon strolled Stahl around one of his trading floors in New York where traders appeared tightly packed in close quarters. Dimon said this: “This is one of six trading floors in the building. There’s like 450 people in this trading floor. An equivalent to this in London, half of this in Hong Kong, and in 23 other countries around the world.”

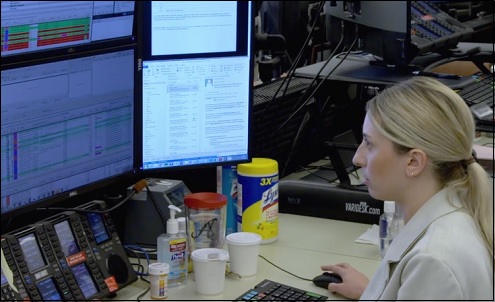

When we went back to re-watch the program to more carefully consider the dystopian work environment of human beings in the 21st century, we took a screen shot of a female trader at JPMorgan Chase. In November 2019, before there was one press report of coronavirus COVID-19 anywhere in the world, this woman already had a serious concern about bacteria and/or viruses. Her workstation included a large bottle of Purell hand sanitizer as well as a large container of Lysol wipes. She was perhaps prescient about what was coming.

On March 23 of this year, for the first time in its history, the New York Stock Exchange closed its iconic trading floor while its electronic operations remained open. It took the action after two people who work at the Exchange tested positive for coronavirus.

The action at the New York Stock Exchange stands in sharp contrast to media reports of what has happened to traders on the trading floor at JPMorgan Chase. According to a report at the Wall Street Journal, despite a coronavirus outbreak, JPMorgan Managers pressured its traders to show up for work with the result that more than two dozen are sick and dozens more in quarantine. And yet, traders are still being pressured to come to work according to new reports.

Bloomberg News is reporting today that while Bank of America has said only one in 20 of its traders are working onsite, that figure is about one in five at JPMorgan Chase.

Troy Rohrbaugh, JPMorgan’s Head of Global Markets, is getting much of the blame, according to the Bloomberg article. He is cited in a memo from a colleague as wanting “to push everyone to get back into the office.”

There is no definitive science on just how long the coronavirus can live on things like ceiling tiles, carpet, sheetrock, or computers. So sending hundreds of traders back to work in that trading environment and then out onto public sidewalks and public transportation may be an issue that Governor Andrew Cuomo of New York State may want to investigate.

Rohrbaugh came under the radar at Wall Street On Parade in 2015. At that time, Rohrbaugh was simultaneously the Head of Foreign Exchange Trading at JPMorgan Chase as well as Chair of the New York Fed’s Best Practices Group for Foreign Exchange trading. On May 20, 2015, JPMorgan Chase was charged with a criminal felony count and pleaded guilty to rigging foreign exchange trading, along with several other banks. JPMorgan Chase paid a not inconsequential fine of $550 million.

One might have assumed that a criminal felony count against the area of trading he headed would have dimmed the rising star of Troy Rohrbaugh. It didn’t. He has now moved up to Head of Global Markets at JPMorgan Chase.

One might also have assumed that the New York Fed, which is a regulator for JPMorgan Chase’s sprawling bank holding company, might have sacked Rohrbaugh as the Chair of its Foreign Exchange Committee. That didn’t happen either. According to the October 2015 minutes of the New York Fed’s Foreign Exchange Committee, Rohrbaugh remained on as its Chair and his Committee was involved in developing a global code of ethics for foreign exchange.

This is the quintessential definition of failing up.

On March 20, Governor Cuomo signed an Executive Order to limit the spread of the coronavirus. Among other things, the order included “a new directive that all non-essential businesses statewide must close in-office personnel functions effective at 8 PM on Sunday, March 22, and temporarily bans all non-essential gatherings of individuals of any size for any reason.” It is not clear to us how trading for billions in profits provides an essential service like food or hospital services.

In the final quarter of last year, JPMorgan Chase reported a profit of $8.52 billion (that’s in just one quarter of the year) and said that its trading operations were a major contributor to pushing its profits up by 21 percent.