By Pam Martens and Russ Martens: December 18, 2019 ~

The Federal Reserve Bank of New York (New York Fed) seems intent on stonewalling Wall Street On Parade from receiving some very basic information on JPMorgan Chase’s rapid drawdown this year on its liquid reserves at the New York Fed – a matter which some on Wall Street have fingered as a contributing cause of the ongoing repo loan crisis. More on that in a moment, but first some background.

For the past decade Wall Street On Parade has been keeping close tabs on the crony operations of the New York Fed. (See related articles below.) The New York Fed has effectively morphed into a key cog in Wall Street’s wealth transfer system – where the little guy’s pocket is picked daily in the service of minting billionaires on Wall Street – who now increasingly want to rule the rest of us from the White House.

During the 2007 to 2010 financial crisis (caused entirely by Wall Street corruption, lax supervision by the New York Fed and the repeal of the Glass-Steagall Act which allowed Wall Street trading firms to merge with too-big-to-fail, federally insured deposit-holding commercial banks) the New York Fed secretly funneled the majority of the staggering sum of $29 trillion in cumulative loans to shore up insolvent or close to insolvent Wall Street trading houses. It even secretly funneled vast sums to Wall Street firms’ trading units in London and to a dizzying array of foreign banks – all without one vote in Congress or disclosure of these vast sums to the American people. The public only learned about the trillions the Fed had loaned at super cheap interest rates after it lost a multi-year court battle and after Senator Bernie Sanders attached an amendment to the Dodd-Frank financial reform legislation that forced the General Accountability Office to audit these loans by the Fed.

Throughout its history, the overarching mandate of the Federal Reserve has been to provide emergency loans to deposit-taking banks, backed by solid collateral, so that they can continue to provide business and consumer loans to keep the economy functioning and growing. The Federal Reserve’s mandate has never been to prop up the high-risk casino trading houses on Wall Street. But since the repeal of the Glass-Steagall Act in 1999, which allowed the casino trading houses on Wall Street – like JPMorgan Chase, Goldman Sachs, Morgan Stanley and Citigroup – to own federally-insured banks holding the life savings of moms and pops across America, the New York Fed has morphed into Wall Street’s lender of first resort.

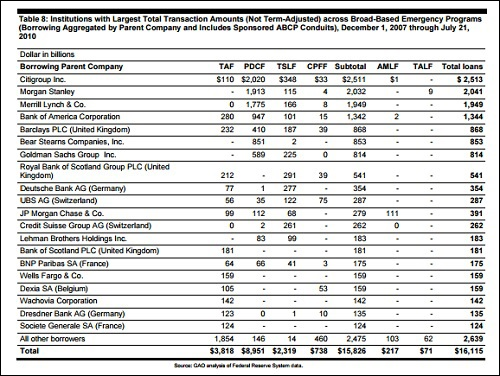

As an illustration of just how far the New York Fed has strayed from the original mandate of the Federal Reserve Act, during the financial crisis it operated one program called the Primary Dealer Credit Facility (PDCF). Under that program, it loaned $8.95 trillion in cumulative loans according to the GAO’s audit. Almost two-thirds of the money went to three trading houses on Wall Street: Citigroup received $2 trillion; Morgan Stanley received $1.9 trillion and Merrill Lynch received $1.775 trillion. (See chart below from the GAO report.) And instead of requiring good collateral, many of these loans were backed with stocks and junk bonds at a time when both markets were in a state of collapse.

This is financial hubris at its finest. The New York Fed failed to rein in the risks of these trading houses while it was wining and dining their executives and setting up committees to jointly set “best practices” for the industry, then it secretly bailed out the corrupt firms to the tune of $29 trillion to cover its failures as a supervisor.

With that as background, consider what is happening now as Wall Street On Parade has attempted to use the nation’s Freedom of Information Act (FOIA) to bring some sunshine to the American people on why there is a liquidity crisis in the overnight lending market (repo market) on Wall Street while there seems to be plenty of liquidity to goose the stock market higher.

On October 2 we filed a FOIA with the New York Fed requesting “emails or any other forms of written correspondence from the Federal Reserve Bank of New York to JPMorgan Chase or any of its subsidiaries or affiliates containing any of the following words or phrases: ‘repo,’ ‘repurchase agreements,’ ‘overnight lending,’ or ‘reserves.’ ”

We explained our request as follows:

“It has been revealed in a published report by Reuters that other Wall Street banks are pointing to JPMorgan Chase as a cause of the distress in the overnight repo market because it drew down $158 billion from its cash deposits at the Fed. We are not asking for any protected supervisory records. We are simply asking to see any correspondence that would explain why JPMorgan Chase did this and what the Fed’s reaction was.”

The $158 billion that JPMorgan Chase withdrew from its liquid reserves this year represented 57 percent of its total reserves at the Fed. That is a stunning amount to draw down in a short period of time.

JPMorgan Chase is not just any bank. It is the largest commercial bank in the United States with $1.6 trillion in deposits – representing the life savings of moms and pops, public pension money, retirement funds and business accounts. Unfortunately, JPMorgan Chase also has the distinction of being a recidivist crime actor. In 2014 it pleaded guilty to two criminal felony counts for its role in the Bernie Madoff Ponzi scheme; in 2015 it pleaded guilty to one more criminal felony count for its role in rigging foreign exchange markets; and on September 16, three of its precious metals traders were charged with participating in a racketeering conspiracy for eight years while turning JPMorgan Chase’s precious metals desk into a criminal enterprise. That criminal probe by the U.S. Department of Justice is ongoing.

In 2013 the FBI investigated JPMorgan Chase over the fact that it had used hundreds of billions of dollars in deposits to make risky gambles in derivatives in London, losing $6.2 billion of its depositors’ money along the way. No criminal charges were brought but the bank paid over $1 billion in fines and settlements.

All of this activity has occurred while JPMorgan Chase was being supervised by the New York Fed and while its Board of Directors has, bizarrely, kept Jamie Dimon as Chairman and CEO.

The New York Fed is one of the 12 regional Federal Reserve banks which are owned by their member banks as shareholders. The Federal Reserve in Washington, D.C. is deemed an independent Federal agency but the 12 reserve banks are considered private institutions. However, the New York Fed professes to abide by the FOIA law, which requires a response to a FOIA request within 20 business days.

Our FOIA request was correctly acknowledged by the New York Fed as received on October 2. We should have had a meaningful response on November 1. Instead, we received this reply from the New York Fed on November 1:

“Dear Ms. Martens,

“We are continuing to work on your request. We are in the process of consulting with another department that may have an interest in the determination of your request. Therefore, we are extending the time to respond and expect to provide you with an update by December 5, 2019. Thank you for your patience.

“Sincerely, Corporate Secretary’s Office”

Instead of the 10-day extension that is allowed under the law, we were given more than a month-long extension.

On December 5, we received yet another stonewalling email from the New York Fed, informing us that:

“Dear Ms. Martens,

“Due to the breadth of your request, we are continuing to search for responsive records. We are therefore extending the time to respond and expect to provide you with an update by January 9, 2020. Thank you.

“Sincerely, Corporate Secretary’s Office”

Under FOIA law, the 20 business-day requirement can only be waived under “unusual circumstances” which must be set forth in the letter to the requester. The letter from the New York Fed does not spell out these “unusual circumstances” and mentions only the “breadth of your request,” while failing under the FOIA statute to offer Wall Street On Parade the opportunity to narrow the scope of our request.

In fact, the breadth of the request is quite narrow. It pertains to just JPMorgan Chase and covers just a nine month period with a handful of search words that any competent search system should be able to readily identify.

Our suspicion of the Fed’s motives are raised by what happened to the Bloomberg News reporter, Mark Pittman, when he filed a FOIA with the Fed during the financial crisis. (Pittman died before ever receiving a response.)

Pittman had filed a FOIA with the Fed in April and May of 2008, seeking details of four lending programs, including the borrowers’ names and the amounts borrowed. The programs were the Discount Window, the Primary Dealer Credit Facility, the Term Securities Lending Facility, and the Term Auction Facility. Pittman’s interest was heightened by what was happening at the Fed’s Discount Window. Borrowing had spiked from approximately $250 million a week in prior years to over $100 billion in October 2008.

According to the lawsuit filed by Bloomberg News for the records, here’s how it was stonewalled: On June 19, 2008, the Fed invoked its right to extend the response time to July 3, 2008. On July 8, 2008, the Fed called Bloomberg News to say it was processing the request. The Fed called Bloomberg again on August 15, 2008, wherein Alison Thro, Senior Counsel and another employee, Pam Wilson, informed the business wire service that their request was going to be denied by the end of September 2008. No further communication came, including the denial.

Related Articles:

New York Fed’s Answer to Cartels Rigging Markets – Form Another Cartel

Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?

New Documents Show How Power Moved to Wall Street, Via the New York Fed

Carmen Segarra: Secretly Tape Recorded Goldman and New York Fed