By Pam Martens and Russ Martens: August 8, 2017

Yesterday, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, spoke to the Rotary Club of Downtown Sioux Falls, South Dakota and then opened up the mic to questions from the audience. One question concerned today’s lack of true innovation rather than just innovations in social media. Kashkari responded as follows:

Yesterday, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, spoke to the Rotary Club of Downtown Sioux Falls, South Dakota and then opened up the mic to questions from the audience. One question concerned today’s lack of true innovation rather than just innovations in social media. Kashkari responded as follows:

Kashkari: “This is a big complicated topic. A big question mark in the economics profession is why is productivity growth in the U.S. economy so low. It’s much lower than it has been in prior decades. And, we think, you pull out your iPhone or Twitter or Facebook – you think, wow, all this stuff is happening. Well, some experts say the things that we’re creating now – that we’re innovating now – just aren’t that impactful. They don’t really move the needle very much. So if you compare Facebook and Twitter, which seem pretty cool, to electricity or the internal combustion engine, or the airplane, it’s just not that important.”

Kashkari is on to something significant but we have to differ with him in this regard: this is not really “a big complicated topic.” It’s a very basic concept: we are living in the most narcissistic era that America has ever experienced and it’s dragging down not only U.S. productivity but the country itself.

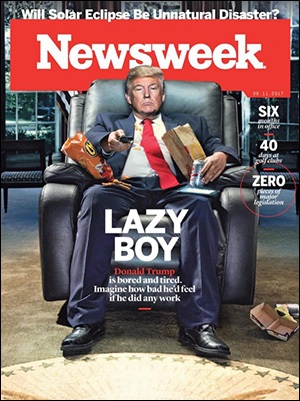

Memorializing this era just last week was the unprecedented “Lazy Boy” cover of Newsweek, depicting the leader of the free world as a slouch, replete with the critical necessity of this era: the smartphone on his lap — which affords him instant narcissistic gratification to his Twitter followers.

Walk on any bustling sidewalk today and you will observe a sea of pedestrian faces buried in their iPhone or some other digital device. These people are not likely thinking about creating the next internal combustion engine. They are posting personal photos to their Facebook page, Tweeting, sending selfies, checking out the latest cool restaurant, or simply gossiping with friends. Innovative minds have succumbed, on a mass scale, to digital hedonism.

Putting self above country extends to the Wall Street analysts who have made easy money fueling this craze by putting out buy recommendations on the social media companies that make these products and the billionaire hedge fund owners who have crowded into these stocks, simply because it’s a lazy boy trade.

On June 9 of this year, Robert Boroujerdi of Goldman Sachs released a report on the FAAMG stocks: Facebook, Apple, Amazon, Microsoft and Google-parent Alphabet. The report found that these five stocks have increased their market value by $600 billion this year, accounting for approximately 40 percent of the year-to-date performance of the entire 500 stocks that make up the Standard and Poor’s 500 Index.

And yet, the essential purpose of the stock market is to efficiently allocate capital to the most promising businesses for innovation that will drive productivity, job and wage growth, and a higher standard of living for all Americans.

Misguided product innovation is routine today in America. Take, for example, this assessment in a July 19, 2017 article by Roger Cheng of c/net describing the poorly vetted Google Glass. Cheng writes:

“Google’s $1,500 eyewear grabbed headlines and readers’ imaginations when four skydivers jumped out of a zeppelin while wearing Glass for a 2012 demo that introduced the device to the world. With it, you could video chat with friends, view Google Maps for directions or quickly snap a photo. But that initial enthusiasm turned into hostility over privacy concerns. Bars, restaurants and the Motion Picture Association of America banned Google’s fancy glasses from their venues.”

Underscoring the nebulous connection between free social media services and the real economy is the fact that these services are not counted in measuring Gross Domestic Product in the U.S. They are not considered part of the market economy where goods and services are sold for a defined price.

Writing in the Wall Street Journal in 2015, reporter Greg Ip summed up the problem:

“Google’s decision to separate its profitable businesses from its money-losing ‘moonshot’ ventures has offered a window into why American productivity is struggling despite so much exciting technological innovation.

“The things at which Google and its peers excel, from Internet search to mobile software, are changing how we work, play and communicate, yet have had little discernible macroeconomic impact. Productivity—the goods and services a worker produces in an hour—grew just 0.4% per year over the past five years…”

Add to all of this the fact that a handful of mega Wall Street banks have concentrated market control over capital allocation and are starving the economy by using 99 percent of their earnings to buy back their own stock and pay dividends to their rich shareholders and it’s clear why we have a malfunctioning economy that no longer works for the majority of Americans.