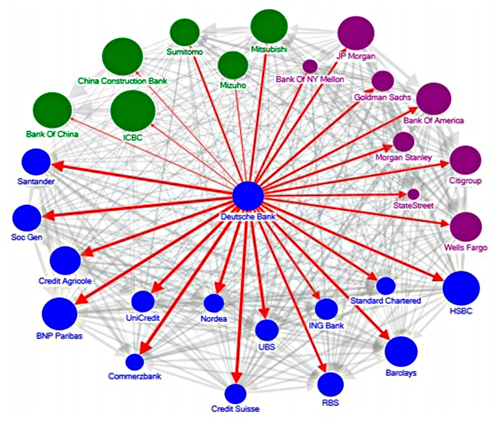

Systemic Risk Among Deutsche Bank and Global Systemically Important Banks (Source: IMF — “The blue, purple and green nodes denote European, US and Asian banks, respectively. The thickness of the arrows capture total linkages (both inward and outward), and the arrow captures the direction of net spillover. The size of the nodes reflects asset size.”)

By Pam Martens and Russ Martens: March 7, 2017

Yesterday, the German global bank, Deutsche Bank, fell by 3.82 percent by the close of trading on the New York Stock Exchange on news of a capital raising and revamp in strategy. That price action took down every major Wall Street bank stock and, interestingly, MetLife, which closed down 1.64 percent, beating out even Citigroup which closed down 1.18 percent. The rest of the major derivatives players fared as follows: JPMorgan Chase closed with a loss of 0.95 percent; Bank of America was off by 0.75 percent; Morgan Stanley closed down 0.56 percent; with Goldman Sachs down a meager 0.35 percent after infusing itself throughout the Trump administration’s corridors of power in Washington.

Last June, Deutsche Bank found itself the subject of unwanted attention in a report issued by the International Monetary Fund (IMF). The report looked at the “Financial System Stability” of German financial institutions and examined the systemic impact that a major bank blowing up would have on other domestic German banks and insurers as well as financial stability in other countries. The report concluded that spillover effects would not be limited to Germany but would impact France, the U.K. and the U.S.

The troubling report called out Deutsche Bank as “the most important net contributor to systemic risks.” (See chart above.) Its findings included the following:

“Notwithstanding moderate cross-border exposures on aggregate, the banking sector is a potential source of outward spillovers. Network analysis suggests a higher degree of outward spillovers from the German banking sector than inward spillovers. In particular, Germany, France, the U.K. and the U.S. have the highest degree of outward spillovers as measured by the average percentage of capital loss of other banking systems due to banking sector shock in the source country…

“Among the G-SIBs [Global Systemically Important Banks], Deutsche Bank appears to be the most important net contributor to systemic risks, followed by HSBC and Credit Suisse. In turn, Commerzbank, while an important player in Germany, does not appear to be a contributor to systemic risks globally. In general, Commerzbank tends to be the recipient of inward spillover from U.S. and European G-SIBs. The relative importance of Deutsche Bank underscores the importance of risk management, intense supervision of G-SIBs and the close monitoring of their cross-border exposures, as well as rapidly completing capacity to implement the new resolution regime.”

The problem, as you may have guessed, is all about derivatives, the counterparties to them and the interconnectivity of these global banks. Despite posturing by the Obama administration on all of the reforms that have reined in Wall Street risk, little meaningful headway has actually been made since the epic 2008 financial collapse when it comes to the concentration of derivatives among a handful of players.

In its 2015 annual report, Deutsche Bank noted the following:

“At December 31, 2015, the notional related to the positive and negative replacement values of derivatives and off balance sheet commitments were € 255 billion, € 606 billion and € 31 billion respectively.”

The continuing interconnectivity of these global banks has been a focus of the Office of Financial Research (OFR) since its creation under the Dodd-Frank financial reform legislation that was signed into law in 2010. A deeply concerning report from OFR was released on February 12, 2015, titled Systemic Importance Indicators for 33 U.S. Bank Holding Companies: An Overview of Recent Data.

The report suggested that major foreign banks were significant counterparties to Wall Street’s derivatives, writing:

“Surprisingly, OTC derivatives contributed only about half as much to intrafinancial system liabilities ($632 billion) as to intrafinancial system assets ($1.2 trillion). Across all OTC market participants, derivatives assets must equal derivatives liabilities, so this imbalance indicates that the U.S. banks held large positive OTC derivatives positions with financial institutions outside this group.”

The chart above, from the June 2016 IMF report, provides further clarity on those entanglements.