By Pam Martens and Russ Martens: September 14, 2016

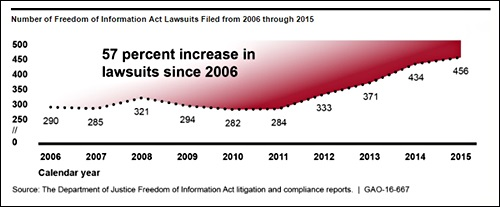

Last Thursday the Government Accountability Office (GAO) released a report showing that since President George W. Bush left office, lawsuits by persons who were unable to obtain Federal records that they believed belonged in the public domain grew dramatically. In 2008, the last year of Bush’s presidency, 321 Freedom of Information Act (FOIA) lawsuits were filed. By 2014, that number had spiked to 434 lawsuits and registered 456 last year, an increase of 42 percent over 2008.

The numbers understate the public’s frustration with Federal government stonewalling on public record requests. According to the GAO report, 713,168 FOIA requests were made by the public last year. Before one can file a FOIA lawsuit, one must file an administrative appeal with the agency that denied or partially denied the records sought. Average citizens have inadequate time and resources to engage in fighting an entrenched, stonewalling bureaucracy.

Curiously, the GAO study wasn’t looking at whether the public interest was being served under the FOIA legislation; it was looking at costs to the Federal government for stonewalling and getting sued. Its finding, in a nutshell, is that it’s quite cost effective to draw a dark curtain around the U.S. government. The report found that for fiscal years 2009 through 2014, Federal agencies “collectively reported costs totaling $144 million for all of the FOIA lawsuits that they defended.” Out of an approximate $3.5 trillion in Federal expenditures in 2014, $144 million is likely pocket change in the government’s view.

Fighting your government in Federal court, where FOIA lawsuits land, is not a particularly winning strategy either. The GAO study found that of the “1,672 Freedom of Information Act (FOIA) lawsuits with a decision rendered between 2009 and 2014, GAO identified 112 lawsuits where the plaintiff substantially prevailed” in court. Federal courts have judges who are appointed by the President of the United States and have lifetime appointments, making them free from worry about losing their job because of a public uprising over jaded decisions.

Barack Obama, the presidential candidate who ran on a platform of “hope and change” issued an “Open Government” memo on the very day he was sworn into office, January 21, 2009. He promised the American people an era of transparency between themselves and their government. In March of that year, the Justice Department, which defends FOIA lawsuits on behalf of the government, issued detailed guidelines on how Federal agencies were to proceed going forward on FOIA requests. A relevant part read:

“The President’s FOIA Memoranda directly links transparency with accountability which, in turn, is a requirement of a democracy. The President recognized the FOIA as ‘the most prominent expression of a profound national commitment to ensuring open Government.’ Agency personnel, therefore, should keep the purpose of the FOIA — ensuring an open Government — foremost in their mind.”

Wall Street On Parade has been one of the media outlets seriously hampered by the repeated denial of its FOIA requests to those Federal agencies whose function, ostensibly, is to oversee the rogues of Wall Street while allowing the public to have sunshine and accountability into the functioning of this process.

Our most recent experience shows just how tattered and shopworn Obama’s FOIA directive has become. On April 22, 2016, we filed a FOIA with the Federal Reserve Board of Governors seeking records and emails between itself and other Federal regulators “regarding derivatives held at the following banks: JPMorgan Chase, Citigroup or Citibank, Goldman Sachs, Lehman Brothers, Morgan Stanley, Bank of America or Merrill Lynch which pertain to a potential threat to the safety and soundness of the U.S. banking system” over a specified eight-year span of time.

In other words, the Federal Reserve could have simply queried the words “derivatives” with the Boolean operator “AND” together with the words “safety and soundness” to efficiently provide us with the sought after documents. Instead, we were told our request was too broad and asked to narrow it.

We dramatically limited the request from eight firms to three (JPMorgan Chase, Citigroup/Citibank), a reduction of 62.5 percent and narrowed the timeframe from eight years to five (January 2, 2008 to December 31, 2012), a reduction of 37.5 percent.

In a letter dated June 20, 2016, Michele T. Fennell, Assistant Secretary of the Board of the Federal Reserve wrote to deny the request, indicating, among other things, that we would need to indicate the specific staff members by name with whom the correspondence would have flowed. This requirement by the Federal Reserve effectively eviscerated the intent of FOIA while asking Wall Street On Parade to acquire omnipotent powers.

Our concern was a valid one. The Dodd-Frank financial reform legislation enacted in 2010 required President Obama to appoint a Vice Chairman for Supervision at the Fed to oversee the big Wall Street banks. It’s six years since the passage of the legislation and that still has not happened. What has happened is that Citigroup and JPMorgan Chase have pleaded guilty to felonies while also mushrooming their derivative holdings to more than $50 trillion each in notional (face) amounts.

We are far from the only media outlet to have difficulty unleashing Federal records from the iron grip of the Federal Reserve. In April and May of 2008 – four months before Lehman Brothers went belly up and supposedly set off the implosion of Wall Street, the intrepid Bloomberg News reporter, Mark Pittman, filed a FOIA with the Federal Reserve Board asking for details on four of its emergency lending programs to banks: the Discount Window, the Primary Dealer Credit Facility, the Term Securities Lending Facility, and the Term Auction Facility. Pittman had noticed a dramatic surge in emergency borrowing at the Fed’s Discount Window. Pittman wanted the borrowers’ names and amounts borrowed.

Under FOIA law, the Federal Reserve had 20 business days to make a determination on the FOIA request. Instead, it stonewalled Bloomberg News for four months. On November 7, 2008, Bloomberg News filed its Federal lawsuit. After Bloomberg News won at both the District Court and the Second Circuit Court of Appeals, the Federal Reserve continued to stonewall. A consortium of the biggest bailed out banks on Wall Street, including JPMorgan Chase, Citigroup and Bank of America, asked the U.S. Supreme Court to reverse the ruling.

The courageous Bloomberg reporter, Mark Pittman, died on November 25, 2009 at age 52 as his government egregiously stonewalled and undermined press freedom. (Pittman’s official cause of death has not been publicly announced as far as we were able to determine.)

On October 28, 2010, Matthew Winkler, Editor in Chief at the time of Bloomberg News, wrote an OpEd in his competitor’s newspaper, the Wall Street Journal, in an effort to shame the Fed into complying with the law and the courts. Winkler wrote:

“More than a dozen books have been written about the collapse of the world’s biggest credit market and the government’s unprecedented steps to protect hundreds of banks from certain ruin. Yet we still don’t know: Who made the decisions? Under what circumstances? When and where was public money disbursed, and how was it allocated?”

Winkler wisely wrote further:

“There is no history that shows opacity is better for markets and the economy than transparency. Money flees secrecy. Unanswered questions engender suspicion, which undermines the financial system while giving some participants an unfair advantage.”

When the Fed finally succumbed and released the information, it showed that more than $13 trillion in cumulative, below-market-rate loans had been provided to Wall Street banks and foreign banks. Senator Elizabeth Warren explained what the Fed was attempting to hide in a March 2015 Senate Banking hearing, stating:

“During the financial crisis, Congress bailed out the big banks with hundreds of billions of dollars in taxpayer money; and that’s a lot of money. But the biggest money for the biggest banks was never voted on by Congress. Instead, between 2007 and 2009, the Fed provided over $13 trillion in emergency lending to just a handful of large financial institutions. That’s nearly 20 times the amount authorized in the TARP bailout.

“Now, let’s be clear, those Fed loans were a bailout too. Nearly all the money went to too-big-to-fail institutions. For example, in one emergency lending program, the Fed put out $9 trillion and over two-thirds of the money went to just three institutions: Citigroup, Morgan Stanley and Merrill Lynch.

“Those loans were made available at rock bottom interest rates – in many cases under 1 percent. And the loans could be continuously rolled over so they were effectively available for an average of about two years.”

For the unsavory chronology of the stonewalling of Wall Street On Parade by the “public servants” who oversee Wall Street, check out our related articles below.

Related Articles:

Suspicious Deaths of Bankers Are Now Classified as “Trade Secrets” by Federal Regulator

Wall Street’s Regulators are Denying FOIAs and Fostering More Public Distrust

Banks Tank: Wall Street Is Keeping Too Many Secrets for Its Own Good