By Pam Martens and Russ Martens: June 27, 2016

Wall Street On Parade has reported on multiple occasions that the Federal Reserve has no idea what it’s doing with its stress testing of the largest banks on Wall Street. Last Friday’s market action, following the Brexit vote in the U.K. to leave the European Union, proved just how feeble the Fed is when it comes to assessing systemic risk and capital vaporization at the deeply interconnected Wall Street mega banks.

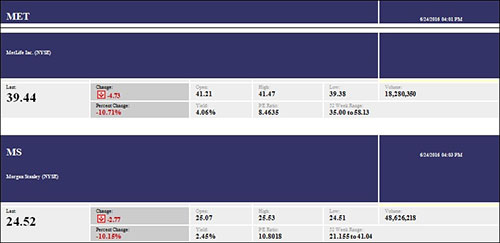

While the Dow Jones Industrial Average dropped 3.39 percent at the close on Friday, Morgan Stanley lost a stunning 10.15 percent of its market capital in a 6-1/2 hour trading session. At that speed, Morgan Stanley’s equity market capital could be wiped out in 10 trading sessions were this Brexit panic to continue.

Citigroup, which became a basket case during the 2008 financial crisis, ending up as a penny stock and requiring the largest bank bailout in the history of financial markets, lost 9.36 percent of its market capital in Friday’s trading session. Bank of America lost 7.41 percent while Goldman Sachs closed down 7.07 percent.

As if to underscore that this panic selling is related to the trillions of dollars of derivatives on the books of the banks, Wells Fargo, which has a much smaller exposure to derivatives than the other major Wall Street banks, lost a much milder 4.59 percent on Friday.

Another casualty of the Friday selloff was MetLife, the large insurer, which has been fighting in court to have its Fed designation as a global systemically important institution repealed. MetLife had won its battle at a lower court but the government is now in the midst of an appeal. MetLife is a derivatives counterparty and the fact that it sold off so dramatically on Friday suggests its exposure to Wall Street banks is significant. MetLife lost even more than Morgan Stanley on Friday, trimming 10.71 percent off its market cap.

According to the Office of the Comptroller of the Currency (OCC), as of December 31, 2015, there was $237 trillion in notional derivatives (face amount) at the 25 largest bank holding companies in the U.S. with the vast majority of that amount held by just five bank holding companies: JPMorgan Chase, Citigroup, Goldman Sachs, Bank of America, and Morgan Stanley.

Foreign global banks fared even worse on Friday with Royal Bank of Scotland and Lloyds plunging 21 percent. Some of the largest Italian banks also took a beating on Friday with losses of over 20 percent. Bloomberg News is reporting this morning that Italy “is weighing measures that may add as much as 40 billion euros ($44 billion)” to shore up its banks.

Hedge fund billionaire George Soros weighed in on the mushrooming crisis in a column at Project Syndicate, writing that: “The consequences for the real economy will be comparable only to the financial crisis of 2007-2008.” Comparing the crisis to 2008 is wrong in this regard: back then central banks actually had plenty of room to slash rates. In the U.S., our central bank is still almost at the zero bound range with a benchmark Fed Funds rate of 0.25-0.50 percent. Slashing that feeble rate would likely be viewed as an act of desperation and ignite greater panic.

The Wall Street behemoth banks were already showing signs of stress earlier this year. As we reported on January 20:

“At 9:52 a.m. this morning in New York, Citigroup’s stock was trading with a loss of 3.71 percent after trading at a new 12-month low of $40.35. Morgan Stanley, Goldman Sachs, and Bank of America also traded at new 12-month lows this morning.

“Despite its stress tests and living wills and enhanced capital requirements and legions of bank examiners, the Federal Reserve can’t seem to get its mind around the meaning of ‘systemic’ – as in Global Systemically Important Banks or G-SIBs.

“Here’s the Random House dictionary definition to help out the Fed:

“Pertaining to or affecting the body as a whole…absorbed and circulated by a plant or other organism so as to be lethal to pests that feed on it.”

Now the banks are back again trading as a herd because their regulator, the Federal Reserve, which attempts to double as the nation’s central bank, plays the role of an indulgent parent rather than a tough cop on the beat. Exactly how many times can the Fed fail in its job as a regulator before it’s stripped of its duties in that arena?