By Pam Martens and Russ Martens: September 30, 2015

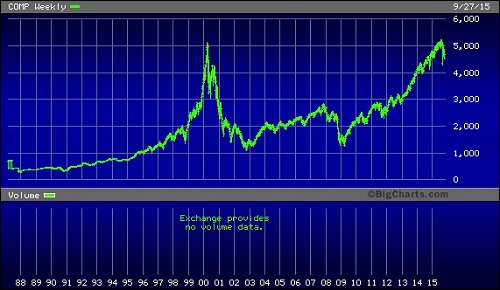

On March 10, 2000 the Nasdaq stock market, which is supposed to hold the technology and startup companies that will keep America globally competitive in the future, closed at a high of 5,048.62. Yesterday, more than 15 years later, it closed at 4,517.32, a decline of 10.5 percent from its level of March 2000.

To fully grasp the unprecedented nature of the Nasdaq bubble of 2000, one has to look at where the three big stocks are today that made that 5,000 mark possible 15 years ago. Just three stocks, Microsoft, Cisco, and Intel, were valued at a market cap of $1.89 trillion in 2000. As of yesterday’s close, those three stocks had a combined market cap of $616.137 billion – a shrinkage of 67 percent after more than 15 years.

Much of the hype, as well as the money, that surrounded Microsoft, Cisco and Intel in early 2000, has moved to Apple today, which also trades on the Nasdaq. As of yesterday’s close, Apple commands a market value of $621.9 billion.

Back on March 19, 2000 the Silicon Valley Business Journal reported that one analyst was predicting Cisco was headed toward a market cap of $1 trillion. (Its market cap at yesterday’s close was $129.7 billion, down 80 percent from 2000.)

The article noted that “Thirty-seven investment banks recommend either a ‘buy’ or a ‘strong buy.’ None recommend a ‘sell’ or even a ‘hold.’ ”

On March 23 of this year, an analyst at Cantor Fitzgerald made the same frothy market prediction that Apple would hit a $1 trillion market cap. It’s lost $122 billion in market cap since that call.

The Federal government has two decades of evidence that the integrity of Nasdaq as a stock market has been repeatedly compromised. Yet it does nothing material to rein in the abuses.

The excesses leading up to the crash of 2000-2002 and the crash of 2008-2009 resulted from a highly orchestrated wealth transfer machine on Wall Street that was allowed to operate with impunity from the Federal regulators. As we reported in 2008:

[Regarding the Nasdaq boom of the late 90s] “First, Wall Street firms issued knowingly false research reports to trumpet the growth prospects for the company and stock price; second, they lined up big institutional clients who were instructed how and when to buy at escalating prices to make the stock price skyrocket (laddering); third, the firms instructed the hundreds of thousands of stockbrokers serving the mom-and-pop market to advise their clients to sit still as the stock price flew to the moon or else the broker would have his commissions taken away (penalty bid). While the little folks’ money served as a prop under prices, the wealthy elite on Wall Street and corporate insiders were allowed to sell at the top of the market (pump-and-dump wealth transfer).

“Why did people buy into this mania for brand new, untested companies when there is a basic caveat that most people in this country know, i.e., the majority of all new businesses fail? Common sense failed and mania prevailed because of massive hype pumped by big media, big public relations, and shielded from regulation by big law firms, all eager to collect their share of Wall Street’s rigged cash cow.

[Regarding the 2008 market]“The current housing bubble bust is just a freshly minted version of Wall Street’s real estate limited partnership frauds of the ‘80s, but on a grander scale. In the 1980s version, the firms packaged real estate into limited partnerships and peddled it as secure investments to moms and pops. The major underpinning of this wealth transfer mechanism was that regulators turned a blind eye to the fact that the investments were listed at the original face amount on the clients’ brokerage statements long after they had lost most of their value.

“Today’s real estate related securities (CDOs and SIVs) that are blowing up around the globe are simply the above scheme with more billable hours for corporate law firms.

“Wall Street created an artificial demand for housing (a bubble) by soliciting high interest rate mortgages (subprime) because they could be bundled and quickly resold for big fees to yield-hungry hedge funds and institutions. A major underpinning of this scheme was that Wall Street secured an artificial rating of AAA from rating agencies that were paid by Wall Street to provide the rating. When demand from institutions was saturated, Wall Street kept the scheme going by hiding the debt off its balance sheets and stuffed this long-term product into mom-and-pop money markets, notwithstanding that money markets are required by law to hold only short-term investments. To further perpetuate the bubble as long as possible, Wall Street prevented pricing transparency by keeping the trading off regulated exchanges and used unregulated over-the-counter contracts instead. (All of this required lots of lobbyist hours in Washington.)”

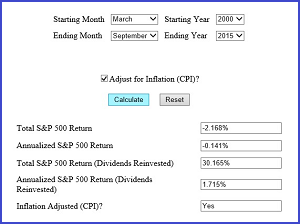

You are likely thinking that Nasdaq doesn’t reflect the performance of the broader market. You will likely be shocked to see the performance of the Standard and Poor’s 500 index of stocks starting from March 2000 to September 2015, courtesy of this handy online calculator. Even with dividends reinvested, the S&P has delivered a paltry 1.715 percent annualized return since March 2000 on an inflation adjusted basis. And that’s before paying taxes on dividends.

Even if you are invested in diversified, actively managed stock mutual funds, over a working lifetime you are likely to lose two-thirds of your money because of the management fees, according to a PBS Frontline report.

This would also be a good time to remember that stock market performance following epic financial crashes that ravage the economy can be hazardous to your wealth. Following the 1929 crash, the stock market did not set a new high until 1954 – 25 years later.

Yesterday, the Securities and Exchange Commission announced that it will hold a hearing on October 27, open to the public, on the stock market’s structure. The SEC has had 15 years since the revelations of the rigged market of 2000 and 7 years since the worst market collapse since the Great Depression to actively engage in reining in the abuses. Yesterday’s announcement was decidedly too little too late.