By Pam Martens and Russ Martens: December 29, 2014

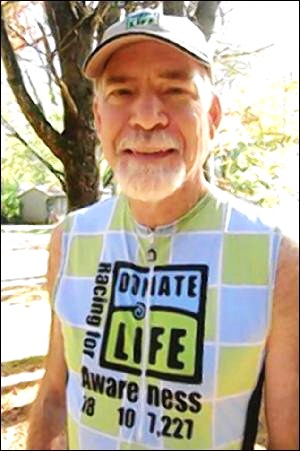

On the cold, wintry afternoon of January 11, 2014, David Bird, a reporter who covered energy markets for the Wall Street Journal, told his wife he was going out for a walk and left his home in Long Hill, New Jersey in a red jacket with yellow zippers. Despite his colorful attire, the involvement of hundreds of volunteers, law enforcement officials, and the FBI in the search, Bird has vanished without a trace.

As Wall Street On Parade previously reported in January, for the three months prior to his disappearance, Bird was reporting on a supply glut and growing stockpiles of oil. A newly retrieved article by Bird that appeared on line at the Wall Street Journal on August 21, 2013, shows the reporter had also presciently made an early connection between the Federal Reserve ending its massive bond-buying program known as “quantitative easing” and a potential crash in the price of oil – a crash that has now cut the price of oil almost in half in the past six months.

Bird wrote the following in his August 21, 2013 article:

“Crude-oil futures fell after the minutes from the Federal Reserve’s latest policy meeting heightened concerns that less economic stimulus could hit demand for the fuel.

“Traders are worried that the end of the $85 billion-a-month bond-buying program will cause dollar-based crude prices to rise in local-currency terms, choking off economic growth in India, Indonesia and other emerging markets that has fueled a rise in global oil consumption in recent years…

” ‘All this tapering talk is absolutely deadly for emerging markets’ because of its effect on the dollar, [Bill O’Grady, Chief Market Strategist at Confluence Investment Management] said. ‘We could see [oil] demand really tail off.’ ”

Why would talk from Federal Reserve officials that the U.S. economy was strong enough to end quantitative easing impact oil consumption in emerging markets as well as impact the U.S. dollar?

International markets perceive all of the happy talk from the Fed as follows: if the U.S. economy is strong enough to stand on its own without stimulus support from the Fed, then U.S. interest rates will be rising to reflect a stronger economy. As interest rates rise in the U.S., this will attract investment inflows into the United States to capture the higher yields at a time when other developed countries are setting record low yields on their bonds. Increased capital inflows, in turn, push up the value of the U.S. dollar.

What Bird hit upon, however, was the uncharted waters of the Fed’s unprecedented and massive pump-priming operation which has quadrupled its balance sheet to over $4 trillion since the financial crash of 2008. How does one exit a stimulus program of that dimension without creating waves – or tsunamis – in interlinked markets.

The simple answer is that the fallout from the Fed’s unwind is going to be excruciatingly painful. It is already rearing its scary head in the collapsing price of oil and other industrial commodity prices. Bird was spot on in his early instincts of how it could all play out.

As the Fed talks incessantly about higher rates looming on the horizon in the United States, it boosts the value of the U.S. dollar versus local currencies in emerging markets. Because crude oil is priced around the globe in U.S. dollars, it becomes more expensive to purchase in emerging markets as those currency values weaken versus the U.S. dollar.

As the cost of crude oil rises in emerging markets that are dependent on oil imports, two things happen: the rising costs dampen demand and slow economic growth. That, in turn, creates an ever-widening glut of oil as OPEC declines to curtail output, choosing instead to focus on grabbing market share, thus fueling more declines in the price of oil as the glut deepens.

Last week the U.S. Energy Information Administration (EIA) reported the following:

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 7.3 million barrels from the previous week. At 387.2 million barrels, U.S. crude oil inventories are well above the upper limit of the average range for this time of year. Total motor gasoline inventories increased by 4.1 million barrels last week, and are well above the upper limit of the average range…

“The WTI [West Texas Intermediate] price was $56.91 per barrel on December 19, 2014, $0.90 under last week’s price and $42.20 below a year ago. The spot price for conventional gasoline in the New York Harbor was $1.640 per gallon, $0.001 less than last week’s price and $1.165 under a year ago. The spot price for No. 2 heating oil in the New York Harbor was $1.804 per gallon, $0.058 below last week’s price and $1.264 less than a year ago.”

The ever growing roster of media pundits who see lower oil prices in the U.S. as a beneficial boon to consumer spending and increased economic growth have failed to make the same connections to the global economic impacts that reporter David Bird had made more than a year ago in August 2013.