By Pam Martens: March 13, 2014

The warning signs are piling up that the U.S. economy is stalling and the feeble measures of the President to address this economic slowdown with executive signings are too little too late. Congress needs to put partisan bickering aside and open its eyes to an onslaught of data pointing to an economy hitting a brick wall.

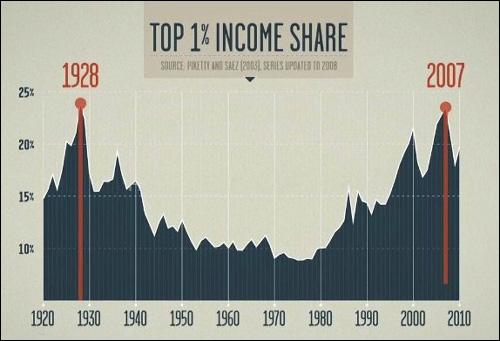

For five years now, the executive branch and Congress have been living under the Wall Street-imposed delusion that flooding the big banks with liquidity (bailouts and years of quantitative easing) would promote job growth in the private sector and restore good jobs to the middle class. What it restored instead were rising bonuses for a limited, elite set of the financial sector who have used that flood of cash to make highly leveraged, high risk wagers in trading venues around the world while exacerbating income inequality in the U.S. and elsewhere.

Signs of the slowdown abound. On February 12, Cisco’s CFO, Frank Calderoni, told MarketWatch that “Clearly, there’s been a slowdown and it’s been very abrupt. It’s difficult to determine how long it will last.”

On February 19, the International Monetary Fund warned of the risk of deflation – a condition incompatible with steady economic growth. Commodity markets are similarly showing a distinct deflationary trend. According to Bloomberg data, the Personal Consumption Expenditures Price Index, minus food and energy costs, “rose 1.2 percent in 2013, matching 2009 as the smallest gain since 1955. Of 27 categories of goods and services in the gauge, 18 showed smaller price increases over the past two years.”

News is coming out of the farm belt showing corn and soybean prices are slumping along with farm land prices. On February 12 the Wall Street Journal reported that “a monthly survey of Midwestern lenders by Omaha-based Creighton University in January found the outlook for farmland and ranchland prices was the weakest in more than four years.”

March is not even half over and two major retailers have announced large store closings. On March 4, Radio Shack said it will close up to 1,100 U.S. stores after reporting that its net loss widened to $191.4 million in the fourth quarter. Two days later, Staples announced it will close 225 stores in North America by the middle of 2015 as a result of weaker sales. The closures will represent approximately 12 percent of its total stores in North America. In 2013, the company closed 40 stores in North America. Other retailers, such as Famous Footwear, Sbarro, Build-A-Bear, and Albertson’s have also announced that they will be trimming the number of their physical store locations.

In mid February, the new Fed Chair, Janet Yellen, testified before Congress that the economy has “picked up strength.” That view may be consistent with the outdated reams of research reports that come across her desk from the economists at the 12 regional Fed banks but it is inconsistent with picking up a current newspaper or walking around the streets of Washington, D.C. or New York City.

According to the Washington Post, the number of homeless families in Washington, D.C. is on pace to double this year. Yesterday, a new study released by the Coalition for the Homeless showed that the number of homeless people staying overnight in New York City shelters has now surpassed the record-high population reached last year, topping more than 50,000 per night.

In October of last year, the U.S. Department of Education reported an all time high in the number of homeless students attending public schools – a figure of 1,168,354, which is acknowledged to underestimate the problem.

As Wall Street On Parade has pointed out time and again, 70 percent of U.S. Gross Domestic Product (GDP) is consumption. That means there is a finite equilibrium in income distribution at which the U.S. economy can sustain an upward growth trajectory. This age of the New Robber Barron is certainly not it.

When workers are stripped of an adequate share of the nation’s income, they are not able to function as consumers. Less consumption means lower corporate earnings resulting in layoffs, store and plant closings, and then even lower corporate earnings and more layoffs. The vicious cycle feeds on itself.

As the cycle feeds on itself, the intractable issue of deflation viciously aggravates the problem further. As prices decline, the consumer is motivated to delay purchases in anticipation that waiting will bring even cheaper prices.

As indicated in the graph below from Robert Reich’s documentary, “Inequality for All,” there are only two years in the history of this nation that income inequality reached these unprecedented levels: 1928, the year before the 1929 Wall Street crash and 2007, the year before the 2008 Wall Street crash. Let that thought sink in for a while.

The President and this Congress know that the institutionalized wealth transfer system that Wall Street is enforcing on the poor and middle class of this country will inevitably lead to another economic crash. Tragically, there is no sign that they will work together to head off the impending train wreck.