By Pam Martens: February 4, 2013

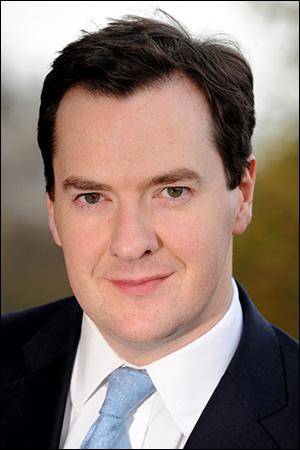

The U.K. Chancellor of the Exchequer,George Osborne, plans to reform big banks in his country the way farmers keep raccoons out of their corn fields: an electrical fence.

Banking reform by soap box and silly ideas has crossed the Atlantic. Osborne delivered a flurry of inspirational words today on his new plans for banking reform in the U.K. Curiously, he delivered his speech at JPMorgan’s back office operation in Bournemouth. Osborne said the site location was to remind everyone how many jobs banking brings to England and specifically mentioned a landscaping business called Stewarts that takes care of JPMorgan’s grounds that he planned to visit later. That was possibly not the best choice of examples since wealth and income inequality has been institutionalized by the lack of banking reform.

On this side of the pond the suspicion rises that Chancellor Osborne’s site selection might have something to do with JPMorgan’s $6 billion in losses from speculating with insured bank deposits in its London offices – the infamous London Whale episode.

Osborne’s electrical fence proposal would work like this: instead of actually separating commercial banking from the casino investment bank, Osborne’s plan calls for putting separate CEOs in charge of each unit and giving regulators the power to actually break up the bank if it tries to game the system. Apparently, the electrical charge of deterrence is supposed to come from the threat inherent in the power to actually break up the bank.

The silliness of this proposal is on a par with the so-called reforms of the U.S. legislation passed on July 21, 2010 – the Dodd-Frank Wall Street Reform and Consumer Protection Act. Both reforms ignore the central problem: executives and traders at big banks in both the U.S. and U.K. are incentivized to game the system to pump up short term profits that bring obscene compensation and bonuses to themselves. The people riding this gravy train don’t care if the bank eventually fails because they’ve become rich and can retire in luxury. (Check out Jamie Dimon’s homes, CEO of JPMorgan, if you want a quick visual understanding of the problem.)

As each week brings new evidence of big banks colluding or gaming the system, the public and the speech-giving politicians know full well that nothing short of breaking up the banks, separating insured deposits from the gambling side of these institutions will work. And yet, all we see is more tinkering at the edges as politicians cower before the bank lobby.

What was remarkable was how closely the theme in Osborne’s speech today resembled the speech President Obama gave in 2010 at Cooper Union as he went on the stump to secure the passage of the Dodd-Frank legislation. Below are two excerpts, followed by the full transcripts of each speech. Be sure to note in the full transcript of Osborne’s speech that banks in the U.K. are taking just as long to clear checks as they are in the U.S. — earning the float on the checks we deposit into our accounts but somehow able to clear their own deposits very rapidly.

Osborne, February 4, 2013: Our principles are simple: if you do the right thing, government should support and help you, and remove the barriers in your way. If you do the wrong thing, you should take responsibility for your actions.

And sadly, nowhere have these simple principles been broken more clearly and indefensibly than in our banking system over the last decade.

Irresponsible behaviour was rewarded, failure was bailed out, and the innocent – people who have nothing whatsoever to do with the banks – suffered. For many, the financial crash was confirmation of what they felt about our society: that those who are only out for themselves get away with it; and those who work hard and play by the rules get punished. That is why, five years on from that crash, people are still so angry.

And when people discover more about what went so wrong: the mis-selling of interest rate swaps to small firms who went bust as a result; the greed and corruption on the LIBOR trading floor. They get angrier still. I understand that anger. I feel it too.

Obama, April 22, 2010: As I said on this stage two years ago, I believe in the power of the free market. I believe in a strong financial sector that helps people to raise capital and get loans and invest their savings. That’s part of what has made America what it is. But a free market was never meant to be a free license to take whatever you can get, however you can get it. That’s what happened too often in the years leading up to this crisis. Some — and let me be clear, not all — but some on Wall Street forgot that behind every dollar traded or leveraged there’s family looking to buy a house, or pay for an education, open a business, save for retirement. What happens on Wall Street has real consequences across the country, across our economy…

In the end, our system only works — our markets are only free — when there are basic safeguards that prevent abuse, that check excesses, that ensure that it is more profitable to play by the rules than to game the system. And that is what the reforms we’ve been proposing are designed to achieve — no more, no less. And because that is how we will ensure that our economy works for consumers, that it works for investors, and that it works for financial institutions — in other words, that it works for all of us — that’s why we’re working so hard to get this stuff passed.

Transcript of Speech by Chancellor of the Exchequer, George Osborne, On Banking Reform: Delivered at JPMorgan Offices in Bournemouth, February 4, 2013

Chancellor Osborne: Thank you for welcoming me to JP Morgan here in Bournemouth.

When you think about where to give a speech on culture and ethics and the future of British banking, the offices of one of the world’s largest American investment banks may seem like an odd choice of venue.

But it’s a deliberate one.

For the four thousand people who work here are, each one of you, a reminder that when banking works, it works for the families and communities of the whole of Britain.

You, each one of you, are a reminder that when we attract international firms to our country – firms that could go anywhere in the world to do their business – those firms bring jobs, and investment and prosperity.

That for every one of the people employed here at the largest business in Dorset, there are many more employed in the businesses that support this office, in the shops that take your custom, and in the local economy that has grown stronger on your back.

I’m going to see two of those businesses after I speak here – a catering company and a landscaping business called Stewarts.

Four of the employees at that landscaping business work full time on JP Morgan site, jobs that wouldn’t exist without your presence.

From JP Morgan, one of the world’s biggest companies, to Stewarts landscaping, Bournemouth teaches us that Britain should continue to aspire to be a home to the world’s financial services.

And what is true for Bournemouth is also true of Bristol, and Edinburgh, Leeds, Cardiff, Birmingham and Manchester.

In all these cities, financial services are some of our largest and most innovative employers.

And it’s true about London too – and the City of London.

Generations have created in the City something extraordinary – a global centre of finance.

The global centre of finance.

Whether its insurance and accountancy, shipping and legal services, hedge funds, private equity, asset management or investment banking, when the world wants to transact – it wants to transact through London.

And we want to keep it that way in the years ahead.

That’s why it’s been good to see Britain and London maintain its number one spot as the home of global financial services.

That’s why it’s been exciting to see the first Renminbi bond issued anywhere in the world outside of Chinese sovereign territory issued in London in the last twelve months.

For that is not just good for their future, it’s good for ours too.

It’s how we will win in the global race.

It’s what I am personally determined to achieve.

And part of having a successful financial services industry is having successful British banks, who want to lend at home and compete around the world.

Think of some of the most important moments in your life.

When you bought your own home with a mortgage.

When you took the plunge and started your own business.

When you retired and drew on your pension.

On each of those occasions, you relied on the financial system and put your trust in them

That is why it’s so important to have that trust reciprocated and a banking system that works for you.

And that is what I’m working night and day to deliver for you.

Like all this Government’s reform – to welfare, to the economy, to schools and to banking – we want to back aspiration and be on the side of those who want to work hard and get on.

Our principles are simple: if you do the right thing, government should support and help you, and remove the barriers in your way.

If you do the wrong thing, you should take responsibility for your actions.

And sadly, nowhere have these simple principles been broken more clearly and indefensibly than in our banking system over the last decade.

Irresponsible behaviour was rewarded, failure was bailed out, and the innocent – people who have nothing whatsoever to do with the banks – suffered. For many, the financial crash was confirmation of what they felt about our society: that those who are only out for themselves get away with it; and those who work hard and play by the rules get punished.

That is why, five years on from that crash, people are still so angry.

And when people discover more about what went so wrong: the mis-selling of interest rate swaps to small firms who went bust as a result; the greed and corruption on the LIBOR trading floor.

They get angrier still.

I understand that anger.

I feel it too.

But anger can be a negative, destructive thing if it is not channelled into change.

Change for the good.

Any bunch of politicians can bash the banks, chase the headlines, court the populist streak.

But what good would that do our country?

The jobs, the investment, the banking system we all need would go with it.

Let’s take the anger we feel about the banks and turn it into change to build the banking system that works for us all.

That is precisely what we are doing.

And through the work we’ve done, the expert help we’ve enlisted, we can make 2013 the year of change in our banking system.

2013 is the year when we re-set our banking system.

So the banks work for their customers – and not the other way round.

So that those who guard over the banks to keep our economy safe are the right people with the right weapons to do the job.

And so that when mistakes are made, it’s the banks and not the taxpayer that picks up the bill.

Let me explain how.

Let me tell you about the four concrete things that are going to change this year.

First, we’ve got a brand new watchdog with new powers to keep our banks safe so they don’t bring down the economy.

Second, we’ve got a new law to separate the branch on the high street from the dealing floor in the city to protect taxpayers when mistakes are made.

Third, we’re going to start, with the industry, changing the whole culture and ethics of the business, so they work for you.

Fourth, we’re going to give customers the most powerful weapon of all: choice.

Real choice about who you bank with – and choice to change who you bank with if you want a better deal.

Let me take each in turn.

First, protecting our economy by keeping our banks safe.

The decision taken by the last government to divide responsibility for financial stability from banking supervision was one of the worst economy policy mistakes of the modern era.

The Bank of England was stripped of its responsibility for keeping the banking system safe.

The Financial Services Authority was only focussed on compliance, with a myriad of individual rules, and missed the wood for the trees.

The Treasury’s banking division was run down.

No-one saw it as their job to monitor risks across the whole system.

So no-one spotted the increase of debt.

Staggeringly, total debt reached five times the size of the entire economy.

The fire alarm was ringing when Northern Rock handed out 120 per cent mortgages.

The fire alarm was ringing when the Royal Bank of Scotland made its reckless purchase of ABN AMRO, after the credit markets had already seized up.

The fire alarm was ringing, but no-one was listening.

And when the crisis hit, the fire was then so great that the whole economy was sacrificed to put it out.

Ten per cent of the entire wealth of this country was lost.

Hundreds of thousands of people lost their jobs and their livelihoods.

Yes, those responsible should be held to account.

But British people need to know that lessons have been learnt.

And they have.

This April, the FSA is being abolished.

This April, the Bank of England will be in charge of keeping our financial system safe.

With the authority that comes from its history, and the new powers we have given it for the future, the Bank of England will be the super cop of our financial system.

The Bank is ready.

The logistics are in place.

And from day one, we will have a powerful new watchdog with real teeth.

Not just to intervene and stop individual wrong doing.

But the power to make a judgement call about the whole system – the power to spot increases in debt or warn of risky practices.

The power to call time before the party gets out of control.

But also the power to support the economy if credit conditions get too tight.

The Bank of England won’t be just empowered to protect us from the excesses of a banking boom, but also to help the bank support us in a bust.

And we’re also creating from April a strong new conduct regulator, the FCA, to ensure London and the UK have the best, most open, and transparently policed markets in the world.

That will win business for Britain, attract investment.

And through the Funding for Lending scheme, we’re giving banks incentives to boost lending to families and businesses.

We’ve already seen the availability and cost of borrowing coming down, but we are monitoring it closely to ensure that rates and availability continue to improve.

Good regulation.

Watchdogs with real teeth.

Open markets with clear rules, properly policed.

These support innovation.

For the industry that suffers most when something goes wrong in finance – is finance itself.

Second, this year we’re going to start separating the high street banking we all depend on from the City trading floor.

When the RBS failed, my predecessor Alistair Darling felt he had no option but to bail the entire thing out.

Not just the RBS on Britain’s high streets, but the trading positions in Asia, the mortgage books in sub-prime America, the property punts in Dubai.

I want to make sure that the next time a Chancellor faces that decision they have a choice.

To keep the bank branches going, the cash machines operating, while letting the investment arm fail.

No more rewards for failure.

No more too big to fail.

No more taxpayers forking out for the mistakes of others.

The same rules for the banking business as any other business in a free market.

When the Government came into office, there was no agreement about how this massive task would be achieved.

That’s why we spent two and a half years painstakingly building a consensus on the future structure of our banking industry, working with leading experts and Members of Parliament and I want to thank Vince Cable for his help in doing that with me.

The work that Sir John Vickers and his Commission has done has won respect all around the world, and has already influenced the European debate.

Today, we are published the legislation that will turn their ideas and this consensus for change into law.

A law for the first time ever, to separate the retail and investment arms of banks, and erect a ring fence around the retail bank so its essential operations continue even if the whole bank fails.

I’m sending the legislation to the House of Commons today and I expect them to be passed by Parliament this time next year.

It won’t mean banks won’t make mistakes.

But it does mean that if they do, those parts of the banking system that are vital for families and businesses can continue without resort to the taxpayer.

Today, we will go further than previously announced, enshrining in law these simple principles.

I can announce that your high street bank will have different bosses from its investment bank.

Your high street bank will manage its own risks, but not the risks of the investment bank.

And the investment bank won’t be able to use your savings to fund their inherently risky investments.

My message to the banks is clear: if a bank flouts the rules, the regulator and the Treasury will have the power to break it up altogether – full separation, not just a ring fence.

We’re not going to repeat the mistakes of the past.

In America and elsewhere, banks found ways to undermine and get around the rules.

Greed overcame good governance.

We could see that again – so we are going to arm ourselves in advance.

In the jargon, we will “electrify the ring fence”.

I want to thank Andrew Tyrie and the fellow members of the Banking Commission we established for help developing this important new idea.

Let’s get on and pass it all into law.

Let me turn to the third force for change – a change in the culture and ethics of the banking industry itself.

I have to say nowhere is this more keenly appreciated than in the responsible parts of the financial community itself.

You here work hard in a great business.

You service customers all over the world.

You don’t want the name of your whole industry to be besmirched because of the crimes of a few.

And nor do I.

That’s why the LIBOR scandal is about far more than atoning for the mistakes of the past.

It’s about becoming a catalyst for change in the future.

We know what happened.

From 2005, traders, brokers and bank officials attempted manipulation of one of the most important reference rates in our economy – a rate which affects the mortgage payments and loan rates of millions of families and hundreds of thousands of firms, large and small.

Deliberately submitting false rates for no motive other than greed.

“Lowballing” their Libor submissions to conceal how vulnerable their banks really were.

Years of manipulation, in twenty banks on three continents.

Over a billion pounds of fines have already been applied worldwide.

And we still haven’t seen the full extent of it – more revelations will come.

We’re expecting reports into what happened at RBS very shortly.

I expect there will be even more public anger – if that’s possible.

But anger is not enough – we need to channel the anger into change.

And I want to do the right thing for the hundreds of thousands of people in the banking sector – like you – in all parts of our country who do conduct themselves with professionalism – and make sure the reputation and standards of the industry are restored.

LIBOR manipulation happened in many countries.

But no country has responded as quickly as decisively as we have now done.

Where people have broken the law, the authorities will have all the resources they need to make sure they are punished.

I’ve changed the system I inherited so that fines paid by banks for wrongdoing got to good causes not back to the industry – I have already announced that £35 million pounds of Barclay’s fines will go to British Armed Forces charities to help those who fight on all our behalves.

The first million has been allocated to the Fisher House Project, which will help the families of wounded soldiers being treated at the Queen Elizabeth Hospital in Birmingham to stay close by.

And we’re now stepping in to regulate previously unregulated markets and we’re making it a criminal offence to make misleading statements about LIBOR.

Shockingly that was not the case before.

And as we approach bonus season let me say this.

This country now has the toughest and most transparent pay regime of any major financial centre in the world.

City bonuses fell by almost two thirds last year, and are less than a quarter of their peak before the crash.

Everyone should exercise restraint and responsibility, but it’s important to remember that the vast majority of people in the banking sector – like the people in this room – do not receive million pound bonuses.

We all know there are Libor investigations ongoing into RBS in both the UK and the US.

Any UK fine will benefit the public.

And when it comes to RBS, I am clear that the bill for any US fine related to this investigation should on this occasion be paid for by the bankers, and not the taxpayer.

But the change to the culture and ethics of banking go beyond bonuses and fines.

I believe we need proper professional standards in the banking sector – just as we have for doctors and lawyers.

I want to see the industry take pride in those standards, as our medical and legal professions do.

And I want to see how we can strengthen the sanctions regime for senior bankers – for example, should there be a presumption that the directors of failed banks do not work in the sector again?

I have asked the Parliamentary Commission to look at how to improve the professional standards and culture of the banking sector.

Their work is underway and will report in the spring.

I would encourage the Commission to come forward with far reaching proposals.

The fourth and final change we need to banking is more choice.

Choice is the most powerful tool we have to improve markets and customer service, reward good companies and penalise poor ones.

Yes, our new regulator can pick up the pieces from the interest swap mis-selling or PPI.

Yes, I believe we must do much more to expose hidden charges and remove the conflicts of interest that plague too much so called independent financial advice.

But I also want to see more banks on the high street, so customers have more choice.

One of the prices we’re paying for the financial crisis is that our banking sector is now dominated by a few big banks.

It verges on an oligopoly.

75% of all personal current accounts are in the hands of just four companies.

I want new faces on the high street.

I want upstart challengers offering new and better services that shake up the established players.

We’ve made a start: with the sale of Northern Rock to Virgin Money, and the proposed sale of Lloyds branches to Co-op.

We’re seeing new banks like Metro Bank on our high streets – but I want to make it easier to start a small bank and grow the business.

This year, in 2013, we’re taking a huge step towards making that happen – by making it easier for customers to move banks if they can get a better deal elsewhere.

From September this year, every customer of every bank in Britain will be able to switch their bank account from their existing bank to another one in seven days.

All they will have to do is sign up to a new bank – and the rest will follow.

All the direct debits, the standing orders, everything will be switched for you with no hassle.

This is a revolution in customer choice.

But today, we will go further.

Payments systems sit at the heart of the banking system.

They are the hidden from view wirings that operate every time you get wages paid into your bank account, deposit a cheque or withdraw money from an ATM.

It’s how the money flows around the system.

And it’s a bit like the electricity grid, every person and every business needs to be plugged into them to enter the banking market.

At the moment, a new player in the industry has to go to one of the existing big banks to use the payment system.

Asking your rival to provide you with the essential services you need at a reasonable price is not a recipe for success.

And it other walks of life, like telecoms, we don’t operate like that.

There are no incentives on the big banks to deliver new and better services for users – like saving the cheque or creating new services like mobile payments.

Why, in the age of instant communication, do small businesses have to wait for several days before they get their money from a credit or debit card payment?

It should be much quicker.

Why do cheques take six days to clear?

Customers and businesses should be able to move their money round the system much more quickly.

Why is it that big banks can move their money around instantly, but when a small business wants to make a payment it takes days?

The system isn’t working for customers, so we will change it.

I can announce today that the Government will bring forward detailed proposals to open up the payment systems.

We will make sure that new players in the market can access these systems in a fair and transparent way.

The last Government let the established players off the hook by failing to implement the conclusions of the review they themselves commissioned, and allowing the big existing banks to regulate themselves.

This Government will make sure payment systems serve the needs of consumers, not the needs of the established banks.

Bank working for their customers, not themselves.

Taxpayers’ money protected.

The guardians of financial stability with the tools they need to keep us safe.

On all these fronts, we are making major changes.

A financial industry that is strong, successful and inspires the pride of all those who work for it.

That’s what Government should be about – taking the big tough decisions because they’re right for the long-term good of our country.

Our country has paid a higher price than any other major economy for what went so badly wrong in our banking system.

The anger people feel is very real.

Let’s turn that anger from a force of destruction into a force for change.

Change that will give us a banking system that will work for us all.

In 2013, thanks to the changes we are making, that goal is in sight.

Transcript of President Obama’s Speech on Banking/Wall Street Reform at Cooper Union, New York City on April 22, 2010.

THE PRESIDENT: Thank you very much. Everybody, please have a seat. Thank you very much. Well, thank you. It is good to be back. It is good to be back in New York, it is good to be back in the Great Hall at Cooper Union.

We’ve got some special guests here that I want to acknowledge. Congresswoman Carolyn Maloney is here in the house. Governor David Paterson is here. Attorney General Andrew Cuomo. State Comptroller Thomas DiNapoli is here. The Mayor of New York City, Michael Bloomberg. Dr. George Campbell, Jr., President of Cooper Union. And all the citywide elected officials who are here. Thank you very much for your attendance.

It is wonderful to be back in Cooper Union, where generations of leaders and citizens have come to defend their ideas and contest their differences. It’s also good to be back in Lower Manhattan, a few blocks from Wall Street. It really is good to be back, because Wall Street is the heart of our nation’s financial sector.

Now, since I last spoke here two years ago, our country has been through a terrible trial. More than 8 million people have lost their jobs. Countless small businesses have had to shut their doors. Trillions of dollars in savings have been lost — forcing seniors to put off retirement, young people to postpone college, entrepreneurs to give up on the dream of starting a company. And as a nation we were forced to take unprecedented steps to rescue the financial system and the broader economy.

And as a result of the decisions we made — some of which, let’s face it, were very unpopular — we are seeing hopeful signs. A little more than one year ago we were losing an average of 750,000 jobs each month. Today, America is adding jobs again. One year ago the economy was shrinking rapidly. Today the economy is growing. In fact, we’ve seen the fastest turnaround in growth in nearly three decades.

But you’re here and I’m here because we’ve got more work to do. Until this progress is felt not just on Wall Street but on Main Street we cannot be satisfied. Until the millions of our neighbors who are looking for work can find a job, and wages are growing at a meaningful pace, we may be able to claim a technical recovery — but we will not have truly recovered. And even as we seek to revive this economy, it’s also incumbent on us to rebuild it stronger than before. We don’t want an economy that has the same weaknesses that led to this crisis. And that means addressing some of the underlying problems that led to this turmoil and devastation in the first place.

Now, one of the most significant contributors to this recession was a financial crisis as dire as any we’ve known in generations — at least since the ’30s. And that crisis was born of a failure of responsibility — from Wall Street all the way to Washington — that brought down many of the world’s largest financial firms and nearly dragged our economy into a second Great Depression.

It was that failure of responsibility that I spoke about when I came to New York more than two years ago — before the worst of the crisis had unfolded. It was back in 2007. And I take no satisfaction in noting that my comments then have largely been borne out by the events that followed. But I repeat what I said then because it is essential that we learn the lessons from this crisis so we don’t doom ourselves to repeat it. And make no mistake, that is exactly what will happen if we allow this moment to pass — and that’s an outcome that is unacceptable to me and it’s unacceptable to you, the American people.

As I said on this stage two years ago, I believe in the power of the free market. I believe in a strong financial sector that helps people to raise capital and get loans and invest their savings. That’s part of what has made America what it is. But a free market was never meant to be a free license to take whatever you can get, however you can get it. That’s what happened too often in the years leading up to this crisis. Some — and let me be clear, not all — but some on Wall Street forgot that behind every dollar traded or leveraged there’s family looking to buy a house, or pay for an education, open a business, save for retirement. What happens on Wall Street has real consequences across the country, across our economy.

I’ve spoken before about the need to build a new foundation for economic growth in the 21st century. And given the importance of the financial sector, Wall Street reform is an absolutely essential part of that foundation. Without it, our house will continue to sit on shifting sands, and our families, businesses, and the global economy will be vulnerable to future crises. That’s why I feel so strongly that we need to enact a set of updated, commonsense rules to ensure accountability on Wall Street and to protect consumers in our financial system.

Now, here’s the good news: A comprehensive plan to achieve these reforms has already passed the House of Representatives. (Applause.) A Senate version is currently being debated, drawing on ideas from Democrats and Republicans. Both bills represent significant improvement on the flawed rules that we have in place today, despite the furious effort of industry lobbyists to shape this legislation to their special interests.

And for those of you in the financial sector I’m sure that some of these lobbyists work for you and they’re doing what they are being paid to do. But I’m here today specifically — when I speak to the titans of industry here — because I want to urge you to join us, instead of fighting us in this effort. I’m here because I believe that these reforms are, in the end, not only in the best interest of our country, but in the best interest of the financial sector. And I’m here to explain what reform will look like, and why it matters.

Now, first, the bill being considered in the Senate would create what we did not have before, and that is a way to protect the financial system and the broader economy and American taxpayers in the event that a large financial firm begins to fail. If there’s a Lehmans or an AIG, how can we respond in a way that doesn’t force taxpayers to pick up the tab or, alternatively, could bring down the whole system.

In an ordinary local bank when it approaches insolvency, we’ve got a process, an orderly process through the FDIC, that ensures that depositors are protected, maintains confidence in the banking system, and it works. Customers and taxpayers are protected and owners and management lose their equity. But we don’t have that kind of process designed to contain the failure of a Lehman Brothers or any of the largest and most interconnected financial firms in our country.

That’s why, when this crisis began, crucial decisions about what would happen to some of the world’s biggest companies — companies employing tens of thousands of people and holding hundreds of billions of dollars in assets — had to take place in hurried discussions in the middle of the night. And that’s why, to save the entire economy from an even worse catastrophe, we had to deploy taxpayer dollars. Now, much of that money has now been paid back and my administration has proposed a fee to be paid by large financial firms to recover all the money, every dime, because the American people should never have been put in that position in the first place.

But this is why we need a system to shut these firms down with the least amount of collateral damage to innocent people and innocent businesses. And from the start, I’ve insisted that the financial industry, not taxpayers, shoulder the costs in the event that a large financial company should falter. The goal is to make certain that taxpayers are never again on the hook because a firm is deemed “too big to fail.”

Now, there’s a legitimate debate taking place about how best to ensure taxpayers are held harmless in this process. And that’s a legitimate debate, and I encourage that debate. But what’s not legitimate is to suggest that somehow the legislation being proposed is going to encourage future taxpayer bailouts, as some have claimed. That makes for a good sound bite, but it’s not factually accurate. It is not true. In fact, the system as it stands — the system as it stands is what led to a series of massive, costly taxpayer bailouts. And it’s only with reform that we can avoid a similar outcome in the future. In other words, a vote for reform is a vote to put a stop to taxpayer-funded bailouts. That’s the truth. End of story. And nobody should be fooled in this debate.

By the way, these changes have the added benefit of creating incentives within the industry to ensure that no one company can ever threaten to bring down the whole economy.

To that end, the bill would also enact what’s known as the Volcker Rule — and there’s a tall guy sitting in the front row here, Paul Volcker — (applause) — who we named it after. And it does something very simple: It places some limits on the size of banks and the kinds of risks that banking institutions can take. This will not only safeguard our system against crises, this will also make our system stronger and more competitive by instilling confidence here at home and across the globe. Markets depend on that confidence. Part of what led to the turmoil of the past two years was that in the absence of clear rules and sound practices, people didn’t trust that our system was one in which it was safe to invest or lend. As we’ve seen, that harms all of us.

So by enacting these reforms, we’ll help ensure that our financial system — and our economy — continues to be the envy of the world. That’s the first thing, making sure that we can wind down one firm if it gets into trouble without bringing the whole system down or forcing taxpayers to fund a bailout.

Number two, reform would bring new transparency to many financial markets. As you know, part of what led to this crisis was firms like AIG and others who were making huge and risky bets, using derivatives and other complicated financial instruments, in ways that defied accountability, or even common sense. In fact, many practices were so opaque, so confusing, so complex that the people inside the firms didn’t understand them, much less those who were charged with overseeing them. They weren’t fully aware of the massive bets that were being placed. That’s what led Warren Buffett to describe derivatives that were bought and sold with little oversight as “financial weapons of mass destruction.” That’s what he called them. And that’s why reform will rein in excess and help ensure that these kinds of transactions take place in the light of day.

Now, there’s been a great deal of concern about these changes. So I want to reiterate: There is a legitimate role for these financial instruments in our economy. They can help allay risk and spur investment. And there are a lot of companies that use these instruments to that legitimate end — they are managing exposure to fluctuating prices or currencies, fluctuating markets. For example, a business might hedge against rising oil prices by buying a financial product to secure stable fuel costs, so an airlines might have an interest in locking in a decent price. That’s how markets are supposed to work. The problem is these markets operated in the shadows of our economy, invisible to regulators, invisible to the public. So reckless practices were rampant. Risks accrued until they threatened our entire financial system.

And that’s why these reforms are designed to respect legitimate activities but prevent reckless risk taking. That’s why we want to ensure that financial products like standardized derivatives are traded out in the open, in the full view of businesses, investors, and those charged with oversight.

And I was encouraged to see a Republican senator join with Democrats this week in moving forward on this issue. That’s a good sign. That’s a good sign. For without action, we’ll continue to see what amounts to highly-leveraged, loosely-monitored gambling in our financial system, putting taxpayers and the economy in jeopardy. And the only people who ought to fear the kind of oversight and transparency that we’re proposing are those whose conduct will fail this scrutiny.

Third, this plan would enact the strongest consumer financial protections ever. And that’s absolutely necessary because this financial crisis wasn’t just the result of decisions made in the executive suites on Wall Street; it was also the result of decisions made around kitchen tables across America, by folks who took on mortgages and credit cards and auto loans. And while it’s true that many Americans took on financial obligations that they knew or should have known they could not have afforded, millions of others were, frankly, duped. They were misled by deceptive terms and conditions, buried deep in the fine print.

And while a few companies made out like bandits by exploiting their customers, our entire economy was made more vulnerable. Millions of people have now lost their homes. Tens of millions more have lost value in their homes. Just about every sector of our economy has felt the pain, whether you’re paving driveways in Arizona, or selling houses in Ohio, or you’re doing home repairs in California, or you’re using your home equity to start a small business in Florida.

That’s why we need to give consumers more protection and more power in our financial system. This is not about stifling competition, stifling innovation; it’s just the opposite. With a dedicated agency setting ground rules and looking out for ordinary people in our financial system, we will empower consumers with clear and concise information when they’re making financial decisions. So instead of competing to offer confusing products, companies will compete the old-fashioned way, by offering better products. And that will mean more choices for consumers, more opportunities for businesses, and more stability in our financial system. And unless your business model depends on bilking people, there is little to fear from these new rules.

Number four, the last key component of reform. These Wall Street reforms will give shareholders new power in the financial system. They will get what we call a say on pay, a voice with respect to the salaries and bonuses awarded to top executives. And the SEC will have the authority to give shareholders more say in corporate elections, so that investors and pension holders have a stronger role in determining who manages the company in which they’ve placed their savings.

Now, Americans don’t begrudge anybody for success when that success is earned. But when we read in the past, and sometimes in the present, about enormous executive bonuses at firms — even as they’re relying on assistance from taxpayers or they’re taking huge risks that threaten the system as a whole or their company is doing badly — it offends our fundamental values.

Not only that, some of the salaries and bonuses that we’ve seen creates perverse incentives to take reckless risks that contributed to the crisis. It’s what helped lead to a relentless focus on a company’s next quarter, to the detriment of its next year or its next decade. And it led to a situation in which folks with the most to lose — stock and pension holders — had the least to say in the process. And that has to change.

Let me close by saying this. I have laid out a set of Wall Street reforms. These are reforms that would put an end to taxpayer bailouts; that would bring complex financial dealings out of the shadows; that would protect consumers; and that would give shareholders more power in the financial system. But let’s face it, we also need reform in Washington. And the debate — the debate over these changes is a perfect example.

I mean, we have seen battalions of financial industry lobbyists descending on Capitol Hill, firms spending millions to influence the outcome of this debate. We’ve seen misleading arguments and attacks that are designed not to improve the bill but to weaken or to kill it. We’ve seen a bipartisan process buckle under the weight of these withering forces, even as we‘ve produced a proposal that by all accounts is a commonsense, reasonable, non-ideological approach to target the root problems that led to the turmoil in our financial sector and ultimately in our entire economy.

So we’ve seen business as usual in Washington, but I believe we can and must put this kind of cynical politics aside. We’ve got to put an end to it. That’s why I’m here today. That’s why I’m here today.

And to those of you who are in the financial sector, let me say this, we will not always see eye to eye. We will not always agree. But that doesn’t mean that we’ve got to choose between two extremes. We do not have to choose between markets that are unfettered by even modest protections against crisis, or markets that are stymied by onerous rules that suppress enterprise and innovation. That is a false choice. And we need no more proof than the crisis that we’ve just been through.

You see, there has always been a tension between the desire to allow markets to function without interference and the absolute necessity of rules to prevent markets from falling out of kilter. But managing that tension, one that we’ve debated since the founding of this nation, is what has allowed our country to keep up with a changing world. For in taking up this debate, in figuring out how to apply well-worn principles with each new age, we ensure that we don’t tip too far one way or the other — that our democracy remains as dynamic and our economy remains as dynamic as it has in the past. So, yes, this debate can be contentious. It can be heated. But in the end it serves only to make our country stronger. It has allowed us to adapt and to thrive.

And I read a report recently that I think fairly illustrates this point. It’s from Time Magazine. I’m going to quote: “Through the great banking houses of Manhattan last week ran wild-eyed alarm. Big bankers stared at one another in anger and astonishment. A bill just passed… would rivet upon their institutions what they considered a monstrous system… such a system, they felt, would not only rob them of their pride of profession but would reduce all U.S. banking to its lowest level.” That appeared in Time Magazine in June of 1933. The system that caused so much consternation, so much concern was the Federal Deposit Insurance Corporation, also known as the FDIC, an institution that has successfully secured the deposits of generations of Americans.

In the end, our system only works — our markets are only free — when there are basic safeguards that prevent abuse, that check excesses, that ensure that it is more profitable to play by the rules than to game the system. And that is what the reforms we’ve been proposing are designed to achieve — no more, no less. And because that is how we will ensure that our economy works for consumers, that it works for investors, and that it works for financial institutions — in other words, that it works for all of us — that’s why we’re working so hard to get this stuff passed.

This is the central lesson not only of this crisis but of our history. It’s what I said when I spoke here two years ago. Because ultimately, there is no dividing line between Main Street and Wall Street. We will rise or we will fall together as one nation. And that is why I urge all of you to join me. I urge all of you to join me, to join those who are seeking to pass these commonsense reforms. And for those of you in the financial industry, I urge you to join me not only because it is in the interest of your industry, but also because it’s in the interest of your country.

Thank you so much. God bless you, and God bless the United States of America.