By Pam Martens: January 4, 2013

According to the Financial Industry Regulatory Authority (FINRA), there are 635,315 licensed securities representatives doling out investment advice throughout the United States. And yet, according to multiple studies, financial illiteracy continues to reign supreme. Is there a connection between the fast-talking, jargon-spewing, commission-focused salesmen on Wall Street and the sad state of basic investment knowledge in America?

My personal experience over two decades on Wall Street suggests that the number of licensed representatives who will take the time to educate their clients and play an integral, long-term, supportive role in helping clients build a secure retirement program is the exception – certainly not the rule.

The characteristics that Wall Street typically seeks in its brokers were accurately summed up in a 1990s Merrill Lynch training film wherein licensed broker, Michael Stamenson, tells rookie brokers that success requires “the tenacity of a rattlesnake, the heart of a black widow spider and the hide of an alligator.” Stamenson went on to play a central role in the bankruptcy of Orange County, California through the sale of complex derivatives. Merrill Lynch made $100 million in fees on the transactions; Stamenson collected $4.3 million in just the two-year period of ’93 and ’94.

Although brokers on Wall Street are frequently designated by their firms as financial consultants or financial advisors, there is far more pitching of products and far less advising on finances going on. That reality is showing up in sobering studies.

According to a Gallup poll conducted in April 2011, the number of Americans who say they will not have enough money to live comfortably in retirement reached a new high of 53 percent in 2011. And the angst is not limited to those nearing retirement. According to a Pew Research survey conducted in 2012, 53 percent of adults between the ages of 36 and 40 said they are either “not too” or “not at all” confident that their income and assets will last through retirement.

In a 2006 study for the National Bureau of Economic Research, Annamaria Lusardi and Olivia S. Mitchell found that financial literacy plays a direct role in a willingness to prudently plan for retirement and that, in turn, has a direct correlation to the ability to successfully accumulate wealth. To quote the authors:

“We show that financial literacy influences planning behavior and that planning, in turn, increases wealth holdings, even after controlling for many sociodemographic factors. Inasmuch as planning is an important predictor of saving and investment success, we believe we have identified an important explanation for why wealth holdings differ so much across households, and why some people enter retirement with very low amounts of wealth.”

Unfortunately, the first component on the road to a secure retirement – financial literacy – is woefully missing in America. In a separate study, Lusardi and Mitchell found that half the respondents could not make a simple calculation regarding interest rates over a 5-year period and did not know the difference between nominal and real interest rates. In the current study, the authors found that only 18 percent of baby boomers could correctly compute compound interest.

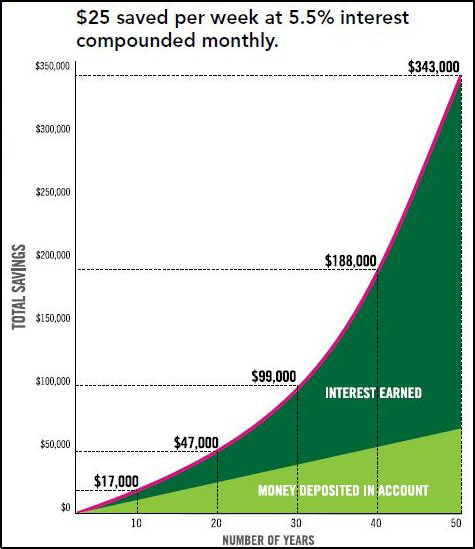

Understanding compound interest is perhaps the most important key to financial security because it leads to the realization that anyone can become financially secure if they start early enough in life and save regularly. It also leads to the epiphany that letting a financial institution pay you interest on the interest they have already paid you is far better than becoming a debt slave to their credit cards.

FINRA offers the following graph for teenagers as part of its financial literacy program. While most teenagers today could not afford to save $25 every week and most adults over the graphed 50-year period should be ratcheting up their savings to more than $25 per week, the illustration provides an excellent, quick snapshot of the wealth-building impact of compound interest.

There do exist trustworthy and education-oriented financial advisors. And since financial literacy and planning are the two indispensable components on the road to financial security, it’s important to take the time to ferret them out through referrals from trusted family members or friends who have a long-term tenure with the same advisor.

————-

Pam Martens, the Editor of Wall Street On Parade, managed the life savings of average Americans for 21 years on Wall Street. Her personal finance columns seek to help the public better understand the jargon, complexities, and conflicts of Wall Street. The information that appears on this site cannot, and does not, take into account your particular investment goals, your unique financial situation or income needs and is not intended to be recommendations appropriate for you. When it comes to making your own investment decisions, you should always consult in advance with your financial advisor and accountant.

At times, Wall Street On Parade links to news or opinion on other sites which we believe to be in the public interest. These web sites may also contain investment advice or investment advertising. We receive no remuneration for these links, provide them purely in the public interest, and are not endorsing or recommending any investment information that may appear on the site.