By Pam Martens: August 16, 2012

According to news reports yesterday, New York State Attorney General Eric Schneiderman has been cranking out the subpoenas to Wall Street’s largest banks over allegations of an international bank cartel rigging Libor interest rates.

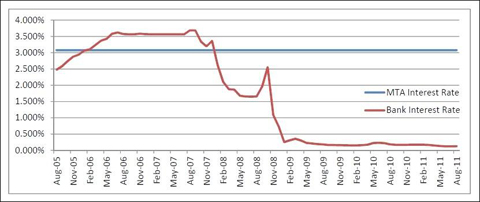

Libor is the benchmark rate used to set many consumer loans, like credit card, student loans, and adjustable rate mortgages. It is also the primary rate used by Wall Street banks in setting rates on interest rate swaps. Both New York State and New York City have a boatload of those deals that are bleeding red ink. (Read how other municipalities around the country are being drained by these deals.)

According to a December 2011 report by Michael Stewart of United NY, JPMorgan Chase is the counterparty to most of the interest rate swaps for New York City; the MTA currently has sixteen active swap agreements with JPMorgan Chase, Citigroup/Citibank, UBS, AIG, Morgan Stanley and Ambac.

Below are just a sampling of the issues from Michael Stewart’s report that Schneiderman is certain to have on his mind:

Since January 2000, the Metropolitan Transportation Authority (MTA) has already paid out a net $658 million to banks under these swap agreements.

The MTA remains on the hook for nearly $1.3 billion in payments to banks before its current swap agreements terminate — nearly half of which will not terminate until after 2030.

As of the end of September 2011, the MTA would have to pay $714 million in termination fees if it were to end its swap arrangements today — up from $408 million in June 2011, a mere three month period.

With few exceptions, the banks have profited each year from their swap deals with the MTA.

The Port Authority of New York and New Jersey has been paying an average of $2.3 million per month to banks since November 2010. Three deals provide no hedge function. In June 2006, the Authority entered into these three swap agreements, expecting to hedge against the variable rate interest on new bonds that the Authority anticipated it would issue. Once these swap contracts were signed, the Authority was bound to the contracts’ terms despite that two of the anticipated bonds were never issued. The principal on the third bond was refunded (paid back to bondholders) only six months after the bond was issued. The $43.2 million in swap payments that the Authority has paid on these swap deals since October 2007 is projected to balloon to over $746 million between October 2011 and their eventual terminations between 2035 and 2038.

According to the Port Authority’s 2009 financial statements, the Authority sought to “mitigate the impacts of unfavorable market conditions” by coming to an agreement with the banks to amend the three swap agreements. The new agreements allowed the Authority to defer their swap payments until October and November 2010 — saving, in the short term, over $35.9 million. But the price for this new arrangement was to pay an even higher interest rate to the banks at the point when the payments resumed. So, instead of paying 3.95% interest to the banks as compared to the 1.83% the banks were paying to the Authority, the Authority is now on the hook for an average interest rate of 4.46% compared to the banks’ average rate of 0.19%.

The interest rate swap report was sponsored by United New York, the Center for Working Families, and the Strong Economy For All Coalition.