By Pam Martens: June 22, 2012

Moody’s had barely published its ratings downgrades of the big banks on Wall Street before their public relations flaks hurled an avalanche of insults at Moody’s. Citigroup was the most vitriolic of the pack, calling Moody’s “arbitrary,” “backward looking,” and “opaque.” This from a company managed by a former hedge fund manager whose stock would be trading at $2.79 (intraday) had it not done a 1 for 10 reverse split and who previously hid tens of billions off its balance sheet in Structured Investment Vehicles (SIVs). In fact, Citigroup wouldn’t even exist today had the taxpayer not bailed it out with $45 billion in TARP funds, over $300 billion in guarantees, and trillions in secret loans from the Fed.

But Citi said in its press release: “In our view, investors and clients should make their own decisions and not rely on ratings — the genesis of which is opaque. In this regard, Citi is aware that analytical alternatives to the ratings agencies exist today from several providers that would further enhance the ability of investors and clients to arrive at their own conclusions without being captive to the judgments of rating agencies.”

Then Citi wrapped itself in the flag: “Also, as a financial intermediary in the business of assessing the creditworthiness of our clients and counterparties, we have been especially surprised by Moody’s disproportionately adverse treatment of U.S. firms relative to banks in Europe.”

Citi wrapped it up with a parody of Jamie Dimon’s patriotic slogan – “best capital markets in the world,” saying, “…Citi believes that the U.S. financial system is stronger, not weaker, than it was before the crisis. Actions by legislators, regulators and firms themselves have substantially enhanced the stability, and resilience, of the system. Moody’s actions ignore this fact.”

What Citi ignores is that right now we have two U.S. Justice Department criminal probes because customer funds are increasingly going missing on Wall Street, to the tune of billions, and high risk trading by global firms is responsible.

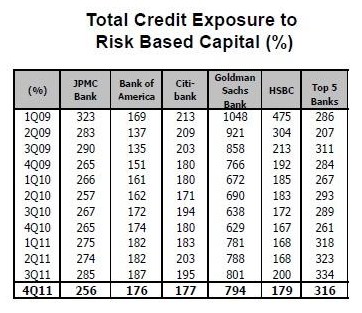

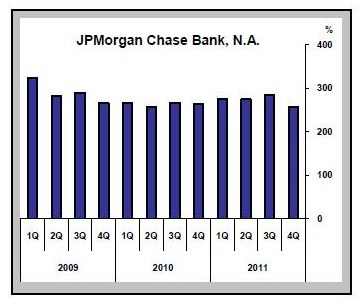

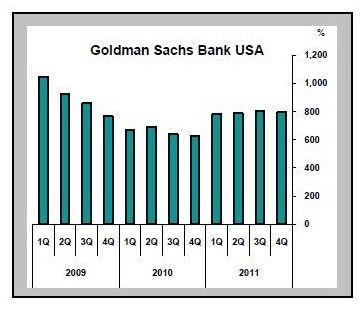

In fact, in a year end report dated December 31, 2011, the primary regulator for these banks raised serious red flags about their ratio of derivatives to risk-based capital.

The Office of the Comptroller of the Currency (OCC) is the Federal agency that is the primary regulator for the national banks. That includes the banks holding insured deposits that exist within the mega Wall Street financial firms.

The OCC report said that derivatives activity in the U.S. banking system is dominated by five commercial banks which represent 96 percent of the total banking industry notional amounts of net current credit exposure. Translation: no lessons have been learned from the 2008 meltdown; credit risk is still insanely concentrated in the U.S.

As of December 31, 2011, those five banks and their derivative holdings were: JPMorgan Chase with $70.1 trillion; Citibank with $52.1 trillion; Bank of America with $50.1 trillion; Goldman Sachs Bank USA with $44.2 trillion; and HSBC with $4.3 trillion.

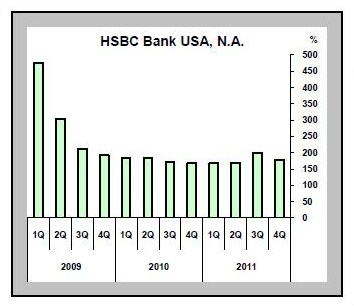

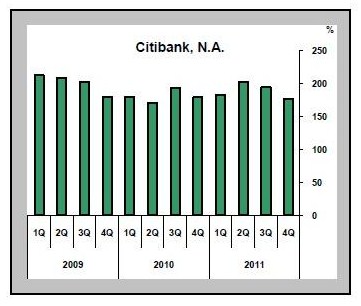

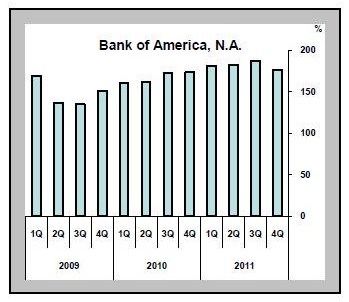

If you need further evidence to ignore Citigroup’s assurances that legislators and regulators are on top of this pile of dung, below are charts from the OCC showing the percentage of total credit exposure to risk-based capital of the top five insured U.S. commercial banks by their derivative holdings from the first quarter of 2009 to the fourth quarter of last year. If Goldman Sachs doesn’t take your breath away, nothing ever will.