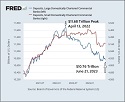

By Pam Martens and Russ Martens: July 20, 2023 ~ The data in the chart above comes directly from what the biggest bank in the United States, JPMorgan Chase, reported on its 10-Q filing with the Securities and Exchange Commission (SEC) for the quarter ending March 31, 2023. Despite all those mainstream media headlines and news stories about the biggest banks in the U.S. being the deposit beneficiaries of the banking panic earlier this year, the cold, hard facts on the ground are the following: at the end of the first quarter of this year, JPMorgan Chase had seen deposit outflows in four out of the past five quarters. Mainstream media conveniently forgot to mention that. The only quarter in which JPMorgan Chase saw an inflow of deposits was the first quarter of this year, when three banks blew up: Silvergate Bank, Silicon Valley Bank and Signature Bank. That increase was … Continue reading