By Pam Martens and Russ Martens: February 7, 2020 ~

On both days this week that the New York Fed offered its $30 billion in 14-day repo loans to 24 trading houses on Wall Street, there was far more demand than the New York Fed had preannounced it would provide. On Tuesday, the demand was for $59.05 billion while the New York Fed provided only $30 billion. On Thursday, the demand was for $57.25 billion while the New York Fed provided $30 billion. In short, there is a growing demand for long-term loans at affordable rates on Wall Street – meaning one or more trading houses has a borrowing problem. The Fed’s loans this week were made at a below-market interest rate of 1.60 percent.

The demand for the 14-day loans came on the same days that the New York Fed also funneled huge amounts of money in one-day loans to Wall Street’s trading houses: $64.45 billion on Tuesday and $46.75 billion on Thursday. Cumulatively, since the Fed began making these unprecedented repo loans to Wall Street’s trading houses on September 17 of last year, it has pumped over $6.6 trillion into Wall Street.

That money has found a home in the stock market, most likely via stock index futures which deliver a big bang for the buck through high leverage via margin loans. Some of these Wall Street trading houses that are borrowing from the Fed at 1.60 percent are likely loaning that money out to hedge funds (at a much higher interest rate) and the hedge funds are then plowing the money into stock index futures.

The stock market has set repeated new highs since the New York Fed turned on this multi-trillion-dollar money spigot that has been operating every business day since September 17.

The dangerous problems for the New York Fed are the following: it is creating an unsustainable bubble in the stock market; the larger that bubble grows, the more economic damage it does when it explodes; the New York Fed clearly had no exit plan when it began this dangerous experiment with no approval from an elected Congress.

Just how much the stock market is being manipulated was evident in yesterday’s chart for the Dow Jones Industrial Average and S&P 500 Index. (See above chart.) The markets plunged at the open; then staged an inexplicable sharp reversal rally; then plunged again – all before noon. We have watched this happen over and over since the New York Fed turned on its money spigot. There is a mantra on Wall Street that “the trend is your friend.” But there is no trend here. Markets can flip on a dime from plunging to spiking on no particular news. That strongly suggests there is a major player(s) pushing the market up using the Fed’s cheap money supply.

In a healthy market, all that super cheap money from the New York Fed would mean a rising tide would lift all boats. But instead, there is underlying deterioration in the market. Yesterday, despite the Dow closing up 88.92 points, 47 percent of the stocks in the Dow Jones Industrial Index of 30 companies closed in the red. Those covered a broad swath of industries, from financials to energy to Big Pharma. The losing stocks were: American Express, Caterpillar, Chevron, Dow Inc., Goldman Sachs, Intel, Johnson & Johnson, McDonald’s, Merck, Nike, Travelers, United Health, Walmart and ExxonMobil.

The deterioration in the market caught the eye of Tomi Kilgore of MarketWatch on Wednesday. He wrote that the New York Stock Exchange Arms Index (also known as the Short-Term Trading Index or TRIN) was registering intra-day readings typically “associated with panic-like selling activity.”

Panic-like selling activity would be completely consistent with Wall Street trading houses coming to the sobering reality that their pals and deregulators in Washington that have given their Dark Pools and derivatives and ownership of federally-insured banks and market-rigging activities a wink and a nod may be replaced with a far less accommodative administration come next year. If Wall Street knows anything it knows that the guy out of the exit gate first takes the biggest winnings when it comes to a looming stock market crisis.

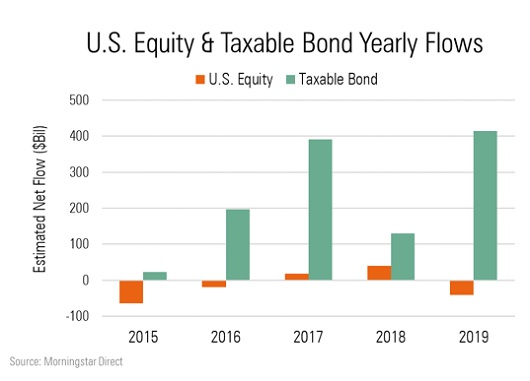

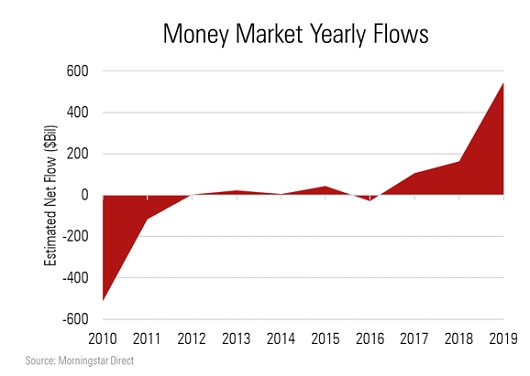

There are two more charts that are completely compatible with big flows of money moving out of the stock market while index futures are propping up the broad stock market indices to disguise the underlying deterioration.

According to the chart below from Morningstar, equity mutual funds in the U.S. have seen net outflows of money in three of the last five years, including last year when U.S. equity funds had a net outflow of $41.3 billion. Even more striking is the enormous amount of money that is seeking a safe haven away from the stock market and moving into liquid money market funds. According to Morningstar, in 2019 money market funds had the largest inflows since the financial crash in 2008, taking in an astounding $547.4 billion of inflows.

The Federal Reserve and the New York Fed seem to have caught themselves in a trap of their own making. They turn off the money spigot and the market plunges. They leave it on and the market becomes an even bigger bubble.

The Fed’s repo madness has finally commanded the attention of the Senate Banking Committee, which will take semiannual testimony from Fed Chairman Jay Powell next Wednesday. In advance of that, Democrats on the Committee, including ranking member Sherrod Brown and presidential candidate Elizabeth Warren, wrote a letter to Powell demanding answers in advance of the hearing. The Senators wrote:

“…the [Federal Reserve Open Market] Committee instructed FRBNY to continue repurchase activities ‘at least through April 2020.’ The shifting volumes and target dates of the Fed’s response suggest that other factors may be the cause of this persistent market dislocation, and it is difficult to evaluate the Fed’s response in the absence of a clear explanation as to what got us here…”

Two of the questions the Senators want Powell to answer are what “necessitates continued intervention” in the repo market by the Fed and “has the Fed analyzed the impact of the availability of this facility on primary dealers’ balance sheets and market activity.”

We’ll be waiting with bated breath to hear Powell explain himself out of this one next Wednesday.