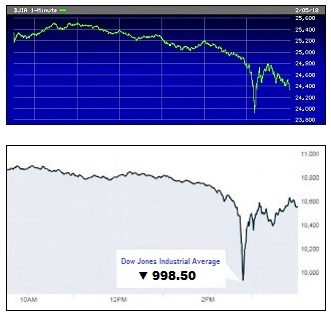

Dow Jones Industrial Average Chart for February 5, 2018 (top) Versus Flash Crash Chart of May 6, 2010 (bottom).

By Pam Martens and Russ Martens: February 6, 2018

Jerome Powell (Right) Is Sworn In As Federal Reserve Chairman on February 5, 2018 by Fed Vice Chairman Randal Quarles.

In little more than a week, $4 trillion in global stock market value has vanished as quickly as a snow cone in July. The heretofore uncanny calm of a U.S. stock market setting regular new highs was punctured Friday with a 665.7 point selloff in the Dow Jones Industrial Average. That was followed by yesterday’s bungee dive in late afternoon that took the Dow down 1597 points followed by a quick partial retracement that left the Dow down 1,175 points on the day. (That plunge and retracement brought back memories of the Flash Crash of 2010. See charts above and our coverage: Flash Crash Report Raises Flags on Quasi Stock Exchanges Inside Wall Street Firms.)

On a point loss basis, yesterday’s decline was the largest in Dow history. On a percentage basis, it paled in comparison to the 22.6 percent decline on October 19, 1987 when the Dow lost 507.99 points.

As we began reporting on January 22 (see Rising Treasury Yields Pose Risk for Those Over-Weighted in Stocks) the stock market had become overly complacent toward the fierce rise in U.S. Treasury yields. We warned that this could “turn out to be a dangerous, slippery slope for those heavily weighted in stocks.” We also cautioned that: “The stock market has been riding the euphoria of anticipating the tax cut benefit to corporate earnings. It seems to have forgotten about what the attendant budget deficits would mean for rising Treasury yields and those higher yields providing a competitive seduction to investors who increasingly see the stock market as asset bubble terrain.”

On January 30 we took a hard look at how Trump’s tax cut plan would drive the yields on Treasuries by impacting the supply and demand at a time when the Federal Reserve was cutting back on its own purchases of Treasuries in order to normalize its bloated balance sheet left over from its interventions following the 2008 financial crash. We wrote:

“The recent market action suggests that investors are about to get a serious investing lesson in the concept of supply and demand. According to research from the major Wall Street banks, there is going to be a stunning doubling of the net issuance of U.S. Treasury securities in the current Federal fiscal year versus last year. Net issuance of Treasuries in the last fiscal year was approximately $500 billion. For the coming year, Goldman Sachs projects the amount will be $1.03 trillion; Deutsche Bank thinks it will be about $1 trillion while JPMorgan Chase is floating the breathtaking figure of $1.42 trillion.

“The huge increase comes from two primary factors: a mushrooming budget deficit from the recently passed tax cuts and the wind down by the Federal Reserve of its Treasury purchases.” (Read the full article: Stocks Dive as Treasury Yields Set Off Alarm Bells.)

Yesterday’s plunge was accompanied by a new Federal Reserve Chair, Jerome Powell, taking his seat for his first day of work. Stock markets hate uncertainty and former Fed chief Janet Yellen’s dovish approach to rate hikes had a calming influence on the stock market. Powell’s approach to the size and timing of rate hikes this year is less predictable.

As the stock market repriced risk yesterday, President Donald Trump was in Ohio giving a speech on the booming economy while referring to Democrats as “treasonous” for not giving him a standing ovation during his State of the Union address. Trump is now waging four domestic wars at once: with the media; with Democrats; with his own Justice Department and FBI (which are headed by his own appointees) over his and his family’s potential involvement with Russia. Up until now, the chaos President has been bucked up by a calm stock market regularly scaling new heights. That all changed yesterday.

As Trump told his Ohio audience that “billions and billions of dollars are being poured back into the United States,” billions and billions of dollars were actually flowing out of U.S. stocks. As Trump remarked that his tax cut legislation had “set off a tidal wave of good news that continues to grow every single day,” the stock market was actually reassessing how much that tax cut was going to add to the U.S. deficit; how much it would mean in new issuance of Treasury bills, notes and bonds; and weighing how far interest rates would have to rise so that this massive doubling of debt issuance would find bids and buyers.

The Trump tax cut legislation reduced the corporate tax rate from 35 percent to 21 percent. The nonpartisan Congressional Budget Office has estimated that it will add $1.5 trillion to the deficit over the next decade.

The chaos President has now been joined by stock market chaos. The widely followed VIX, the CBOE’s Volatility Index which measures fear or raw nerves in the market, more than doubled yesterday and was up another 13 points this morning to 50.30, touching its highest level since 2009, which was in the midst of the fallout from the Wall Street collapse of 2008.

Heretofore, the stock market has shrugged off the President’s historically low approval ratings for his first year in office; his low approval on the global stage; and the sagging world view of U.S. leadership.

On January 19 of this year we wrote:

“Since the inauguration of Donald Trump on January 20, 2017, the stock market has performed as if it is operating in an alternative universe, regularly setting new record highs despite unprecedented chaos coming from the White House. Now, a new Gallup poll is calling into question how long the divergence between the market’s view of Trump and the world view of Trump can continue.

“A new Gallup poll released yesterday puts global approval of US leadership at just 30%, behind China at 31% and Russia at 27%. Germany has moved into the top slot in the world with a leadership approval rating of 41%.”

Stock investors who shrugged off the critical need for the world’s only superpower to have steady, credible leadership in Washington are about to find out if we truly are in a new paradigm or if they have been lulled into the same fool’s paradise as Bitcoin investors.