By Pam Martens and Russ Martens: February 1, 2018

Yesterday we reported that the Chairman of the Securities and Exchange Commission, Jay Clayton – the man ostensibly in charge of providing financial transparency to the American people – has tens of millions of dollars in family net worth tied to a Delaware company specializing in providing secrecy to corporate entities. (This actually makes sense for an administration packed with billionaires with lots of tax haven accounts.)

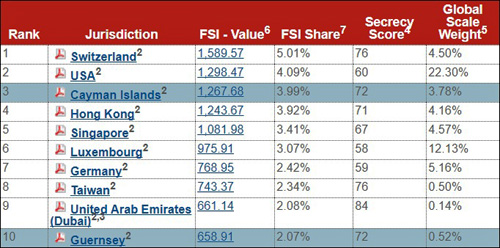

On the heels of that confidence-draining news comes the Financial Secrecy Index for 2018 which names the United States the 2nd worst country for facilitating financial secrecy and illicit money flows, just behind Switzerland. The accompanying report from the Tax Justice Network on the U.S. specifically calls out the state of Delaware, noting the following:

“The U.S. provides a wide array of secrecy and tax-free facilities for non-residents, both at a Federal level and at the level of individual states. Many of the main Federal-level facilities were originally crafted with official tolerance or approval, in some cases to help with the U.S. balance of payments difficulties during the Vietnam War; however some facilities – such as tolerance by states like Delaware or Nevada of highly secretive anonymous shell companies – are more the fruit of a race to the bottom between individual states on standards of disclosure and transparency.”

The report includes an eye-opening memo from 1966 that was “passed by a former State Department operative to a Chase Manhattan bank staffer.” It reads:

“The US is probably the second major flight money center in the world, but with little probability of rivalling Switzerland for the foreseeable future. Like Switzerland, flight money probably flows to the US from every country in the world. . . however this is insignificant relative to the total potentially available. . . US-based and US-controlled entities are badly penalized in competing for flight money with the Swiss or other foreign flight money centers over the long run.”

The memo went on to explain why the U.S. was losing ground to Switzerland for illicit money flows:

“the ability of the US Treasury, Justice Department, CIA and FBI to subpoena client records, attach client accounts, and force testimony from US officers of US-controlled entities . . . restrictive US investment and brokerage regulations and policies, which limit the flexibility and secrecy of investment activity . . the US estate tax and US withholding tax on foreign investments…”

With captured Federal regulators overseeing the largest Wall Street banks that facilitate money laundering and getting slaps on the wrist for failures to report it, it’s easy to see how the U.S. caught up with Switzerland. (See Trump’s Justice Department Goes Easy on Citigroup Unit for Criminal Money Laundering and JPMorgan and Madoff Were Facilitating Nesting Dolls-Style Frauds Within Frauds.)

A key milestone in the United States’ march toward becoming a major financial secrecy haven was, according to the report, the International Banking Facility mechanism that was introduced in 1981. “This,” notes the report, “allowed banks in the U.S.A., which had previously needed to go offshore (particularly to London) to get around domestic financial regulations, to keep a separate set of books that effectively allowed them to obtain these exemptions while remaining at home. This attracted still more funds out of foreign tax havens and marked a further step offshore for the United States.”

The report also discusses the impact of the Foreign Account Tax Compliance Act (FATCA) that was enacted by the U.S. in March 2010 but didn’t take effect until four years later. A December editorial at Bloomberg News nicely summed up how that’s been perverted by the U.S., writing:

“Under threat of losing access to the U.S. financial system, more than 100 countries — including such traditional havens as Bermuda and the Cayman Islands — are complying or have agreed to comply. The U.S. was expected to reciprocate, by sharing data on the accounts of foreign taxpayers with their respective governments. Yet Congress rejected the Obama administration’s repeated requests to make the necessary changes to the tax code. As a result, the Treasury cannot compel U.S. banks to reveal information such as account balances and names of beneficial owners. The U.S. has also failed to adopt the so-called Common Reporting Standard, a global agreement under which more than 100 countries will automatically provide each other with even more data than FATCA requires…

“From a certain perspective, all this might look pretty smart: Shut down foreign tax havens and then steal their business. That would be the kind of thinking that’s undermining America’s standing in so many areas, from trade to climate change. Instead of using its power to establish an equitable system of global governance, it’s demanding a standard from the rest of the world that it refuses to apply to itself. That isn’t leadership.”

The well-researched report from the Tax Justice Network notes that a handful of U.S. states are leading the race to the bottom. Delaware pops up again:

“A few states such as Delaware, Wyoming and Nevada took an early lead in offshore secret incorporations, and remain leaders today.

“Here is how it works. A wealthy Ukrainian, say, sets up a Delaware shell company using a local company formation agent. That Delaware agent will provide nominee officers and directors (typically lawyers) to serve as fronts for the real owners, and their details and photocopies of their passports can be made public but that gets you no closer to who the genuine Ukrainian owner of that company is: if the nominees are lawyers they are bound by attorney-client privilege not to reveal the information (if they even have it: the owner of that shell company may be another secretive shell company or trust somewhere else). The company can run millions through its bank account but nobody – whether domestic or foreign law enforcement – can crack through that form of secrecy in any efficient or effective way. In the words of Dennis Lormel, the first chief of the FBI’s Terrorist Financing Operations Section and a retired 28-year Bureau veteran, ‘Terrorists, organized crime groups, and pariah states need access to the international banking system. Shell firms are how they get it.’ “

One of the most powerful and profound paragraphs in the report is this one:

“The problems go far beyond tax. In providing secrecy, the offshore world corrupts and distorts markets and investments, shaping them in ways that have nothing to do with efficiency. The secrecy world creates a criminogenic hothouse for multiple evils including fraud, tax cheating, escape from financial regulations, embezzlement, insider dealing, bribery, money laundering, and plenty more. It provides multiple ways for insiders to extract wealth at the expense of societies, creating political impunity and undermining the healthy ‘no taxation without representation’ bargain that has underpinned the growth of accountable modern nation states.”