By Pam Martens and Russ Martens: March 2, 2016

Two interesting things happened this week in Jamie Dimon’s world: two gutsy attorneys, Helen Davis Chaitman and Lance Gotthoffer, published a book comparing JPMorgan Chase to the Gambino crime family, explaining how the bank could and should be prosecuted under RICO statutes for serial frauds against the investing public. Taking a diametrically different tack, Bloomberg Markets magazine editor, Joel Weber, fawned over Dimon in a Bloomberg TV interview, repeatedly asserting that Jamie Dimon is all about the customer.

Two interesting things happened this week in Jamie Dimon’s world: two gutsy attorneys, Helen Davis Chaitman and Lance Gotthoffer, published a book comparing JPMorgan Chase to the Gambino crime family, explaining how the bank could and should be prosecuted under RICO statutes for serial frauds against the investing public. Taking a diametrically different tack, Bloomberg Markets magazine editor, Joel Weber, fawned over Dimon in a Bloomberg TV interview, repeatedly asserting that Jamie Dimon is all about the customer.

This Bloomberg video is so hilarious we had to watch it several times to make sure it wasn’t satire. As Weber makes his case that Dimon is all about the customer, his Bloomberg colleague, Stephanie Ruhle, is having none of it, reminding the obviously star-struck Weber that the big banks are hated in this country for good reason. Instead of acknowledging the serial frauds at JPMorgan, Weber suggests (and this is the belly laugh/roll on the floor part) that banks are hated because when you go to a car dealer to buy a car you walk out with one. But if you go into a bank for a loan or credit card, it might turn you down. This brand of logic is on a par with Hillary Clinton suggesting that Wall Street was lavishing millions of dollars on her in speaking fees because she was kind to Wall Street during 9/11.

Weber’s interview on Bloomberg TV was to promote the cover story on Dimon in the relaunch of Bloomberg Markets magazine. The article mentions in passing that JPMorgan Chase has paid “more than $36 billion in settlements and fines since the financial crisis” but then it fails to deliver the gory details of what those fines were about. Other than the London Whale fiasco, where $6.2 billion of depositors’ money was lost to reckless derivatives gambling in London, there is barely a mention of the endless stream of crimes that JPMorgan Chase has been charged with over the past four years. That history is whitewashed in the article with this comment from Dimon: “Businesses are going to make mistakes. They shouldn’t be shot and hung every time,” along with allowing Dimon to have the final word in the article with this: “But I’ve always believed business is here to serve your clients, your shareholders, your communities. If we do this well, everyone benefits. We have to do a good job for all of them.”

The most damning part of this article is that the fearsome “F” word doesn’t appear once. JPMorgan dates back to 1871. It managed to survive 143 years without being charged with criminal activity. But under Dimon’s reign, it was charged with two felony counts in 2014 under a deferred prosecution agreement from the U.S. Justice Department for its involvement in the Bernie Madoff fraud and charged with another felony count, to which it admitted, on May 20, 2015 for its involvement in rigging the foreign currency market. How could a reporter forget to mention an unprecedented three felony counts in the past two years against Dimon’s story line that it’s all about the customer.

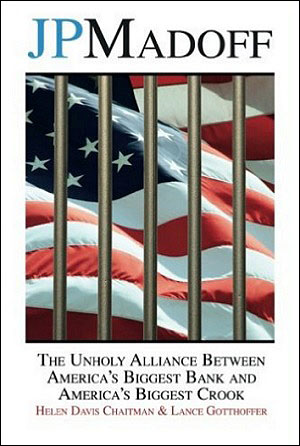

Unfortunately for Dimon, attorneys Chaitman and Gotthoffer have no such lapse of memory. In their newly published book, JPMadoff: The Unholy Alliance between America’s Biggest Bank and America’s Biggest Crook, they provide a rap sheet of exactly how JPMorgan has been “taking care” of its customers under Dimon’s oversight:

“In April 2011, JPMC agreed to pay $35 million to settle claims that it overcharged members of the military service on their mortgages in violation of the Service Members Civil Relief Act and the Housing and Economic Recovery Act of 2008.

“In March 2012, JPMC paid the government $659 million to settle charges that it charged veterans hidden fees in mortgage refinancing transactions.

“In October 2012, JPMC paid $1.2 billion to settle claims that it, along with other banks, conspired to set the price of credit and debit card interchange fees.

“On January 7, 2013, JPMC announced that it had agreed to a settlement with the Office of the Controller of the Currency (‘OCC’) and the Federal Reserve Bank of charges that it had engaged in improper foreclosure practices.

“In September 2013, JPMC agreed to pay $80 million in fines and $309 million in refunds to customers whom the bank billed for credit monitoring services that the bank never provided.

“On November 15, 2013, JPMC announced that it had agreed to pay $4.5 billion to settle claims that it defrauded investors in mortgage-backed securities in the time period between 2005 and 2008.

“On December 13, 2013, JPMC agreed to pay 79.9 million Euros to settle claims of the European Commission relating to illegal rigging of benchmark interest rates.

“In February 2012, JPMC agreed to pay $110 million to settle claims that it overcharged customers for overdraft fees.

“In November 2012, JPMC paid $296,900,000 to the SEC to settle claims that it misstated information about the delinquency status of its mortgage portfolio.

“In July 2013, JPMC paid $410 million to the Federal Energy Regulatory Commission to settle claims of bidding manipulation of California and Midwest electricity markets.

“On November 19, 2013, JPMC agreed to pay $13 billion [that’s billion with a ‘b’] to settle claims by the Department of Justice; the FDIC; the Federal Housing Finance Agency; the states of California, Delaware, Illinois, Massachusetts, and New York; and consumers relating to fraudulent practices with respect to mortgage-backed securities.

“In December 2013, JPMC paid $22.1 million to settle claims that the bank imposed expensive and unnecessary flood insurance on homeowners whose mortgages the bank serviced.

“On May 15, 2015, five financial institutions, including JPMC, pled guilty to a criminal conspiracy to fix the foreign exchange market, paying a total of $5.6 billion in fines. JPMC paid $892 million in fines.”

Less than three months ago, JPMorgan agreed to charges by the SEC that it had steered its customers into in-house products where it reaped higher profits without disclosing this conflict to the customer. It paid $267 million to settle these charges.

If you compare what presidential candidate Senator Bernie Sanders has been repeatedly telling debate viewers on national TV, that the business model of Wall Street is fraud, against the above rap sheet, you understand exactly why the public is angry and outraged at the Wall Street banks and the establishment candidates who take their campaign money and then do their bidding with toothless regulatory appointments once in office.

There’s one more interesting aspect to this story. Last October, the New York Post reported that Bloomberg Markets magazine was going to cease to exist as a monthly magazine but would relaunch this year as a “promotional tool” for the company’s financial news/data terminals. According to the article, the decision “came directly from Michael Bloomberg.”

At an annual cost of $24,000 a year for the Bloomberg terminal and about 320,000 terminals spread across Wall Street trading rooms around the world, you’re looking at somewhere in the neighborhood of $7 billion a year in revenues (mega users of multiple terminals like JPMorgan Chase may get a discount from the $24,000). In fact, the Bloomberg terminal is the cash cow that has made former New York City Mayor Michael Bloomberg a multi-billionaire with Forbes reporting yesterday that his “net worth increased $4.5 billion” last year to a cool $40 billion total. That was just enough, adds Forbes “to edge out Republican power player David Koch as the richest man in New York.”

Let’s face it, you don’t become the richest man in New York by dredging up pesky details like felony counts against your largest customers on Wall Street.