By Pam Martens and Russ Martens: December 29, 2015

Senator Elizabeth Warren, Democrat of Massachusetts, has breathed new life into bolstering Americans belief in our Democratic system of government and the notion that one good man or good woman can make a meaningful difference in Congress. Senator Warren was the driving force behind the creation of the Consumer Financial Protection Bureau which has opened a robust two-way dialogue and redress system with the American people regarding the financial crimes being inflicted on them – otherwise known as Wall Street’s institutionalized wealth transfer system – while it is simultaneously under relentless assault by corporate attack dogs masquerading as Republican members of Congress.

It was Senator Warren in 2013 that informed us that the so-called Independent Foreclosure Reviews to settle the claims of 4 million homeowners who had been illegally foreclosed on by the bailed out Wall Street banks were a sham. The “independent” consultants had been hired by the banks and paid by the banks, with the banks themselves allowed to determine the number of victims.

Senator Warren was the pivotal person who put the high frequency trading scam described in the Michael Lewis book, “Flash Boys,” into layman’s language. During a Senate hearing on June 18 of last year, Warren explained:

“High frequency trading reminds me a little of the scam in Office Space. You know, you take just a little bit of money from every trade in the hope that no one will complain. But taking a little bit of money from zillions of trades adds up to billions of dollars in profits for these high frequency traders and billions of dollars in losses for our retirement funds and our mutual funds and everybody else in the market place. It also means a tilt in the playing field for those who don’t have the information or have the access to the speed or big enough to play in this game.”

Warren was also the driving force in introducing legislation that will hopefully restore the Glass-Steagall Act and sanity to Wall Street. In 2013, together with Senators John McCain, Maria Cantwell and Angus King, Warren introduced the “21st Century Glass-Steagall Act,” explaining its critical importance as follows:

“By separating traditional depository banks from riskier financial institutions,” explained Warren, “the 1933 version of Glass-Steagall laid the groundwork for half a century of financial stability. During that time, we built a robust and thriving middle class. But throughout the 1980’s and 1990’s, Congress and regulators chipped away at Glass-Steagall’s protections, encouraging growth of the megabanks and a sharp increase in systemic risk. They finally finished the task in 1999 with the passage of the Gramm-Leach-Bliley Act, which eliminated Glass-Steagall’s protections altogether.”

Thanks to Elizabeth Warren and Senator Bernie Sanders of Vermont, restoring the Glass-Steagall Act has become a hot button issue in the ongoing Presidential debates, helping American voters differentiate between the candidates. (For example, the sole Democratic Presidential candidate who is not in favor of restoring the Glass-Steagall Act is Hillary Clinton, who is heavily funded by executives of Wall Street firms and their legal powerhouses.)

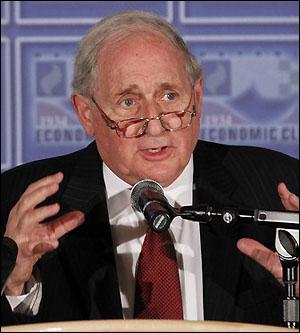

Senator Carl Levin, Democrat from Michigan, who retired at the end of last year after serving 36 years in the U.S. Senate, exemplified the meaning of public servant and embodied the highest ideals of representative government – of, by, and for the people. Senator Levin chaired the Senate’s Permanent Subcommittee on Investigations (PSI), which, under Levin, functioned as a feared investigative body, turning out unparalleled reports on financial crimes by Wall Street and foreign banks with such fine detail and subpoenaed documents that regulators were forced to take action.

In just the last two years of his Chairmanship of the PSI, Senator Levin took on high frequency trading, released a 396-page report on the Wall Street mega banks’ ownership of a staggering amount of the nation’s industrial commodities like oil, aluminum, copper, natural gas, and even uranium. The investigative study called the scale of these bank holdings “unprecedented in U.S. history.” In July of 2014, Senator Levin released a report and conducted a hearing on a mind-boggling plot by financial institutions to evade taxes. We reported the following at the time:

“According to a copious report released last evening, here’s what hedge funds have been doing for more than a decade with the intimate involvement of global banks: the hedge fund makes a deposit of cash into an account at the bank which has been established so that the hedge fund can engage in high frequency trading of stocks. The account is not in the hedge fund’s name but in the bank’s name. The bank then deposits $9 for every one dollar the hedge fund deposits into the same account. Some times, the leverage reaches as high as 20 to 1.

“The hedge fund proceeds to trade the hell out of the account, generating tens of thousands of trades a day using their own high frequency trading program and algorithms. Many of the trades last no more than minutes. The bank charges the hedge fund fees for the trade executions and interest on the money loaned.

“Based on a written side agreement, preposterously called a ‘basket option,’ the hedge fund will collect all the profits made in the account in the bank’s name after a year or longer and then characterize millions of trades which were held for less than a year, many for just minutes, as long-term capital gains (which by law require a holding period of a year or longer). Long term capital gains are taxed at almost half the tax rate of the top rate on short term gains.

“There are so many banking crimes embedded in this story that it’s hard to know where to begin. Let’s start with the one most dangerous to the safety and soundness of banks: extension of margin credit.

“Under Federal law known as Regulation T, it is perceived wisdom on Wall Street that a bank or broker-dealer cannot extend more than 50 percent margin on a stock account. But since the banks involved in these basket options called these accounts their own proprietary trading accounts, even though the hedge fund had full control over the trading and ultimate ownership of profits, the banks were justified (in their minds) with thumbing their nose at a bedrock of doing business on Wall Street.”

In 2013, Senator Levin’s PSI released a 307-page report on the obscene derivatives trading in London by JPMorgan Chase, which infamously became known as the “London Whale” debacle with a loss of over $6.2 billion in bank deposits, much of which were FDIC-insured. The exhaustive report led to a $920 million settlement by JPMorgan Chase with findings that it had violated both banking and securities laws.

To fully grasp why Carl Levin was so dedicated and determined as a public servant, you need to hear this little story told in the Huffington Post by MJ Rosenberg who previously worked as a staffer in Congress for 20 years. Rosenberg had worked for Levin in the early 80s and was asked by the Senator to have a photograph of himself and his cherished older brother, Sander (Sandy), a long-tenured member of the House of Representatives, framed by the Senate carpentry shop so he could hang it on his office wall. When Rosenberg returned with the framed photograph and reported that there had not been a charge, Levin handed him a check and insisted that he return to the carpentry shop and pay for it. When the carpentry shop reported that they had no cash register or means of accepting payment, Levin quietly sent a payment to the U.S. Treasury office.

When we first learned that Senator Levin was planning to retire, we were filled with dread as to what would happen to the Senate’s Permanent Subcommittee on Investigations. Our fears were well-founded. A corporate-friendly Republican is now in charge, Rob Portman of Ohio. Rather than looking at the crimes committed by the mega corporations, backstopped by their legions of lobbyists and armies of lawyers, Senator Portman is focusing on corporations as victims of government abuse. The sum total of his hearings this past year at the PSI has been two, one of which focused on the Federal government’s unfair taxation of corporations.

As BloombergBusiness wrote at the time of the first hearing under Portman in July:

“A U.S. Senate investigative subcommittee, which has used its power for more than a decade to scrutinize corporations and financial institutions for wrongdoing, is shifting its focus to keeping tabs on the government.

“The U.S. Senate Permanent Subcommittee on Investigations is slated to hold its first hearing under new leadership on Thursday with a dive into the U.S. corporate tax code. That topic is in line with the priorities laid out by the committee’s new chairman, Ohio Republican Rob Portman, who says he views its role as ‘primarily oversight of the federal government, agencies and departments.’ ”

If you’re considering skipping going out to vote in the 2016 Presidential and Congressional elections, you might want to reflect on the meaningful difference just one determined person can make in Washington. Below we feature Senator Levin’s farewell address.