By Pam Martens: February 1, 2013

Gad Levanon, Director of Macroeconomic Research at The Conference Board, and Ben Cheng, a Researcher in the organization’s economics department, have a new report out titled “Trapped on the Worker Treadmill.”

The report finds that of respondents aged 45 to 60, the percent that plans to delay retirement has gone up 20 percent in two years.

This and previous research by Levanon and Cheng made the following findings:

-

In the mid-1990s, roughly 12 percent of workers were 55 and older, compared with 21 percent in 2011. Before the end of this decade more than one in four workers will be 55 or older;

-

Business owners were more likely to delay their retirement than employees;

-

Workers in highly paid occupations, such as managers and professionals, were more likely to delay retirement than workers in lesser paid occupations;

-

Public administration workers, many of whom have defined-benefit pension plans, tended not to delay retirement at all.

-

Workers in households that experienced labor loss/compensation cuts and significant declines in home prices were much more likely to plan to delay retirement.

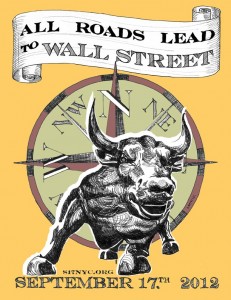

There are likely very sad realities underlying each of these bullet points and almost all can be traced to the doorstep of Wall Street’s greed machine and its devastating impact on the American worker and saver.

The 2008 Wall Street financial collapse and ensuing economic downturn cost millions of Americans their jobs, forcing them to dip into retirement savings. The Federal Reserve’s efforts to avoid a repeat of the Great Depression and even greater job losses by slashing interest rates to spur an economic revival dealt a double whammy to tens of millions of savers.

In December 2007, Treasury Notes were paying over 4 percent; Treasury Bonds were paying over 7 percent; and CDs were paying 5 percent. Today, retirees seeking safe income can earn 1 to 2 percent. And it is very likely they are sharing their experiences about strugging to make ends meet with friends and family members who have not yet retired, leading the non-retirees to rethink leaving the security of salaried income.

Workers in higher paid occupations have likely developed a lifestyle requiring a minimum of $100,000 a year to sustain it. At 2 percent interest on safe fixed income investments, $1 million dollars in retirement assets provides $20,000 a year in income. And only a small percentage of Americans have come close to saving that amount and many who were at that level in 2007 have seen it halved today.

The reality is that while the stock market indices like the Standard and Poor’s 500 and Dow Jones Industrial Average have made up lost ground in the past two years, many widely held stocks lost all or almost all of their shareholders’ equity when they filed bankruptcy, merged or were put into receivership. And, as is human nature, many pre-retirees could only take so much pain and angst and sold at close or near to the bottom of the market’s plunge, locking in their losses.

Small business owners may be delaying retirement both because they have suffered losses to their net worth from declines in equity in their homes, business borrowing, and investment losses. Another factor, which I’ve heard from a few acquaintances, is the fear that the business would fail without them, putting their workers and their families in dire straits. Yes, we still do have wonderful people like that in America.

That public administration workers – city, county, state and federal workers – will still be able to retire on fixed income payments from pension plans managed by professional money managers is the greatest testimony that stripping private industry workers of these plans and pushing those workers into self-managed 401(k) plans heavily correlated to the performance of the stock market, has benefited the Wall Street greed machine and few others.