-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: Federal Reserve

For the First Time in History, the Fed Is Reporting Billions in Losses Weekly; It’s Still Paying High Interest Income to the Mega Banks on Wall Street

By Pam Martens and Russ Martens: April 8, 2024 ~ As of April 3 of this year, the Federal Reserve (Fed) has racked up $161 billion in accumulated losses. We’re not talking about unrealized losses on the underwater debt securities the Fed holds on its balance sheet, which it does not mark to market. We’re talking about real cash losses it is experiencing from earning approximately 2 percent interest on the $6.97 trillion of debt securities it holds on its balance sheet from its Quantitative Easing (QE) operations while it continues to pay out 5.4 percent interest to the mega banks on Wall Street (and other Fed member banks) for the reserves they hold with the Fed; 5.3 percent interest it pays on reverse repo operations with the Fed; and a whopping 6 percent dividend to member shareholder banks with assets of $10 billion or less and the lesser of 6 percent … Continue reading

Jamie Dimon Huddles in Private with Biden Bigwigs as His Bank Faces More Crime Charges

By Pam Martens and Russ Martens: April 1, 2024 ~ Remember that time in 2016 when Attorney General Loretta Lynch decided she would take a private meeting with Bill Clinton on her plane as it was parked on the tarmac in Phoenix – while his wife, Hillary Clinton, was under federal investigation for using an unsafe private email server at her New York home to receive classified government emails when she was Secretary of State? What President Biden’s Vice President, Kamala Harris, and his Chief of Staff, Jeff Zients, did in mid-March was equally scandalous. Harris had a “one-on-one lunch at the White House” with Jamie Dimon, the Chairman and CEO of the most crime-riddled bank in the United States, JPMorgan Chase. Zients also separately met with Dimon. That reporting comes courtesy of reporters Joshua Franklin and James Politi of the Financial Times (paywall). It has not been disputed by the Biden … Continue reading

Report: Five Banks Have a Combined Half Trillion Dollars in Commercial Real Estate Loans; Number 1 is JPMorgan Chase

By Pam Martens and Russ Martens: March 28, 2024 ~ Yesterday, American Banker released a report showing that five banks in the U.S. hold a combined half trillion dollars in commercial real estate (CRE) loans. It came as a big surprise to a lot of folks that the bank holding the largest amount of CRE loans is JPMorgan Chase – whose bank holding company is also exposed to $49 trillion in derivatives as of December 31, 2023 according to the Office of the Comptroller of the Currency. (See Table 14 at this link.) JPMorgan Chase is already considered the riskiest bank in the U.S. according to its regulators. American Banker reported the following CRE totals for the five banks: JPMorgan Chase, $173 billion; Wells Fargo, $139.65 billion; Bank of America, $82.8 billion; U.S. Bank, $55.66 billion; and PNC Bank, $48.89 billion. Some of the same hubris and willful blindness that prevailed in … Continue reading

Billionaire Larry Fink of BlackRock, Which Grabbed Fed Bailouts in 2020-2021, Lectures Struggling Seniors on Making More Sacrifices

By Pam Martens and Russ Martens: March 27, 2024 ~ Yesterday, billionaire Larry Fink, Chairman and CEO of the giant investment manager BlackRock, released his annual letter to shareholders. In it, Fink revives the same ole trope that billionaires Kenneth Langone and Stanley Druckenmiller were taking on a road show in 2013. Back then the billionaire propaganda was called: “Generational Theft: How Entitlement Spending is Stealing Opportunity from America’s Youth.” Every time there is talk of raising taxes on the super-rich, some of whom pay less in taxes than plumbers and teachers through a tricked-up tax dodge known as “carried interest,” the billionaires launch a concerted effort to scapegoat struggling seniors living on an average monthly Social Security retirement benefit of $1772.51. The inability of younger Americans to save enough for retirement couldn’t possibly have anything to do with Wall Street gobbling up two-thirds of lifetime retirement savings in fees, as Frontline … Continue reading

Almost 10,000 U.S. Banks Have Disappeared Since 1985, Leaving 4 Mega Banks Controlling 39 Percent of Bank Assets

By Pam Martens and Russ Martens: March 26, 2024 ~ According to Federal Deposit Insurance Corporation (FDIC) data, there were 14,417 federally-insured banking institutions in the U.S. in 1985. As of December 31, 2023, the FDIC reports there are only 4,587 remaining. The vast majority of the 9,830 banks that have disappeared since 1985 did not fail – they were merged with other banks. Today, just four banks control $9.3 trillion in consolidated bank assets or 39 percent of all bank assets. Those four banks are JPMorgan Chase with $3.395 trillion in consolidated assets; Bank of America with $2.540 trillion; Wells Fargo with $1.7 trillion; and Citigroup’s Citibank with $1.685 trillion. (All asset figures are as of December 31, 2023 and come from the Federal Reserve’s statistical release of the largest banks.) The political clout of these mega banks is such that one of them, JPMorgan Chase, has been allowed to commit … Continue reading

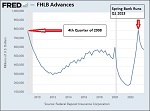

During Spring Bank Panic of 2023, Liquidity Advances from FHLBs Topped Those of Q4 2008, when Wall Street Was in Collapse

By Pam Martens and Russ Martens: March 19, 2024 ~ According to data from the Federal Deposit Insurance Corporation, and using a graph from the St. Louis Fed above, the liquidity crisis among banks in the spring of last year was far more dramatic than has been acknowledged by banking regulators. According to the data, during the worst financial crisis since the Great Depression (at the end of the fourth quarter of 2008 when Wall Street was in a state of collapse), banks had borrowed a total of $790 billion in advances from Federal Home Loan Banks (FHLBs). But during the bank panic in the spring of last year, those FHLB advances topped the Q4 2008 number, registering $804 billion as of March 31, 2023. According to data from the Congressional Budget Office, at the end of the quarter before the banking panic of 2023 (the quarter ending December 31, 2022) … Continue reading

Wall Street Mega Banks Have Drawn a Law-Free Zone Around Themselves – The Media Is Complicit

By Pam Martens: March 13, 2024 ~ From revoking the American people’s right to a jury trial in matters involving Wall Street; to brazenly thumbing their nose at anti-trust law; to trading the stock of their own bank in the darkness of their own dark pools; to forming their own stock exchange; to committing serial felonies without being criminally prosecuted or having their bank charters revoked – Wall Street mega banks have drawn a law-free zone around themselves and are more dangerous today than they have ever been in U.S. history. The most dangerous eras for the American people versus Wall Street mega banks have been the late 1920s and 1930s; 2007 to 2010; and today. We know that today is the most dangerous era because we read 12,000 pages produced by the Senate Banking Committee of the early 1930s on the Wall Street corruption in the late 20s and 30s; we … Continue reading

FDIC Data Contradicts Fed Chair Powell: Shows Real Estate Problems Have Skyrocketed at Largest U.S. Banks, Not the Smaller Regionals

By Pam Martens and Russ Martens: March 11, 2024 ~ On Sunday, February 4, the CBS program 60 Minutes aired a taped interview with Federal Reserve Chairman Jerome Powell. The actual interview had occurred three days earlier and was conducted by 60 Minutes interviewer Scott Pelley. Two noteworthy things happened in connection with that interview: First, CBS did not indicate above the transcript of the interview that Powell’s comments had been materially shortened in the program that aired on TV; secondly, Powell calls the real estate problem at the largest banks “manageable” while shifting the more serious real estate loan problem to “smaller and regional banks.” Below is what Powell had to say about problem real estate loans at U.S. banks in the 60 Minutes’ interview. The bracketed bold text is what is in the transcript but did not air in the broadcasted program on television. (Scroll to 8 minutes and 20 … Continue reading

Senator Elizabeth Warren Calls Fed Chair Powell “Weak-Kneed”; Says He Is “Driving Efforts Inside the Fed” to Gut Higher Capital Requirements

By Pam Martens and Russ Martens: March 7, 2024 ~ Engaged Americans are watching in real time a replay of how Wall Street mega banks in 2008 created the worst financial collapse since the Great Depression, then used their campaign money and lobbying clout to intimidate Congress and the Obama administration into passing the pathetically watered down financial “reform” legislation known as Dodd-Frank in 2010. The Fed has been bailing out the mega banks’ excesses and casino style of banking ever since. The same dynamic is playing out today with the proposal by three federal banking regulators (the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency and the Federal Reserve) to strengthen the capital requirements on the 37 largest banks in the U.S. – less than one percent of all banks in the U.S. For important background on the capital proposal, see our reports below: The Fed … Continue reading

Wall Street Mega Banks Have Created a Circular Firing Squad with Credit Derivatives and Capital Relief Trades – with the Fed’s Blessing

By Pam Martens and Russ Martens: March 6, 2024 ~ On June 11, 2015, the Office of Financial Research (OFR) released a sobering report on how banks were reducing their requirements to hold adequate capital against potential losses by engaging in non-transparent “capital relief trades” with potentially questionable counterparties. The OFR researchers summarized the problem as follows: “Capital relief transactions may have benefits to banks. But, even if real risk transfer is involved, these transactions can pose financial stability concerns by increasing interconnectedness, transforming credit risk into counterparty risk, and obscuring capital adequacy to investors and counterparties. And while bank supervisors have extensive data about banks, they may have less information about the nonbanks who are selling credit risk to those banks and ultimately bearing the risk of loss.” The Office of Financial Research was created under the Dodd-Frank financial reform legislation of 2010 to make sure that Wall Street mega banks … Continue reading