-

Recent Posts

- Matt Gaetz Case Has Echoes of the Justice Department’s Failure to Prosecute Jeffrey Epstein’s Sex-Trafficking Ring

- Trump’s Nominees Are Being Hand-Picked to Enact a Dangerous Platform the Koch Brothers Made Public 44 Years Ago

- Trump Makes Second Attempt to Install Wall Street’s Lawyer, Jay Clayton, to Oversee Prosecutions of Wall Street

- Trump Is President-Elect for Just 7 Days and a Sex, Drugs and Bribe Scandal Breaks Out

- Howard Lutnick, the Wall Street Billionaire Staffing Trump’s Cabinet, Hosted a Fundraiser for Hillary Clinton’s Presidential Bid in 2016

- The U.S. Has Failed Its Children – In the Most Unconscionable Ways

- Jamie Dimon’s House of Frauds Is the Target of More than 200 Investigations, Costing $2 Billion in Legal Expenses in Less than Two Years

- New York Fed Report: 27 Percent of Bank Capital Is “Extend and Pretend” Commercial Real Estate Loans

- The U.S. Government Is Plowing Billions into SpaceX, Overlooking Drug Use, Sex Parties, and Elon Musk’s Coziness with Putin

- The U.S. Has Given Top Secret Clearance to Elon Musk and Over $19 Billion in Contracts, Ignoring His Illegal Drug Use and Phone Chats with Putin as His SpaceX Puts Spy Satellites into Orbit

- Goldman Sachs Has Ripped Off Its Customers for a Century – a Puny $64.8 Million Fine for Abusing Thousands of Apple Credit Card Customers Fails the Smell Test

- Academic Paper Finds U.S. Banking System Is Less Safe Today than Before the 2010 Dodd-Frank Financial Reform Legislation Was Passed

- Jerome Powell’s Fed Notches an Historic Record of $204 Billion in Cumulative Operating Losses – Losing Over $1 Billion a Week for More than Two Years

- Could Big Tech Own Federally-Insured Banks? Here Are the Dangers

- FEMA Was First Targeted by Project 2025; Now FEMA Workers Are Being Threatened While Providing Disaster Relief in North Carolina

- Bloomberg News Writes Puff Pieces on Jamie Dimon While Its Parent Does Business Deals with the Bank He Heads, JPMorgan Chase

- Hurricanes Helene and Milton Send Climate Change Wakeup Call as Gulf of Mexico Water Breaks Heat Records

- A Bank Regulator Provides a Frightening Look at the Trading Casino Jamie Dimon Has Built Inside His Federally-Insured Bank

- Report: “Flash Flooding Is the Number One Storm-Related Killer in the U.S.” Few Cities or Towns in America Are Built to Survive Its Wrath

- Hurricane Helene Dumped 20 Trillion Gallons of Rain, Destroying Entire Towns in Western North Carolina, Hundreds of Miles from any Coastline

- Half of All Deaths from Hurricane Helene Occurred 485 Miles North of Where It Made Landfall

- What Did Madoff, Jeffrey Epstein and Sanctioned Russian Mercenary Group, Wagner, Have in Common? They All Banked at JPMorgan Chase

- Deadly, Exploding Pagers Force the U.S. to Get Serious About Malware from China in U.S. Products that Are Potential National Security Threats

- Wall Street Has Moved Vast Sums of Its Trading to Its Federally-Insured Banks

- The Stock Market Had a Psychotic Episode After the Fed Rate Cut Yesterday, Plunging 479 Points from the Day’s High

- As Trump Launches a Crypto Firm, FBI Reports Crypto Fraud Has Exploded to $5.6 Billion; Representing Almost 50 Percent of All Financial Fraud

- Everything this Book Predicted on Wall Street Megabanks Ruling their Regulators Is Now Unfolding

- The Fed Just Kicked the Capital Increases for the Dangerous Megabanks and their Derivatives Down the Road for Years

- Intel, Boeing and U.S. Steel May Hold the Secrets to What’s Behind All the Talk of a U.S. Sovereign Wealth Fund

- Trump and Paulson’s Proposal: U.S. Sovereign Wealth Fund (or Another Grifter Bailout)

- A Wall Street Regulator Is Understating Margin Debt by More than $4 Trillion – Because It’s Not Counting Giant Banks Making Margin Loans to Hedge Funds

- After JPMorgan Threatens to Sue, the Fed Cuts Its Capital Requirement on the 5-Count Felon from a Planned 25 Percent Hike to Less than 8 Percent

- Three Megabanks Had Loans Outstanding of $1.832 Trillion to Giant Hedge Funds on March 31

- Jamie Dimon’s Washington Post OpEd Gets Pummeled at Yahoo Finance

- In the Span of 72 Hours, Four People Tied to a Hewlett-Packard Criminal Case Died in Two Separate Events

- Crypto Took Down Another Federally-Insured Bank and Just Handed Its CEO a 24-Year Prison Sentence

- All the Devils from 2008 Are Back at the Megabanks: Leverage, Off-Balance-Sheet Debt, Over $192 Trillion in Derivatives, Shaky Capital Levels

- New Study Says the Fed Is Captured by Congress and White House — Not the Megabanks that Own the Fed Banks and Get Trillions in Bailouts

- Data from the Fed’s Emergency Funding Program Shows Spring 2023 Banking Crisis Was Far Deeper than Americans Were Told

- These FDIC-Insured Banks Have Lost 69 to 40 Percent of their Market Value Year-to-Date

- Exposure at Hedge Funds Has Skyrocketed to Over $28 Trillion; Goldman Sachs, Morgan Stanley and JPMorgan Are at Risk

- We Charted the Plunge and Rebound in the Nikkei Versus Nomura and Citigroup; the Correlation Is Frightening

- Former U.S. Labor Secretary Says Billionaires Have No Right to Exist Because their Wealth Comes from Five Illegal or Bad Practices

- Citigroup Is Having a Helluva Summer: A Protest on Thursday Will Turn Up the Heat

- Nikkei Has Biggest Drop in History: Here’s What’s Causing the Global Market Selloff

- JPMorgan Is Tapping Illiquid Assets in its Global Collateral Program; the New York Fed Is Paying for Its Services

- Bank Regulators Issue Warnings on Fintech and Banking as Disasters Pile Up

- Donald Trump Gives a Speech on Not Letting China Win the Crypto Race – Not Realizing China Banned Crypto Mining and Transactions Four Years Ago

- The New York Fed Has Contracted Out Key Functions to JPMorgan Chase; We Filed a FOIA and Got These Strange Invoices

- On the Eve of Netanyahu’s Address to Congress, Senator Bernie Sanders Delivers a Breathtaking Assessment of His War Crimes

Search Results for: Yellen

Janet Yellen’s Treasury Department Hires 5-Count Felon JPMorgan Chase to Look for Fraud

By Pam Martens and Russ Martens: October 11, 2023 ~ Immediately upon departing her post as Chair of the Federal Reserve, but prior to getting the nod from the Biden administration to become U.S. Treasury Secretary, Janet Yellen engaged in what the courageous reporter at ProPublica, Jesse Eisinger, called a “two-fisted money grab from banks.” Yellen raked in more than $7 million in speaking fees with the bulk of that coming from Wall Street banks and trading houses, including JPMorgan Chase. In a Tweet, Eisinger said: “This is corruption, but isn’t called that because it’s so quotidian.” Now there is the appearance that a quid pro quo is coming full circle. According to a press release posted on JPMorgan Chase’s website, “it has been designated by the United States Treasury Department under a financial agency agreement to provide account validation services for federal government agencies” in order to ensure “Treasury’s commitment to … Continue reading

Senator Elizabeth Warren Slams Treasury Secretary Yellen and Bank Regulator Hsu for “Courting Disaster” on Bank Mergers

By Pam Martens and Russ Martens: July 13, 2023 ~ Senator Elizabeth Warren is the Chair of the Senate Banking Committee’s Subcommittee on Economic Policy. She is also the most knowledgeable member of Congress when it comes to the mega banks on Wall Street and the most willing to hold them accountable. (See related articles below.) Yesterday, Warren’s Subcommittee held a hearing on “Bank Mergers and the Economic Impacts of Consolidation.” The urgency of this hearing was heightened by the fact that almost two years after President Joe Biden signed an Executive Order urging members of his administration to take a more aggressive investigation into the harmful impacts of consolidation and monopoly power before approving more mergers in a number of industries, including banking, bank regulators signed off on one of the most egregious mergers of this century. Senator Warren explained it this way: “When First Republic Bank collapsed in April, … Continue reading

Powell and Yellen Say the Banking System Is Sound as Another Global Bank Teeters

By Pam Martens and Russ Martens: March 24, 2023 ~ The reassurances of Federal Reserve Chairman Jerome Powell and U.S. Treasury Secretary Janet Yellen that the U.S. banking system is sound, stand in sharp contrast to what is happening in markets. This week, the shorts have found another easy new global bank target to try to take down after making a bundle of money betting against Credit Suisse, which was taken over for 82 cents a share on Sunday by its Swiss competitor, UBS. This time the global banking target is Deutsche Bank, a global behemoth we have warned about ad nauseum here at Wall Street On Parade. Deutsche Bank was a $120 dollar stock prior to the financial crisis in 2008. It closed yesterday at $9.65 in New York and is down another 10 percent in early morning trading in Europe. The weakness in Deutsche Bank is spilling over into … Continue reading

Secretary Yellen, We’ve Got a “Staggering” Problem: New Report Shows Foreign Banks Have Secret Derivative Debt that Is “10 Times their Capital”

By Pam Martens and Russ Martens: December 6, 2022 ~ U.S. Treasury Secretary Janet Yellen has the dual role of Chairing the Financial Stability Oversight Council (F-SOC), whose role is to provide “comprehensive monitoring of the stability of our nation’s financial system.” Heads of each of the federal agencies that supervise Wall Street and the mega banks sit in on meetings of F-SOC. One would think that such an august body would have a handle on “staggering” threats to the U.S. financial system – especially since F-SOC was created under the 2010 Dodd-Frank financial reform legislation to prevent a replay of the off-balance sheet derivatives that crashed the U.S. economy in 2008 and forced an unprecedented and secret bailout of U.S. and foreign global banks by the Federal Reserve to the tune of $29 trillion. If Yellen is aware of the latest threat to financial stability, she’s not sharing the details … Continue reading

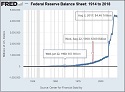

Fed Data Shows a Half Century of Moderate Growth in the Fed’s Balance Sheet through Two World Wars – Then a Seismic Explosion Under Bernanke, Yellen and Powell

By Pam Martens and Russ Martens: June 6, 2022 ~ Last month the Federal Reserve Bank of New York released its 2021 annual report from its “Markets Group.” That’s the group that operates a trading floor (complete with speed dials to the trading houses on Wall Street) at the New York Fed, located not far from the New York Stock Exchange, as well as another trading floor on the premises of the Chicago Fed, which is not far from the futures exchanges in Chicago. That report showed that despite all of the recent talk about the Fed dramatically shrinking its balance sheet from its current size of $8.9 trillion, the internal Federal Reserve plan for the balance sheet is actually this: “After declining by about $2.5 trillion from the peak size reached in the first half of 2022, the portfolio stops declining in mid-2025, at which point it is held constant … Continue reading

Senator Tells Treasury Secretary Yellen that Crypto Market Is Now Larger than Subprime Market that Triggered Global Financial Crisis

By Pam Martens and Russ Martens: May 11, 2022 ~ As a result of the Dodd-Frank financial reform legislation of 2010, the U.S. Treasury Secretary chairs a key group of banking and Wall Street regulators called the Financial Stability Oversight Council – pronounced F-SOC for short. The idea behind F-SOC was that Wall Street’s insane binges into things like toxic subprime debt and credit default swaps would never again be allowed to sneak up on snoozing government watchdogs, take down the U.S. economy and put the Wall Street megabanks on a long-term feeding tube from the Fed as occurred from 2008 to 2010. Yesterday, the Senate Banking Committee held a hearing to take testimony from Treasury Secretary Janet Yellen on F-SOC’s annual report to Congress and what F-SOC sees as the biggest threats right now to financial stability. There were numerous fireworks during the hearing, including when Senator Tim Scott, a … Continue reading

After Taking Millions in Speaking Fees from Wall Street, Treasury Secretary Yellen Redacted 73 Meetings or Phone Calls in First 3 Months in Office

By Pam Martens and Russ Martens: August 13, 2021 ~ After stepping down as Fed Chair on February 3, 2018, Janet Yellen began a whirlwind of speaking engagements that netted her millions of dollars over the next two years. But when it came time to disclose those fees after she was nominated by President Biden to become Treasury Secretary, Yellen disclosed only the fees she had made in 2019 and 2020, not the millions she had made in fees in 2018. What Yellen did disclose showed more than $7 million in speaking fees, with the bulk of that coming from Wall Street banks, trading houses and hedge funds. As the news broke this past January about Yellen’s cash haul, Senior Reporter Jesse Eisinger of ProPublica Tweeted this: “Deeply troubling two-fisted money grab from banks by Janet Yellen. This is corruption, but isn’t called that because it’s so quotidian.” Eisinger added: “Sure, Yellen … Continue reading

Janet Yellen Is Attempting to Consolidate the Fed’s Power to “Supervise” Wall Street Banks

By Pam Martens and Russ Martens: May 10, 2021 ~ You know there’s a problem when the media relations office at the Federal Reserve will not turn over the bio for one of its employees that Treasury Secretary Janet Yellen just tapped to be the acting head of a key Wall Street banking regulator. After days of media rumors that Yellen was set to appoint Michael Hsu, an Associate Director of the Federal Reserve’s Division of Supervision and Regulation, to be the acting head of the Office of the Comptroller of the Currency (OCC), Yellen made the announcement official on Friday. Hsu is set to assume that position today. We had attempted to obtain Hsu’s bio from the Federal Reserve for days. We were told they had no official bio. We asked for the resume Hsu provided when he was hired. We received no response. We then asked the Treasury Department’s … Continue reading

Janet Yellen’s Plunge Protection Team Has $142 Billion to Play With

By Pam Martens and Russ Martens: March 17, 2021 ~ Most Americans are unaware of the existence of the Exchange Stabilization Fund (ESF). Together with the Federal Reserve Bank of New York (New York Fed) it has morphed into the U.S. Treasury Secretary’s Plunge Protection Team. The ESF was created in 1934 to provide support to the U.S. dollar during the Great Depression. As recently as March 31, 2007, the ESF was fairly modest in size, with assets of just $45.9 billion. Prior to Trump taking office, it had grown to $94.3 billion in assets. But thanks to a fancy maneuver by President Donald Trump’s Treasury Secretary, Steve Mnuchin, the ESF skyrocketed to a staggering balance of $682 billion as of September 30, 2020. Mnuchin was able to give himself this massive slush fund by helping to write the 2020 stimulus bill known as the CARES Act, which handed him $500 … Continue reading

Janet Yellen’s Slush Fund to Meddle in Markets Got a $490 Billion Haircut

By Pam Martens and Russ Martens: February 10, 2021 ~ Remember all the hubbub in the fall of last year when then U.S. Treasury Secretary Steve Mnuchin demanded in a November 19 letter that the Fed return all of the money from the CARES Act that it had not used for emergency lending programs. Mnuchin’s stated reason for the demand was because he was going to turn the unused funds over to the general fund of the Treasury so that Congress could reappropriate it for other purposes. At the time, Mnuchin made it sound like the Fed had been sitting on the bulk of the $454 billion that the CARES Act had allotted to be used as loss-absorbing capital for the Fed’s emergency lending programs. In reality, Mnuchin had never turned over the bulk of the CARES Act money to the Fed, but had parked it instead in a Treasury … Continue reading