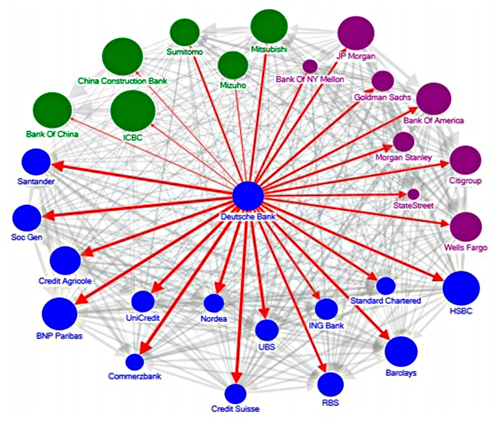

Systemic Risk Among Deutsche Bank and Global Systemically Important Banks (Source: IMF — “The blue, purple and green nodes denote European, US and Asian banks, respectively. The thickness of the arrows capture total linkages (both inward and outward), and the arrow captures the direction of net spillover. The size of the nodes reflects asset size.”)

By Pam Martens and Russ Martens: March 5, 2018

Today’s front page of the print edition of the New York Times has articles on the Oscars, the election in Italy, Ben Carson’s reign at HUD and the death of an elderly Briton who once broke the four-minute mile among numerous other less than urgent news pieces. What it does not have on its front page is any headline showing concern that the seminal piece of Wall Street reform legislation of the Obama era, which already has enough loopholes to set off champagne corks on K Street, may be dismantled this week by a vote in the Senate. The move would come in the midst of the 10th anniversary of the greatest Wall Street collapse and economic catastrophe since the Great Depression, both of which were underpinned by casino capitalism — Wall Street banks making obscenely leveraged bets for the house while holding Mom and Pop deposits.

This is now the new normal at the New York Times with its editorial page editor declaring in December at a staff meeting that the paper is “pro-capitalism.” This is really code for “Wall Street is our home-town team and we’re not going to bite the hand that feeds us” – even if it means intentionally rewriting the facts on what actually caused the Wall Street crash.

Instead of calling front page attention to the ongoing critical threat to the nation’s financial system and providing an in-depth analysis of how Wall Street has already whittled down the 2010 Dodd-Frank financial reform legislation by a thousand cuts, the Times buried its tepid article on page B1under the headline: “Big Banks May Weaken Dodd-Frank Oversight.”

Citigroup was the poster child of the 2008 financial crash. It had loaded up on dodgy off-balance sheet “assets,” lied about its subprime debt exposure, and then received the largest taxpayer bailout in U.S. history. In December 2014 Congress allowed Citigroup to take a chain saw to Dodd-Frank. Citigroup pushed through a measure in the must-pass spending bill to keep the government running that allowed it and the other biggest banks on Wall Street to keep their riskiest assets – derivatives – in the commercial banking unit that is backstopped with FDIC deposit insurance. The taxpayer-subsidized deposit insurance allows the mega banks to get a higher credit rating than they would otherwise receive while paying pathetically low interest rates to savers on those deposits. By holding tens of trillions of dollars in derivatives on their respective commercial bank books, the mega banks are perceived as too-big-to-fail and can put a gun to the head of taxpayers for another bailout the next time their risky bets fail. All of these tricks are effectively public subsidies of a banking system gone mad.

The situation with the anticipated vote this week in the Senate is so critical that Senator Elizabeth Warren has released a video about the threat on YouTube. (See video below.) Warren says in the video that the proposed legislation “takes about 25 of the 40 largest banks in this country and just moves them off the special watch list and treats them like they were tiny little community banks that just couldn’t do any harm to the economy.” Warren adds: “Those exact same 25 banks that are being taken off the watch list got about $50 billion in taxpayer bailout money during the last crash.”

The 25 banks would be removed from the watch list through changes to Dodd-Frank Section 401. At present, any bank with over $50 billion in assets is subject to enhanced requirements like extra capital, liquidity, stress tests and monitoring of risk management protocols. The proposed legislation raises the asset threshold to a stunning $250 billion – a mega bank by any rational interpretation.

Three of the banks that would be exempted under the legislation are U.S. bank holding companies of mega foreign banks: Deutsche Bank, UBS and Credit Suisse. All three have been serially fined for running afoul of U.S. banking laws. And Deutsche Bank stands out for its potential to amplify financial contagion in the U.S.

In June 2016, Deutsche Bank was the subject of a report issued by the International Monetary Fund (IMF). The report looked at the “Financial System Stability” of German financial institutions and examined the systemic impact that a major bank blowing up would have on other domestic German banks and insurers as well as its ability to set off financial contagion in other countries – most likely because it is a major counterparty to derivatives at global banks. The report concluded that spillover effects would not be limited to Germany but would impact France, the United Kingdom and the United States.

The alarming report called out Deutsche Bank as “the most important net contributor to systemic risks.” (See chart above.) The IMF findings included the following:

“Notwithstanding moderate cross-border exposures on aggregate, the banking sector is a potential source of outward spillovers. Network analysis suggests a higher degree of outward spillovers from the German banking sector than inward spillovers. In particular, Germany, France, the U.K. and the U.S. have the highest degree of outward spillovers as measured by the average percentage of capital loss of other banking systems due to banking sector shock in the source country…

“Among the G-SIBs [Global Systemically Important Banks], Deutsche Bank appears to be the most important net contributor to systemic risks, followed by HSBC and Credit Suisse. In turn, Commerzbank, while an important player in Germany, does not appear to be a contributor to systemic risks globally. In general, Commerzbank tends to be the recipient of inward spillover from U.S. and European G-SIBs. The relative importance of Deutsche Bank underscores the importance of risk management, intense supervision of G-SIBs and the close monitoring of their cross-border exposures, as well as rapidly completing capacity to implement the new resolution regime.”

The proposed legislation in the Senate is S.2155 which carries the Orwellian reverse-speak title of “Economic Growth, Regulatory Relief, and Consumer Protection Act.” It was introduced by Republican Senate Banking Chair Mike Crapo and currently has 25 co-sponsors, including 12 Democrats. Hillary Clinton’s former running mate for Vice President, Tim Kaine, is among the Democratic co-sponsors, as is his fellow Senator from Virginia, Mark Warner. Kaine is currently running for re-election and has received large contributions from Big Law partners that represent Wall Street. Warner’s last campaign in 2014 included among his 20 largest donors the mega Wall Street banks Goldman Sachs and JPMorgan Chase. Goldman’s employees and PACs gave Warner’s campaign $71,600 while JPMorgan Chase gave the Warner campaign committees $50,566 according to the Center for Responsive Politics.

In addition to Kaine and Warner, other Democratic senators who are co-sponsoring the legislation are: Tom Carper (Delaware), Chris Coons (Delaware), Joe Donnelly (Indiana), Heidi Heitkamp (North Dakota), Jon Tester (Montana), Claire McCaskill (Missouri), Joe Manchin (West Virginia), Gary Peters (Michigan), Michael Bennet (Colorado) and Doug Jones (Alabama).

Senator Heidi Heitkamp is also up for reelection this year and her number one contributor at present is employees and/or PACs of Goldman Sachs which have contributed $79,500 thus far.

Senator Joseph Donnelly will also be attempting to keep his Senate seat this year. His largest campaign donor by a huge margin is Votesane PAC which has kicked in $265,887. The PAC was founded by Rob Zimmer whose LinkedIn profile says he is presently a consultant to the financial services industry.