By Pam Martens and Russ Martens: November 29, 2017

“Populist” candidate for President, Donald Trump, railed against the “political establishment” and Wall Street elites who were “getting away with murder.” On October 26, 2016, just days before the Presidential election, Trump spoke at a rally in Charlotte, North Carolina and promised to uphold the plank in the Republican Party platform to break up the big banks by restoring the Glass-Steagall Act. He stated:

“The policies of the Clintons brought us the financial recession — through lifting Glass-Steagall, pushing subprime lending, and blocking reforms to Fannie and Freddie. Two friendly names but they’re not so friendly. It’s time for a 21st century Glass-Steagall and, as part of that, a priority on helping African-American businesses get the credit they need.”

Now, as the sitting President, the former populist candidate has become the embodiment of the political establishment he railed against. He has stacked his administration with former bankers from Goldman Sachs; he has placed deeply conflicted Wall Street cronies in key regulatory posts; and he is promising to roll back critical financial reforms. His Treasury Secretary, Steve Mnuchin, has disavowed any intention to reinstate the Glass-Steagall Act.

To the careful observer, it would appear that the American people have, once again, been played for fools by billionaires who no longer need to hide behind a dark political curtain but have simply seized the reins of power for themselves in broad daylight.

Trump’s latest propaganda ploy is reminiscent of how the Murdoch-owned Wall Street Journal runs its editorial and opinion pages – using every opportunity to portray Wall Street as the victim of government overreach rather than acknowledging the thoroughly documented reality that Wall Street has been looting the public for the past century.

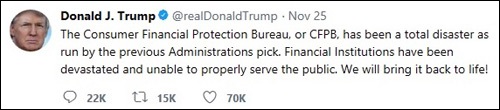

In a Tweet on November 25 of this year, Trump stated: “Financial institutions have been devastated and unable to serve the public.”

Consider that statement against the following facts. On June 7, Fortune Magazine provided the names of the 10 most profitable companies for 2016. Four of the 10 were the largest Wall Street banks. JPMorgan Chase had reported $24.7 billion in profits for 2016; Wells Fargo weighed in with $21.9 billion; Bank of America posted $17.9 billion in profits while the serially charged malefactor Citigroup reported $14.9 billion in 2016 profits. That’s just four banks with a total of $79.40 billion in profits, which represents 51 percent of the $157 billion earned by all 5,112 insured commercial banks in the U.S.

To any rational human being, the above figures would be all the proof one needs that banking in the United States is dangerously concentrated in mega Wall Street banks and these banks must be broken up.

Derivative statistics also show just how lax Federal regulators have been under both Obama and Trump in reining in the abuses that collapsed Wall Street and the U.S. economy in 2008. According to the quarterly derivative reports coming out of the national bank regulator, the Office of the Comptroller of the Currency (OCC), at the end of the second quarter of 2007, prior to the 2008 financial collapse and Dodd-Frank “financial reform” legislation, the 25 largest bank holding companies held a total of $160.4 trillion in notional amounts of derivatives. A decade later, the 25 largest bank holding companies hold a total of $252 trillion in notional amounts of derivatives as of June 30, 2017 according to the OCC.

These unfathomable levels of derivative holdings are predominantly held at the insured depository institution – the FDIC insured bank where the taxpayer is on the hook for losses. Making the situation exponentially more dangerous is that the OCC reports the following in its June 30, 2017 assessment of derivatives:

“A small group of large financial institutions continues to dominate derivative activity in the U.S. commercial banking system. During the second quarter of 2017, four large commercial banks represented 89.6 percent of the total banking industry notional amounts [of derivatives]…”

Those four banks are Citigroup’s insured depository, Citibank; JPMorgan Chase, Goldman Sachs Bank USA and Bank of America. Citigroup is the bank that blew itself up in 2008 and required the largest U.S. taxpayer bailout in U.S. history, including: $45 billion in capital infused into Citigroup by the U.S. Treasury to prevent its total collapse; the government guaranteed over $300 billion of Citigroup’s assets; the Federal Deposit Insurance Corporation (FDIC) guaranteed $5.75 billion of its senior unsecured debt and $26 billion of its commercial paper and interbank deposits; and the Federal Reserve secretly sluiced $2.5 trillion in almost zero-interest loans to Citigroup from 2007 to at least the middle of 2010.