By Pam Martens and Russ Martens: December 3, 2024 ~

The semi-annual Financial Stability Report released recently by the Federal Reserve Board of Governors rang a loud warning bell about high levels of leverage at hedge funds and life insurers.

Wall Street watchers will no doubt recall that in 2008, during the worst Wall Street collapse since the Great Depression, Bear Stearns went under after it blew up two internal hedge funds the prior year and the giant life insurer, American International Group (AIG), blew itself up by acting as a counterparty to Wall Street’s derivative schemes and had to be taken into receivership by the U.S. government.

On the matter of leverage at hedge funds, the Fed wrote this in its most recent Financial Stability Report:

“Comprehensive data collected through SEC Form PF indicated that measures of leverage averaged across all hedge funds were at or near the highest level observed since these data became available in 2013. Relative to the previous report, leverage increased when measured using either average on-balance-sheet leverage…or average gross leverage of hedge funds…a broader measure that also incorporates off-balance-sheet derivatives exposures, but which does not account for netting of offsetting exposures.”

And just who was providing this leverage to hedge funds? It was the federally-insured megabanks on Wall Street, of course. You won’t find that information in the Fed’s report but you can gain an in-depth understanding of this issue from our September 3 article titled: Three Megabanks Had Loans Outstanding of $1.832 Trillion to Giant Hedge Funds on March 31.

The Fed seems to be a serial protector of the illusion that U.S. megabanks are doing just swell. It says this in its current report: “The banking system remained sound and resilient, with regulatory capital ratios approaching or exceeding historical highs.”

That statement on capital levels would be much more convincing from the Federal Reserve Board of Governors if researchers at one of their 12 regional Fed banks, the New York Fed, had not just told the public in October that 27 percent of bank capital is “extend and pretend” commercial real estate loans.

On the issue of high leverage at life insurers in 2024, the Fed’s Financial Stability Report tells us this:

“Life insurers continued to allocate a substantial percentage of assets to risky and less liquid instruments, such as leveraged loans, collateralized loan obligations (CLOs), high-yield corporate bonds, privately placed corporate bonds, and alternative investments. Moreover, life insurance companies have material direct exposures to commercial mortgages and are large holders of commercial mortgage-backed securities (CMBS). This exposure to illiquid and risky assets makes life insurers vulnerable to an array of adverse shocks, including that of an economic downturn or of a significant further deterioration of the CRE [commercial real estate] market.”

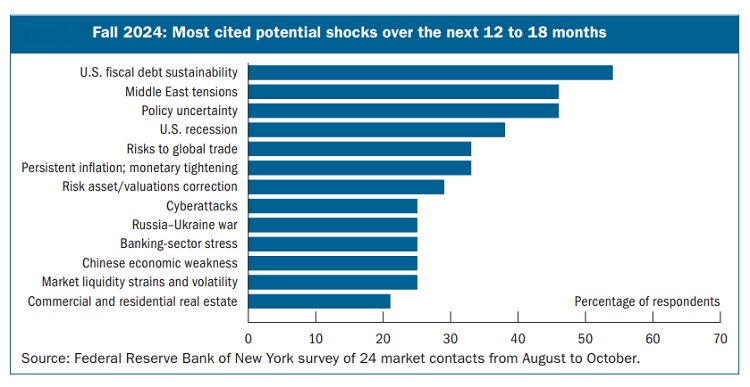

Another section of the Fed’s Financial Stability Report that looks highly suspect is the list of the most cited potential shocks that two dozen sophisticated contacts expressed as top concerns that might occur over the next 12 to 18 months. The Fed explains the survey as follows:

“As part of its market intelligence gathering, staff from the Federal reserve bank of New York solicited views from a wide range of contacts on risks to U.S. financial stability. From late August to late October, the staff surveyed 24 contacts, including professionals at broker-dealers, investment funds, research and advisory firms, and academics. This section is a summary of the views provided by survey respondents and should not be interpreted as representing the views of the Federal reserve bank of New York or the Federal reserve board.”

The chart below is the list of the most cited concerns. We do not find the list credible. From August to late October, tens of millions of Americans could think of little else than the possibility that Donald Trump might return to the White House for a second reign of chaos. But we are asked to believe that not one person out of the two dozen the New York Fed spoke to mentioned Trump as a key concern according to the chart the Fed released.

Two days after the presidential election, on November 7, when it was clear that Trump had won both the electoral college and the popular vote, the U.K.’s Guardian newspaper summed up the view around the world on its front cover with this: “American dread.” A column headlined on the front page read: “Time to Rethink Everything We Thought About the U.S.” Tens of millions of Americans were thinking those exact words with many doing a Google search on how to relocate to a foreign country.

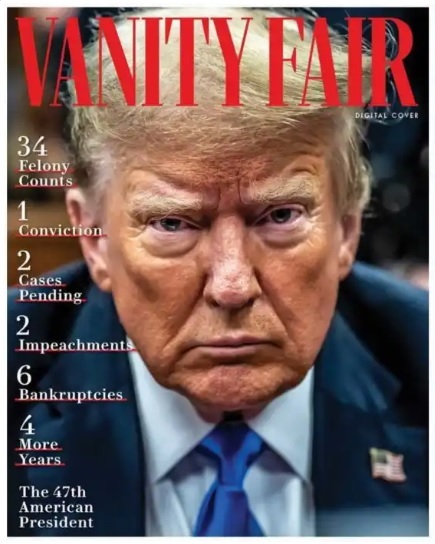

Vanity Fair’s digital front cover on November 6 captured the mood perfectly with these words: “34 Felony Counts; 1 Conviction; 2 Cases Pending; 2 Impeachments; 6 Bankruptcies; 4 More Years: The 47th American President.”