By Pam Martens and Russ Martens: October 14, 2024 ~

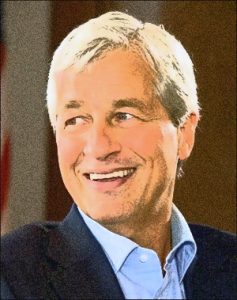

For years now, we have observed the digital front page of Bloomberg News treating JPMorgan Chase’s Chairman and CEO, Jamie Dimon, as the wise, venerable statesman of Wall Street. (See here, here, and here for a quick background.)

That reverential treatment has continued as the bank Dimon is charged with overseeing has admitted to the following: laundering money for the largest Ponzi scheme mastermind in history, Bernie Madoff; rigging foreign exchange markets; rigging trading in U.S. Treasury securities and the precious metals markets; using depositors’ money from its federally-insured bank to trade derivatives in London and lose at least $6.2 billion of its depositors’ money; bribing Chinese officials with jobs for their relatives in order to get business deals in China.

Even worse, throughout much of last year, the Attorney General of the U.S. Virgin Islands built a comprehensive case in federal court in Manhattan that JPMorgan Chase had “actively participated” in the sex trafficking of young girls by Jeffrey Epstein. A Memorandum of Law filed by attorneys for the U.S. Virgin Islands made the following charges:

“Even if participation requires active engagement…there is no genuine dispute that JPMorgan actively participated in Epstein’s sex-trafficking venture from 2006 until 2019. The Court found allegations that the Bank allowed Epstein to use its accounts to send dozens of payments to then-known co-conspirators [redacted] provided excessive and unusual amounts of cash to Epstein; and structured cash withdrawals so that those withdrawals would not appear suspicious ‘went well beyond merely providing their usual [banking] services to Jeffrey Epstein and his affiliated entities’ and were sufficient to allege active engagement.”

According to internal documents revealed in the case, JPMorgan Chase had been funneling hard cash to Epstein to the tune of $40,000 to $80,000 a month without filing the legally required Suspicious Activity Reports with the Financial Crimes Enforcement Network (FinCEN), an agency of the U.S. Treasury in charge of monitoring potential money laundering.

While Jamie Dimon vehemently denied knowing that Epstein was even a client of the bank until his arrest on federal sex trafficking charges in 2019 – despite the fact that Epstein was referring billionaires to the bank as clients for years – the General Counsel of the bank at the time, Stephen Cutler, did know Epstein was a client, according to his deposition in the case. Cutler had been the Director of Enforcement at the Securities and Exchange Commission prior to arriving as General Counsel at JPMorgan Chase. His office was next door to Dimon’s. It strains the imagination to think that a man of Cutler’s background would not have mentioned Epstein’s problematic relationship with the bank to Dimon, given that Epstein was a registered sex offender with a voluminous police file in Palm Beach County for engaging in sex with minors prior to his federal arrest in 2019. (Epstein died in a Manhattan jail in 2019 while awaiting trial. His death was ruled a suicide by the New York City Medical Examiner.)

The Federal Court Judge in the case, Jed Rakoff, allowed many of the documents in the case and most of the depositions to be sealed from the view of the public. Then JPMorgan Chase tied the whole matter up with a tidy red bow by settling the case for $75 million and a related case filed by Epstein’s victims for $290 million – thus proving that even in federal court in the United States, money talks far louder than justice. While the U.S. Department of Justice brought criminal money laundering charges against JPMorgan Chase in the Madoff case, it has thus far been silent regarding the bank’s extensive money laundering role with Epstein. (See A JPMorgan Court Filing Shows Another Bank Exec Visited Jeffrey Epstein’s Sex-Trafficking Residences 13 Times – Two More Times than Jes Staley.)

Under Dimon’s “stewardship” of the largest bank in the United States, it has admitted to five criminal felony counts while building a rap sheet that rivals that of an organized crime family. The bank’s Board of Directors’ response to all of this is not to sack Dimon, but to make him a billionaire.

One might have thought that at some point in this nonstop crime journey, the intrepid reporters at Bloomberg News or its editorial team might have skewered Dimon and urged his Board to replace him. Instead, Dimon has been lionized at Bloomberg News.

A headline today on Bloomberg’s digital front page reads (paywall): Jamie Dimon for Treasury Secretary: The Idea That Never Fades.

Equally outrageous, on April 17 of this year, Bloomberg News posted what is effectively an infomercial for Jamie Dimon but is styled as a news interview. Its title: “When JPMorgan CEO Jamie Dimon Speaks, the World Listens.” (You can watch the video without the Bloomberg paywall at this YouTube link.) The interviewer in this piece of puffery is Bloomberg’s Emily Chang. In the opening minutes, Chang says this:

“Jamie Dimon is an institution. Since 2005 he’s been the head of the world’s biggest bank, JPMorgan Chase. He’s widely seen as a rock in the storms of 21st century finance and even at times a kind of guardian of the U.S. and global economy.”

Later in the interview, there is this exchange:

Chang: “You’ve got this reputation of sort of a white knight for the economy. Do you ever feel pressure to come in with the save?”

Dimon: “I feel like a tremendous amount of pressure to do — I’m just, my family comes first. Okay. But to do a great job for my company and our clients. I also feel to do a good job for my country. So, when my country wants me to do something, and we talk all the time to, you know, the Senators and regulators, what can we do to make the system better, to lift up the country, lift up inner cities. We’re trying to figure out how to make this country better. And I do consider that part of our job.”

What could possibly be the incentive for Bloomberg News to try to perpetuate this fantasy world of Jamie Dimon as the wise statesman of Wall Street?

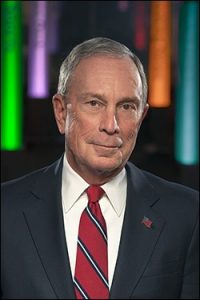

Billionaire Michael Bloomberg, the former Mayor of New York, is the majority owner of Bloomberg LP, the owner of Bloomberg News. In 2016, the New York Post reported that JPMorgan Chase was the second largest customer of Bloomberg’s data terminal business with 10,000 leases of Bloomberg’s terminals. At the time, the terminals cost approximately $21,000 each per lease, per year, or about $210 million being paid by JPMorgan Chase to Michael Bloomberg’s company annually. Bloomberg’s data terminals are the cash cow of the company.

On May 28, 2020, Bloomberg LP announced a joint business venture with J.P. Morgan Securities, the broker-dealer and trading arm of JPMorgan Chase. The press release is so jargonized that it is almost impossible to decipher, even for veteran Wall Street traders. A key section reads as follows:

“Bringing together Bloomberg AIM, a leading Investment and Order Management System, with J.P. Morgan’s cutting edge back office technology and operational expertise, it provides a seamless and fully-integrated real-time settlement process that mitigates buy-side clients’ operational costs. The offering is now live and in production with the first joint Bloomberg and J.P. Morgan’s Securities Services client and is being made available to other buy-side clients.

“Clients can achieve real-time post-trade workflows, enriched with custodian data, while operating within their existing Bloomberg AIM order management system. By centralizing and streamlining operational processes and data integration, this offering reduces manual touchpoints and provides increased transparency, thereby mitigating post-trade risks and costs. This is the first of a series of ongoing front-to-back integration points between Bloomberg and J.P. Morgan’s Securities Services.”

One might be forgiven for thinking that the fact that the parent of Bloomberg News has “a series of ongoing front-to-back integration points” with the trading division of JPMorgan Chase should be revealed at the end of each article its reporters write about JPMorgan Chase and Jamie Dimon.