By Pam Martens and Russ Martens: July 9, 2024 ~

Last week the American Banker published an opinion article by Arthur E. Wilmarth, Jr., the Professor Emeritus of Law at George Washington University. Wilmarth is the man who wrote the seminal book on the continuing threat to financial stability posed by U.S. megabanks – the same ones that blew up Wall Street and the U.S. economy in 2008.

Last week the American Banker published an opinion article by Arthur E. Wilmarth, Jr., the Professor Emeritus of Law at George Washington University. Wilmarth is the man who wrote the seminal book on the continuing threat to financial stability posed by U.S. megabanks – the same ones that blew up Wall Street and the U.S. economy in 2008.

The title of Wilmarth’s article (paywall) is: “The FDIC’s resolution plan for failed megabanks is an empty promise.” The thrust of the article is this: the Dodd-Frank Act was passed by Congress and signed into law in 2010 – 14 years ago. One of its primary goals was to prevent taxpayers from having to rescue megabanks, as occurred in 2008. A key component of that goal is Title II of Dodd-Frank, which provides an Orderly Resolution Plan to unwind failing megabanks that does not require taxpayer or Federal Reserve bailouts. That Plan, in turn, requires a giant pool of instantly available cash, which Dodd-Frank calls the Orderly Liquidation Fund or OLF.

Stunningly, Wilmarth reveals that there hasn’t been a dime in the OLF since its creation in 2010. Wilmarth explains:

“…the FDIC’s sole source of funding for a Title II receivership is the Orderly Liquidation Fund, or OLF, which the Treasury administers. When Congress passed the Dodd-Frank Act, the big-bank lobby defeated proposals that would have required megabanks to pay risk-based premiums to prefund the OLF. As a result, the OLF has a zero balance. The FDIC must therefore borrow from the Treasury to pay the costs of a Title II receivership that cannot be covered by wiping out the holding company’s shareholders and debt-holders.

“The FDIC has very strong incentives to avoid borrowing from the Treasury to finance the resolution of a failed megabank. Borrowing from the Treasury would raise political red flags by increasing the federal government’s debt burden and signaling that taxpayers might have to pay additional taxes if the FDIC cannot repay the Treasury.”

Since the financial crash of 2008, the U.S. has experienced three serious banking crises. And not once during those crises was the Orderly Liquidation Fund used. The reason is simple. As long as the megabanks can get trillions of dollars in below-market-rate revolving loans from emergency programs quickly created by an obliging Federal Reserve, why would they settle for billions of dollars that involve approval from the U.S. Treasury and public scrutiny.

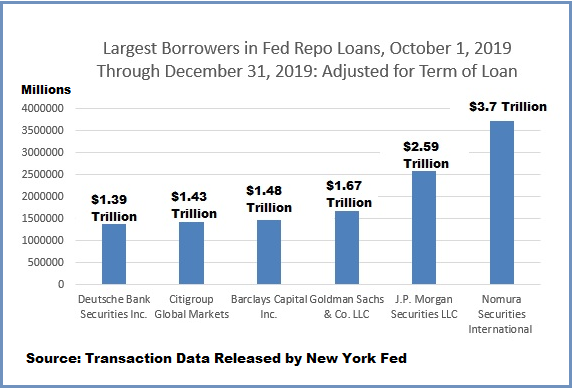

The first banking crisis since 2008 began on September 17, 2019 when the repo market seized up. In the last quarter of 2019, the New York Fed secretly funneled emergency repo loans cumulatively totaling (on a term-adjusted basis) $19.87 trillion into Wall Street megabanks. As the chart below indicates, just six trading units of the megabanks on Wall Street received 62 percent of that amount. (Unadjusted for the term of the loan, the cumulative total was $4.5 trillion.) The names of the banks and the amounts they borrowed were not disclosed to the public for two years. When the Fed did release the loan data, there was a mainstream media news blackout. Only Wall Street On Parade published the charts and tallied the loan amounts.

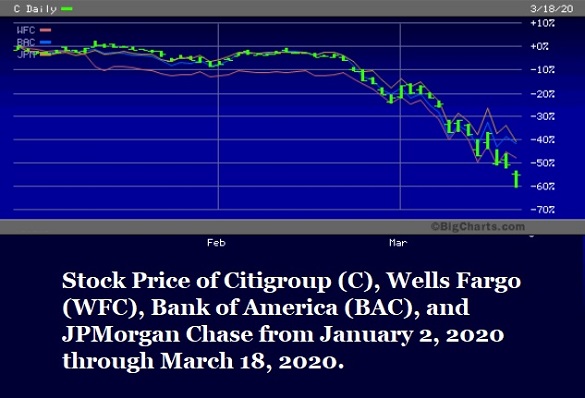

The next banking crisis occurred in March 2020 and was blamed on the COVID-19 pandemic. The share prices of the four largest banks (by deposits) collapsed by as much as 40 to 60 percent between January 2, 2020 and March 18, 2020. (See chart below.) The Fed rolled out the same alphabet soup of emergency lending programs that it had rolled out in 2008 – with the New York Fed once again in charge of the bulk of those programs.

In the spring of 2023, the second, third and fourth largest bank failures in U.S. history occurred. One of those banks (Silicon Valley Bank) experienced the fastest run on its deposits in U.S. history, showing just how quickly large banks can fail in the digital age. The Fed ran to the rescue again with another emergency bailout program: the Bank Term Funding Program.

Wilmarth correctly concludes his article at the American Banker with this:

“Megabanks continue to exploit implicit subsidies resulting from widely shared expectations of future bailouts. Given the lack of credible strategies for resolving failures of megabanks without publicly funded rescues, we must recognize that megabanks pose grave threats to financial stability and social welfare. Requiring big banks to increase their equity capital significantly would be an important first step in addressing those threats.”

The second critical step would be separating federally-insured banks from the casino trading houses on Wall Street by restoring the Glass-Steagall Act, which provided financial stability in the U.S. for 66 years until its repeal in 1999.